Investing

made easier

Stocks, ETFs and up to 1.91% interest with zero commissions and powerful automation.

Capital at risk. Other fees apply.

As seen in

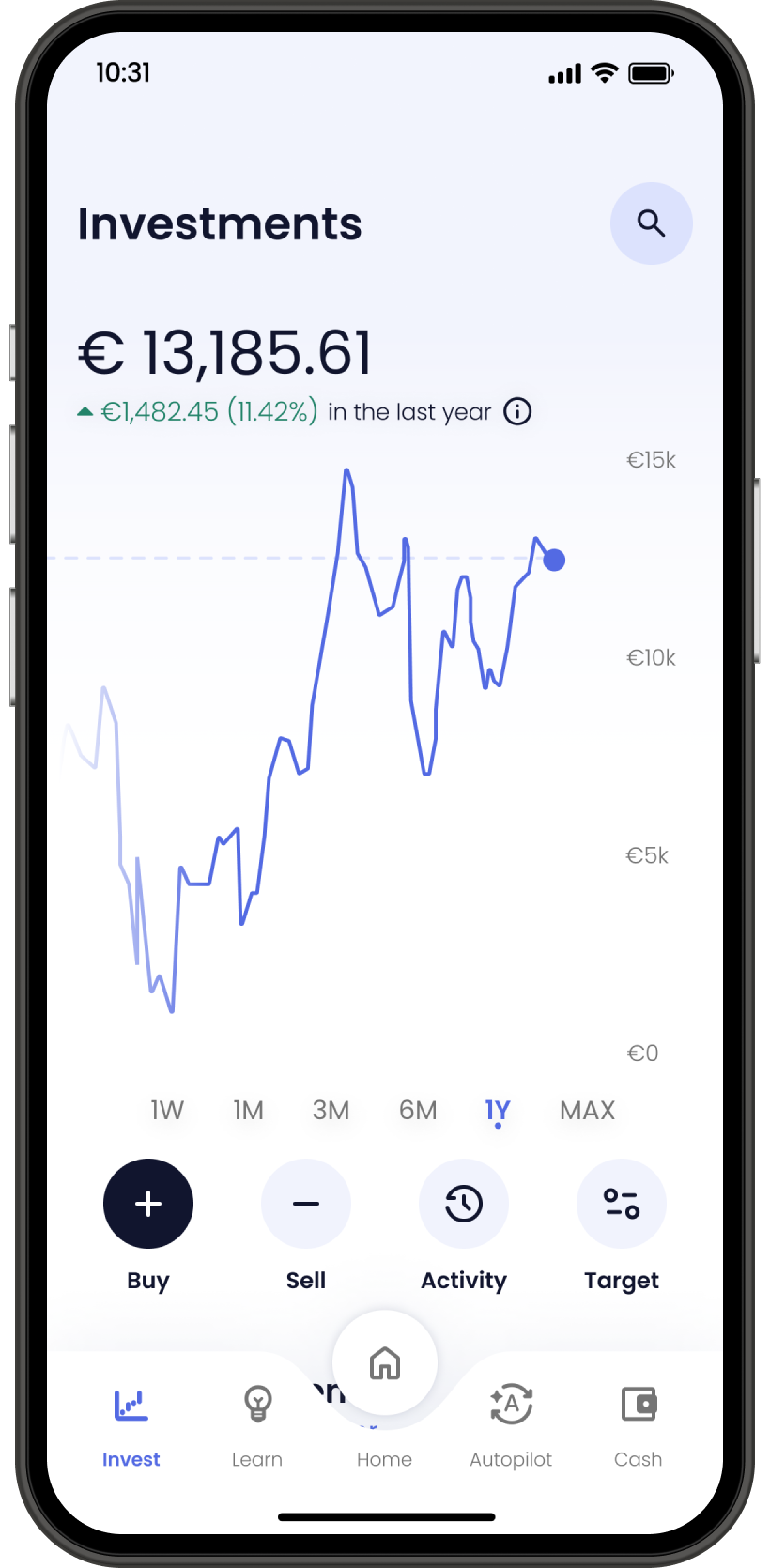

A world of investments in one app

Invest in US, UK, European and international shares

Investing shouldn't be contained. Create your investment portfolio with some of the largest and most innovative companies across the world.

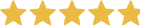

With Wealthyhood's fractional shares, you can invest in international stocks from as little as €1 with zero commissions.

Capital at risk. Other fees apply.

