Investing

made easy

No more day-trading. Start building your long-term wealth today!

Capital at risk.

Why invest with Wealthyhood

Made for beginners

Simple investing for everyone, with no jargon, and tools to guide you at every step.

For the long term

Forget day-trading. Wealth-building is a marathon. We help you run that race!

Smart

Develop, finetune and automatically maintain a top-class portfolio.

Personalised

You're special. Invest in what matters to you and achieve your own goals.

Commission-free

Every £ saved compounds in your portfolio. FX fees of 0.75%/0.35% apply.

Capital at risk.

Stop gambling,

start investing

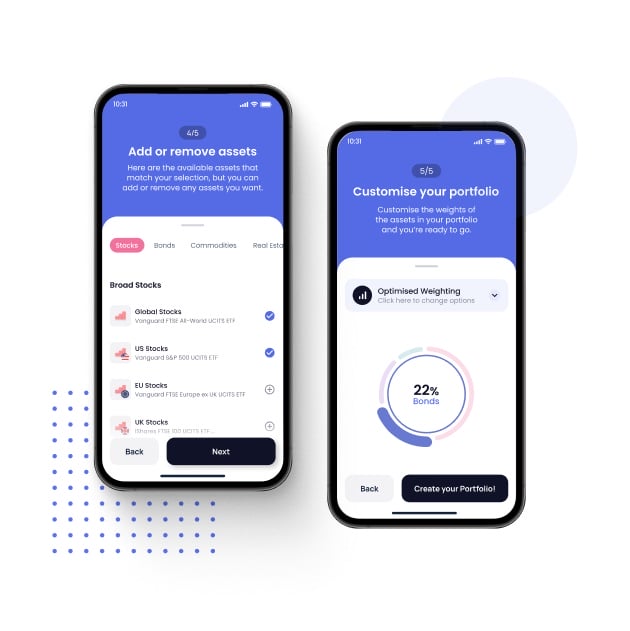

Build a personalised portfolio

Every investor is unique - build your custom, diversified portfolio in a few simple steps.

Not confident enough? Don't worry - our tools will guide you through your journey.

We've taken all the complexity away, so you can focus on what matters to you.

Invest

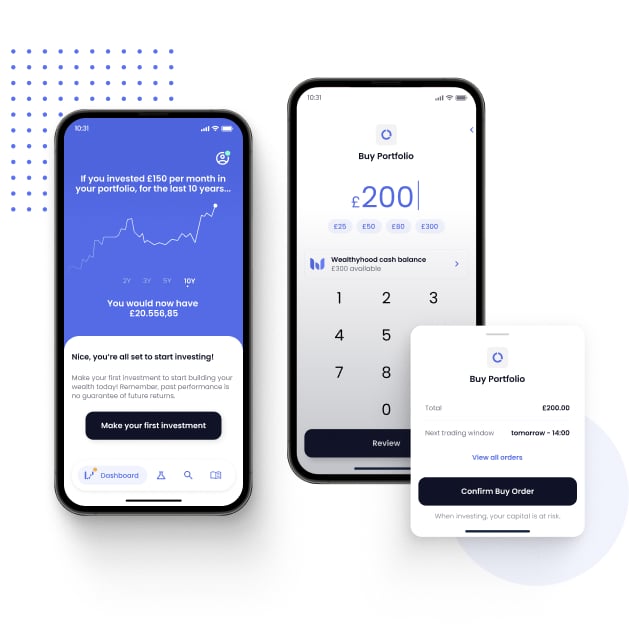

Buy as little as £1 of your favourite stocks and ETFs with Wealthyhood fractional shares.

Invest what you can afford with ease and make sure you're always well-diversified.

Top-up your portfolio with 1 click, in seconds.

