Wealthyhood begins onboarding Greek users

It’s coming home: Greek-founded investment app comes “home”, onboarding first Greek investors.

July 1, 2025

Wealthyhood, the Greek-founded investing app already trusted by more than 50,000 investors in the UK, is officially expanding into Europe, opening its doors to Greek users. The launch represents the culmination of months of preparation following the company’s regulatory approval by the Hellenic Capital Markets Commission.

Starting today, Wealthyhood begins granting exclusive early-access invitations to users who have joined the Greek waitlist, with new users being welcomed in weekly waves over the coming months, ensuring a smooth onboarding experience.

Those not yet on the waitlist can still join to secure their place in the queue for early access.

Breaking down barriers to investing

Wealthyhood’s entry into the Greek market addresses long-standing issues that have kept investing out of reach for many Greeks.

Alexandros Christodoulakis, Co-Founder & CEO of Wealthyhood, explains: “For too long, investing has been designed to exclude, not include. High fees, confusing language and minimum investments that locked most people out. A system built to make investing feel impossible for regular people. First, we built Wealthyhood to change that. Then, we decided to bring it to our home country.”

Alexandros adds “The financial system loves complexity because it keeps people away. We say let’s make investing easy, accessible and secure.”

Konstantinos Faliagkas, Co-Founder & CTO of Wealthyhood, underlines: “Launching in Greece has been a major milestone for our team, and we’re very excited the time has now come!”

Free share to say welcome

As a welcome gesture, exclusive to waitlist subscribers, new users will receive a free share worth up to €200 when they complete their first investment of €100 or more!

“We’ve seen incredible demand on our waitlist, and we want to thank each and every person who shares our vision from the very beginning!” Alexandros concludes.

Strategic expansion

The Greek launch is part of Wealthyhood’s broader European expansion strategy. The company chose Greece as its European headquarters for regulatory authorisation, demonstrating confidence in the Greek fintech ecosystem.

“Bringing Wealthyhood to our home country represents more than just market expansion. It’s about changing how an entire generation approaches wealth-building”, Alexandros emphasises. “This is just the beginning of our mission to democratise investing across Europe.”

From his part, Konstantinos explains: “The technical challenges of expanding to Greece were significant, but our team delivered. We’re now energised by this next chapter for Wealthyhood and the opportunities it brings.”

The company is also expanding its B2B offering, leveraging its tech platform to help financial institutions seeking to modernise their digital investment and wealth services. The first strategic partnerships will be announced in the coming months.

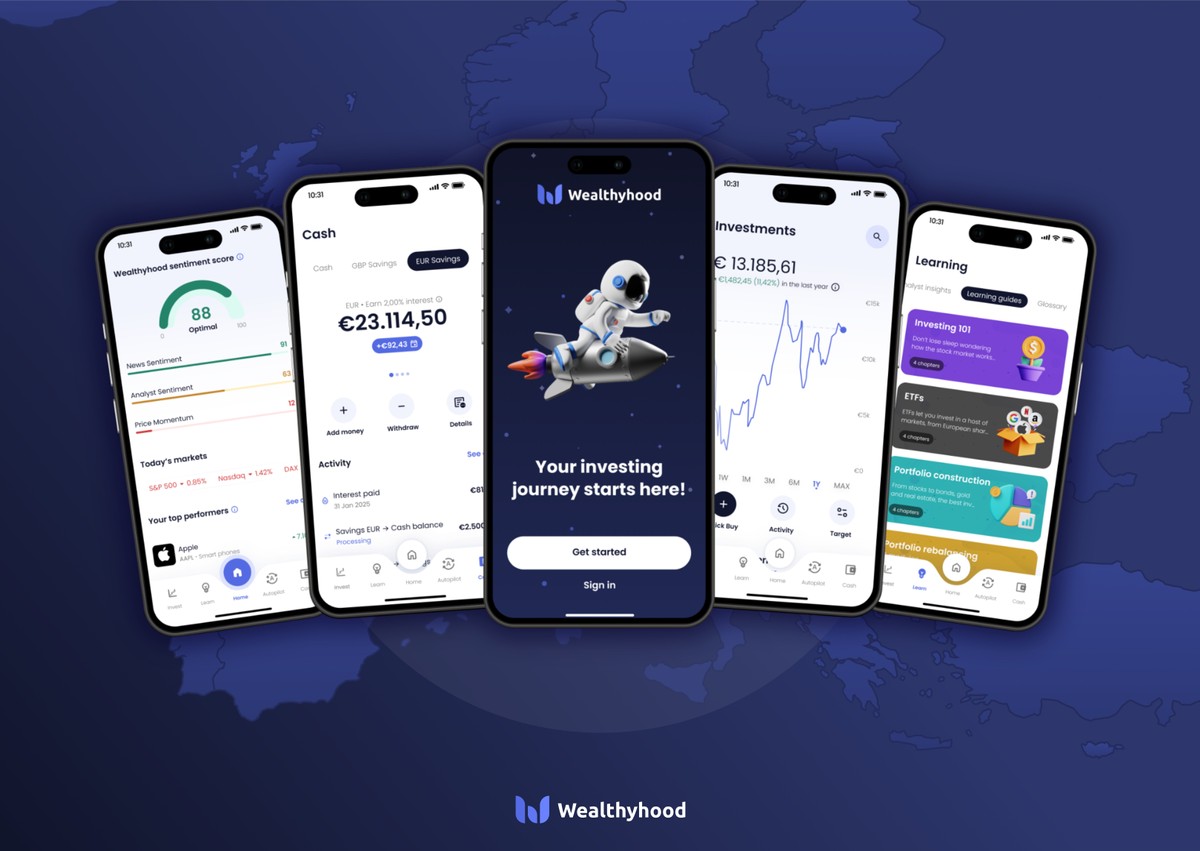

The Wealthyhood investing experience

Wealthyhood is the Greek-founded investing app, helping younger investors learn, save and invest. Committed to making investing easier, more accessible and transparent, the company has already attracted over 50,000 active users in the United Kingdom within just two years of launching its app.

Wealthyhood focuses on empowering users to start building their wealth, regardless of their knowledge, experience or available capital, through a user-friendly and modern environment. The investment experience revolves around four pillars:

-

Financial education: Wealthyhood has developed a dynamic knowledge ecosystem with more than 50 interactive lessons, daily market analyses, bit-sized summaries and insights tailored to each user’s needs, leveraging the power of AI.

-

Saving: Wealthyhood’s Savings Vaults paying market-beating interest on uninvested cash balances.

-

Investing: Users can invest in the largest and most innovative companies in the world from €1, with zero commissions and fractional shares, while smart tools guide them through their investment journey.

-

Automation: Wealthyhood Autopilot automates the saving and investment process with just one tap.

Wealthyhood Europe Investment Services SA (ΑΕΠΕΥ) is authorised and regulated to operate as an investment firm by the Hellenic Capital Markets Commission (HCMC) under activity licence number 3/1014. Please read our terms and conditions before using our services.

Disclaimer: When investing, your capital is at risk. The value of your investments may go up as well as down. Wealthyhood does not render investment, financial, legal, tax or accounting advice. You should consider your own personal circumstances when making investment decisions and, if necessary, seek qualified advice. Terms and conditions apply to the free share offer.