Amazon.com Inc • AMZN

Capital at risk.

About Amazon.com Inc

Ticker

Trading on

ISIN

Industry

Sector

CEO

Headquarters

Employees

Website

Metrics

Market cap

P/E ratio

EPS

Dividend Yield

Beta

Forward P/E ratio

EBIDTA

Ex dividend date

Price & volume

Market cap

Average daily volume

90-day return

30-day return

7-day return

Dividends

Dividend per share

Dividend yield

Forward dividend per share

Forward dividend yield

Payout ratio

Valuation

P/E ratio

Forward P/E

PEG ratio

Trailing P/E

Price to sales

Price to book

Earnings

EPS

EPS estimate (current quarter)

EPS estimate (next quarter)

EBITDA

Revenues (TTM)

Revenues per share (TTM)

Technicals

Beta

52-week High

52-week Low

50-day moving average

200-day moving average

Short ratio

Short %

Management effectiveness

ROE (TTM)

ROA (TTM)

Profit margin

Gross profit margin

Operating margin

Growth

Quarterly earnings growth (YoY)

Quarterly revenue growth (YoY)

Share stats

Outstanding Shares

Float

Insiders %

Institutions %

Analyst Insights & forecasts

95% Buy

5% Hold

0% Sell

Based on information from 70 analysts.

Average price target

Earnings per share (EPS) forecast

Financial Performance

Data displayed above is indicative only and its accuracy or completeness is not guaranteed. Past performance is no guarantee of future results. Your return may be affected by currency fluctuations and applicable fees and charges. The value of your investment may go up as well as down. When investing, your capital at risk.

How to Buy Amazon Shares in the UK and the EU

Quick List

Step 1: Download the Wealthyhood app.

Step 2: Signup for a free account

Step 3: Complete the W-8BEN Form

Step 4: Top - Up your account

Step 5: Select the Amazon Stock

Step 6: Specify Amazon shares quantity

Step 7: Hit "Buy" and then submit your order

Investing in any company should be taken seriously as investing carries risks and can cause permanent loss of funds.

Buying Amazon shares in the UK or in the EU is a process that involves a lot of research. Here is how you can buy Amazon stocks in the UK and the EU.

1. Signup on an Investing Platform

Wealthyhood is an investing app designed for long-term investors who are looking to DCA and strategically grow their portfolio.

The app is free to use and offers commission-free investments. Keep reading to see how you can utilise Wealthyhood's tools to invest for the long term.

Επένδυσε με την Wealthyhood

Capital at risk

2. Complete the W - 8BEN Form

(This step is facilitated automatically by Wealthyhood to make your onboarding as smooth as possible.)

Completing the W-8BEN form is a crucial step for non-U.S. residents who earn income from U.S. sources, allowing them to claim tax treaty benefits, including reduced rates of withholding tax. This form serves as a declaration of one's foreign status and eligibility for these benefits, ensuring compliance with U.S. tax laws while potentially lowering the tax burden on U.S.-sourced income.