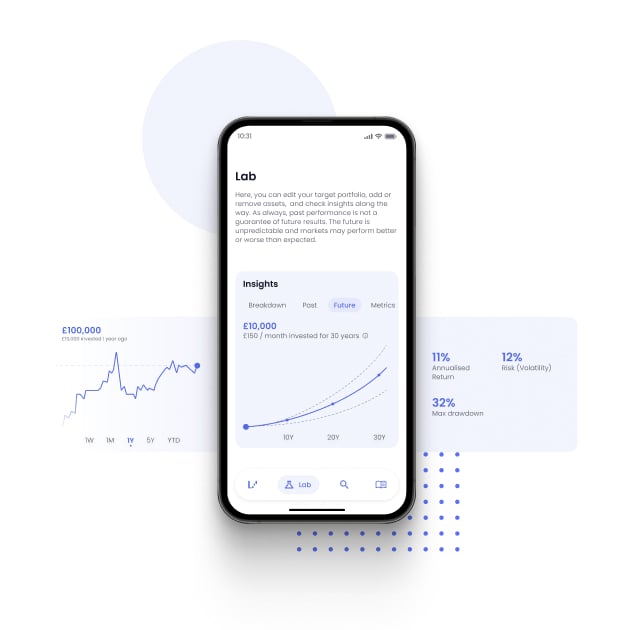

Your money on auto-pilot

Just decide how much and how often.

Our powerful automation helps finetune and maintain your portfolio over the long term.

Schedule monthly top-ups, dynamically rebalance and auto-invest your spare cash.

Start early

Start small

Build long-term

You don’t need much money to get started. But if you’re looking for a balanced portfolio, a consistent plan and the right tools, we have some good news! Wealthyhood is here to hold your hand during your investing journey. For long-term investing, early is more! Your monthly investments add up over time. And compound!

Past performance is no guarantee of future returns.

Investing vs saving over 30 years

Invest your money to its full potential

Capital at risk.

Learn more, invest with confidence

Invest in yourself along with your money! We have partnered with Finimize to provide you the best learning guides and help you navigate the stock markets with ease.

FAQs

Wealthyhood is the first DIY wealth-building app for long-term investors. We provide the tools to guide long-term investors to build their wealth over time by intelligently investing their money the way they want, with no commissions.

Wealthyhood provides the perfect mix of personalisation and automation so that even beginner investors can navigate the stock markets and put their money to work for them, like the top-1%.

Simply put, trading apps came to democratise investing. We're now rationalising it.

Wealthyhood gives you the tools you need to build wealth for the long term. Here's how Wealthyhood works.

- Build your portfolio. When you first join Wealthyhood, you get to create your personalised portfolio. Pick your asset classes, geography, themes and investment style and make your first long-term portfolio.

- Customise. Use Wealthyhood's guidance and real-time insights to further customise your portfolio. Add or remove stocks and ETFs, and set your target allocation.

- Top-up & invest your way. Get started with as little as £1 and get your portfolio working for you. Buy stocks and ETFs with Wealthyhood fractional shares. Invest what you can afford with no commissions.

- Automate. Schedule monthly top-ups, dynamically rebalance and auto-invest your spare cash. Just sit back, relax and watch your money grow.

You can buy stocks and ETFs from as little as £1 with Wealthyhood's fractional shares! The minimum deposit and portfolio investment is £20.

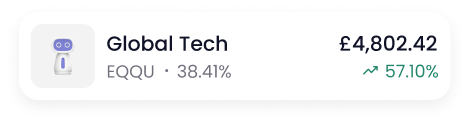

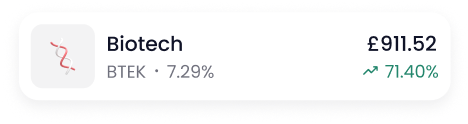

Wealthyhood offers a wide range of stocks and ETFs from all around the world.

- ETFs: You can invest in ETFs from all asset classes (stocks, bonds, commodities, real estate), sectors and geographies, and also access a wide range of thematic ETFs, including Biotechnology, Cloud Computing, Artificial Intelligence, Digitalisation, Clean Energy, Video Gaming and many more.

- Stocks: Wealthyhood also offers a broad range of individual stocks, from the US, UK, European and global markets, like NVIDIA, Apple, Amazon, Tesla and many more.