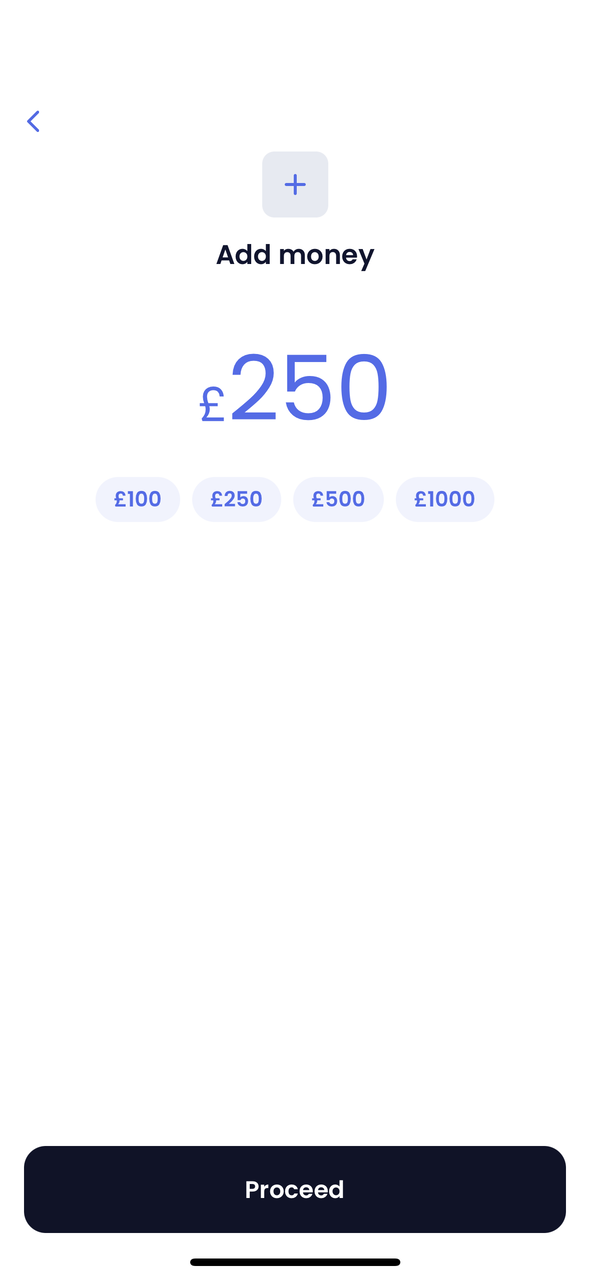

3. Top - Up Your Account

To buy shares in Amazon you will first need to top up your account with the amount of money you would like to invest. Just go to "Account" in the Wealthyhood app and select "Top Up". From there you can specify the amount you would like to add to your account.