We currently offer General Investment Accounts (GIA) and are working hard to add more options in the coming months.

Orders for individual stocks placed within market hours, will be executed instantly. If an order is placed outside market hours, it will be queued and executed at the opening of the next market session. The regular trading hours for the US stock market, including the Nasdaq and the New York Stock Exchange, are from 9:30 to 16:00 ET.

ETF orders are executed within a 13:00 trading window every weekday. This allows us to provide our clients real commission-free investing across all ETFs.

Wealthyhood charges no commissions or fees per trade to execute your orders! That's because we want to make it easy for everyone to get started investing. We also offer three easy plans for investors with different needs and goals.

- Wealthyhood Basic is free. It is great to get started and set up your personal investment account. It includes unlimited commission-free investing in stocks and ETFs, access to fractional shares from only £1, portfolio automation, premium learning guides, daily insights & news, and over 1 million personalised portfolio templates. The Basic plan comes with a custody fee of 0.18% per annum, charged monthly and a 0.75% currency conversion fee when you want to access products in different currencies.

- Wealthyhood Plus costs £2.99 / month or £23.99 / year. It includes everything in Wealthyhood Basic, plus zero custody fees, premium currency conversion rates of 0.35%, a 1% bonus dividend on the value of your portfolio and 0.25% cash back on investments over £50!

- Wealthyhood Gold costs £12.99 / month or £119.99 / year. It is best for savvy wealth-builders to supercharge their investing. It includes everything in Wealthyhood Basic, plus zero custody fees, premium currency conversion rates of 0.25%, a 4% bonus dividend on the value of your portfolio, 0.4% cash back on investments over £50 and priority customer service!

All our plans offer unlimited free deposits and withdrawals.

Of course! You can use all our tools to play around and easily construct your personalised, diversified portfolio in minutes for free!

You can then track your virtual portfolio, finetune it and invest whenever you feel comfortable.

You can also leverage the power of our Learning Hub, our powerhouse of knowledge and learning, designed to take your investment savvy to the next level, with daily market news, analyst insights, learning guides and a glossary!

No, we don't manage your money on your behalf.

We just make sure you have all the tools, insights and the best investing experience to help you make informed decisions and start building your long term wealth safely.

Yes, your money is FSCS-protected, up to £85,000 subject to the conditions set out by the FSCS.

This doesn't cover losses incurred through investment performance or if you get back less than you originally invested. When you invest, your capital is at risk.

At Wealthyhood, we are committed to following rigorous processes and policies to ensure the security of your money and investments.

- Your assets are kept separate from our own and are held by authorised custodians, as we partner with top-tier financial institutions for the safeguarding and safekeeping of your assets. This arrangement ensures that, even in the unlikely event of financial issues affecting our company, creditors would not be able to access your investments or cash holdings with us. Your money and investments will always be there for you to access.

- Your money is FSCS-protected, up to £85,000 subject to the conditions set out by the FSCS.

- Wealthyhood uses cutting-edge security features. Wealthyhood employs advanced security measures to protect your assets and information. These include state-of-the-art encryption technology to safeguard data during transmission and storage, multi-factor authentication for user access, and continuous monitoring for any suspicious activities.

Read more about our Investor T&Cs.

Wealthyhood (Wealthyhood Ltd, FCA Register: 933675) is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Invite your friends to join Wealthyhood, receive free shares, and head start your wealth-building journey! Refer a friend, and you'll both get a free share (or fraction of a share) worth up to £200!

What's next?

- Set up your Wealthyhood account

- Make your first investment

- Invite your friends with their email or share your referral code or link.

- When your friend invests at least £100, you'll both get a free share between £5 and £200!

What is Wealthyhood?

Wealthyhood is the first DIY wealth-building app for long-term investors. We provide the tools to guide long-term investors to build their wealth over time by intelligently investing their money the way they want, with no commissions.

Wealthyhood provides the perfect mix of personalisation and automation so that even beginner investors can navigate the stock markets and put their money to work for them, like the top-1%.

Simply put, trading apps came to democratise investing. We're now rationalising it.