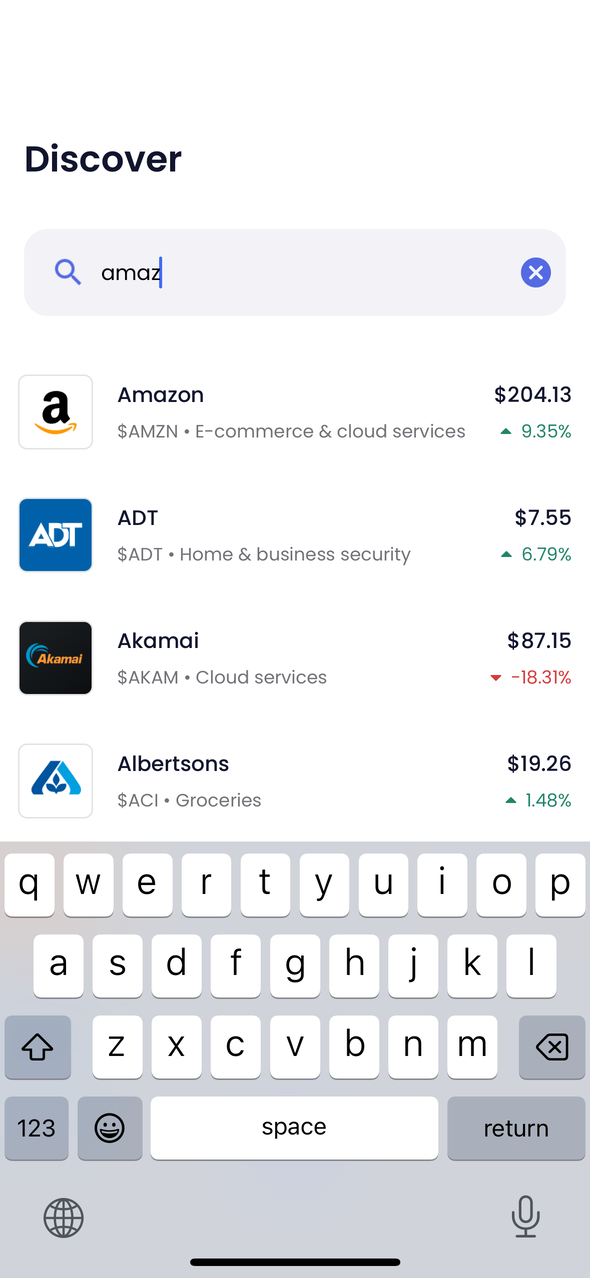

4. Choose The Amazon Stock

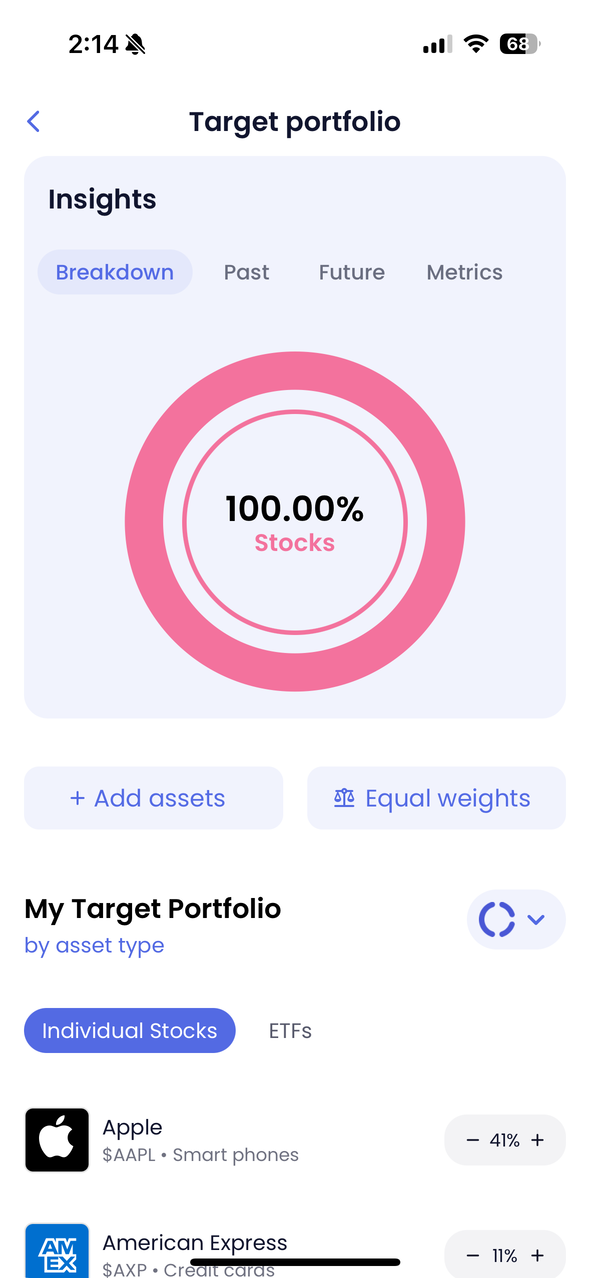

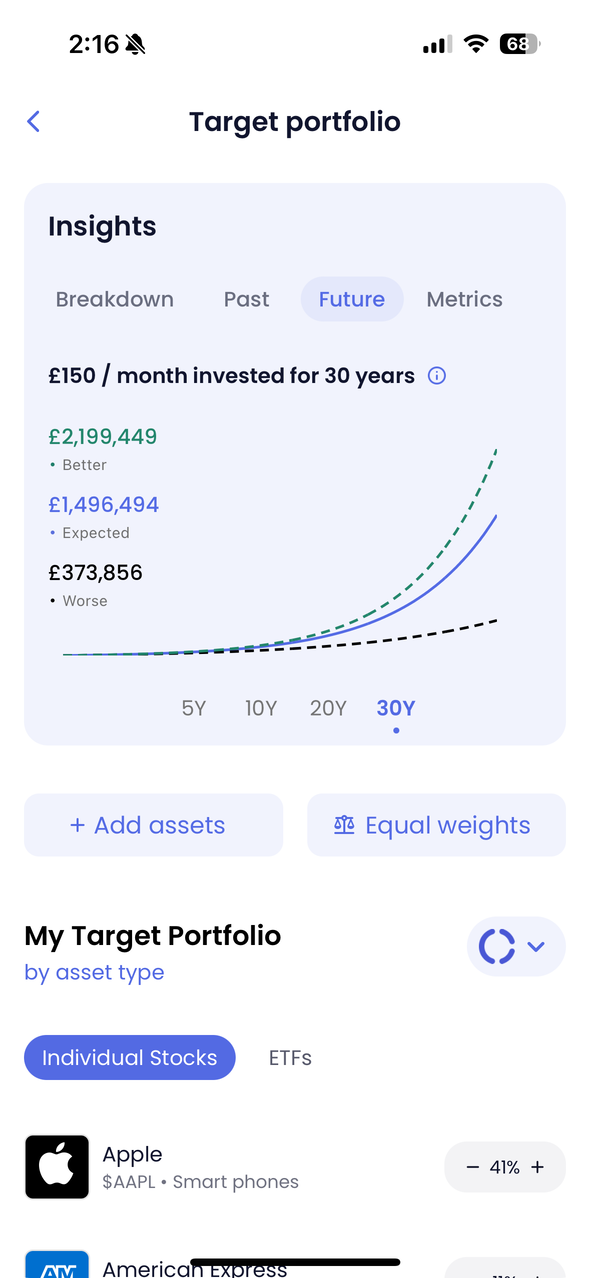

Once you have funded your account, you can go back to "Target". In the target portfolio, you can select how to structure your portfolio. Type Amazon in the search bar and select Amazon. If you want to buy only Amazon shares you should select only Amazon. However, you can also include more stocks if you prefer a more diversified portfolio.

5. Construct your portfolio

Constructing your portfolio involves selecting investments that align with your long-term goals and risk tolerance. This step is about diversification, balancing between stocks, bonds, real estate, and other assets to minimize risk while aiming for a desired return. Regular rebalancing ensures your portfolio stays on track.

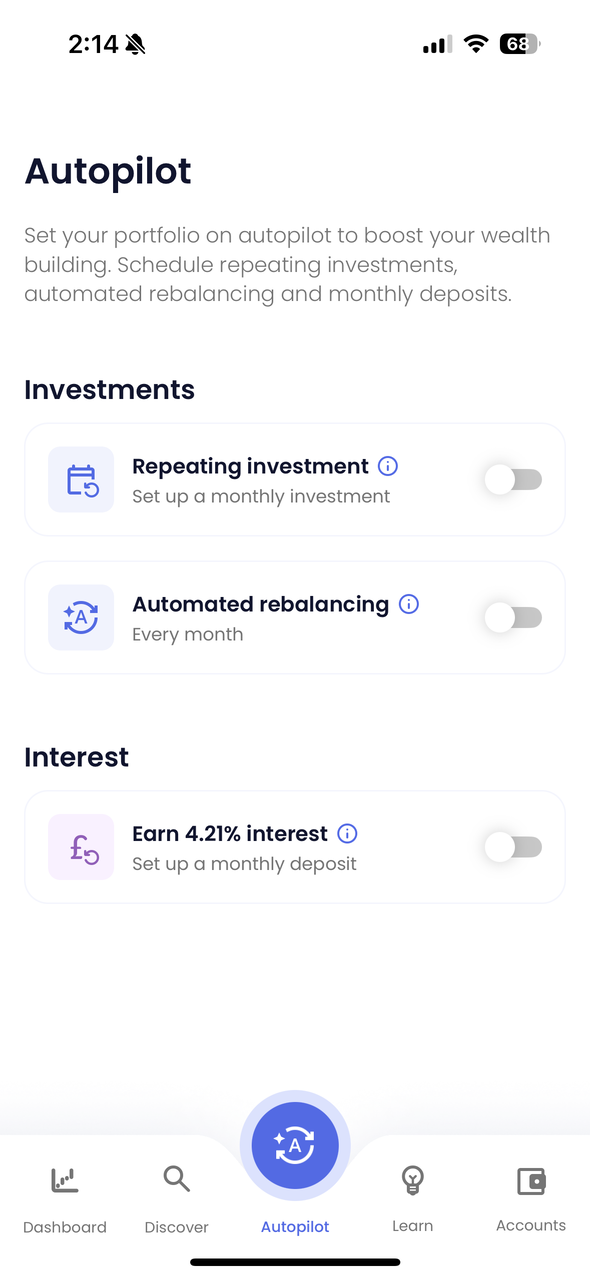

6. Set Up a recurring monthly investment (Optional)

Setting up a recurring monthly investment is a powerful strategy to build robust investing habits. It involves automatically investing a fixed amount of money into your portfolio every month, regardless of market conditions. This approach, known as dollar-cost averaging, can reduce the impact of volatility and help build investment discipline.

7. Monitor your Amazon Investment

Monitoring your investments is a critical aspect of managing your portfolio. It involves regularly reviewing your investment performance and making adjustments as needed to align with your financial goals and market conditions. This may include rebalancing your portfolio, reinvesting dividends, or changing your investment strategy based on life changes.

8. Calculate and Pay your Taxes

Doing your taxes is a vital annual task for EU or UK investors, involving the accurate reporting of income and capital gains from investments to HM Revenue and Customs (HMRC). It's essential to be aware of your tax allowances, such as the Capital Gains Tax allowance and the Dividend Allowance, to optimize tax efficiency.

Buy Amazon SharesIf you are investing in the UK, tax-advantaged accounts like ISAs and pensions can significantly reduce your tax liability, maximizing the growth of your investments. Staying informed about tax changes and seeking professional advice if necessary can ensure compliance and optimize your financial strategy.

Build your future fund today!

Automate your wealth-building journey and turn investing into a habit that your future self will be grateful for!

Capital at risk.

Build your future fund today!

Automate your wealth-building journey and turn investing into a habit that your future self will be grateful for!

Capital at risk.

FAQs

Amazon.com Inc shares are currently traded for undefined per share.

Amazon.com Inc currently has 10.7B shares.

No, Amazon.com Inc doesn't pay dividends.

Amazon.com Inc 52 week high is $258.60.

Amazon.com Inc 52 week low is $161.38.

Amazon.com Inc 200-day moving average is $215.41.

The CEO of Amazon.com Inc is Andrew R. Jassy.

Amazon.com Inc has 1,578,000 employees.

The market cap of Amazon.com Inc is $2.42T.

The current P/E of Amazon.com Inc is 32.07.

The EPS of Amazon.com Inc is $7.07.

The PEG Ratio of Amazon.com Inc is 1.5.

According to the analysts Amazon.com Inc is considered a buy.