Learn, Save, Invest, Automate

Start investing from €1

Invest in stocks and ETFs from €1 with fractional shares! A whole share can be hundreds of pounds. Buy fractional shares (pieces of stock) at any amount and easily diversify your portfolio across some of the largest and most disruptive companies in the world.

Automated wealth building

Want to invest without the guesswork? Set it and forget it! Schedule repeating investments, rebalance your portfolio and reinvest dividends automatically. Sit back, relax and enjoy your wealth-building journey. Remember you should periodically review that automation is suitable for you.

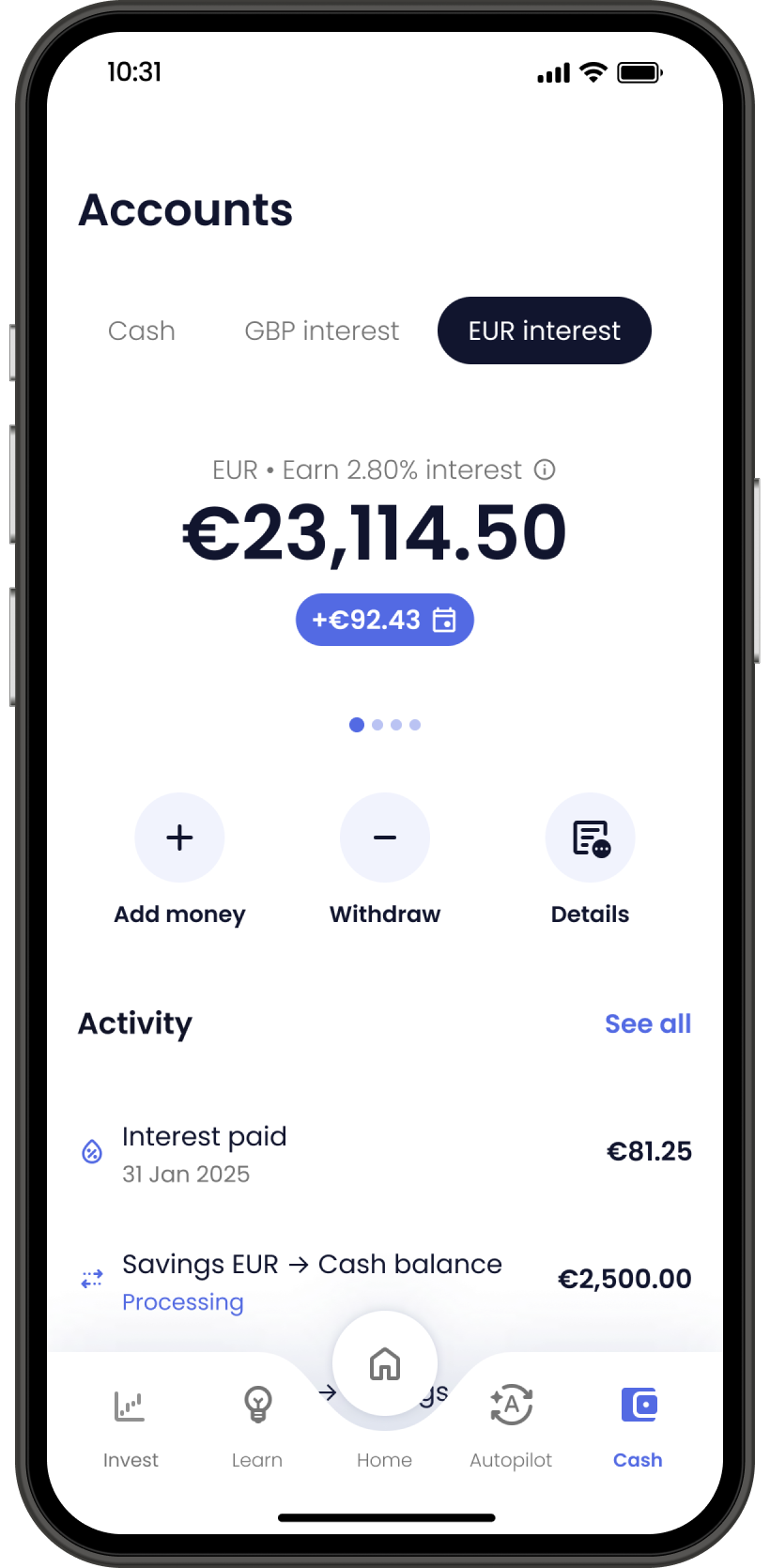

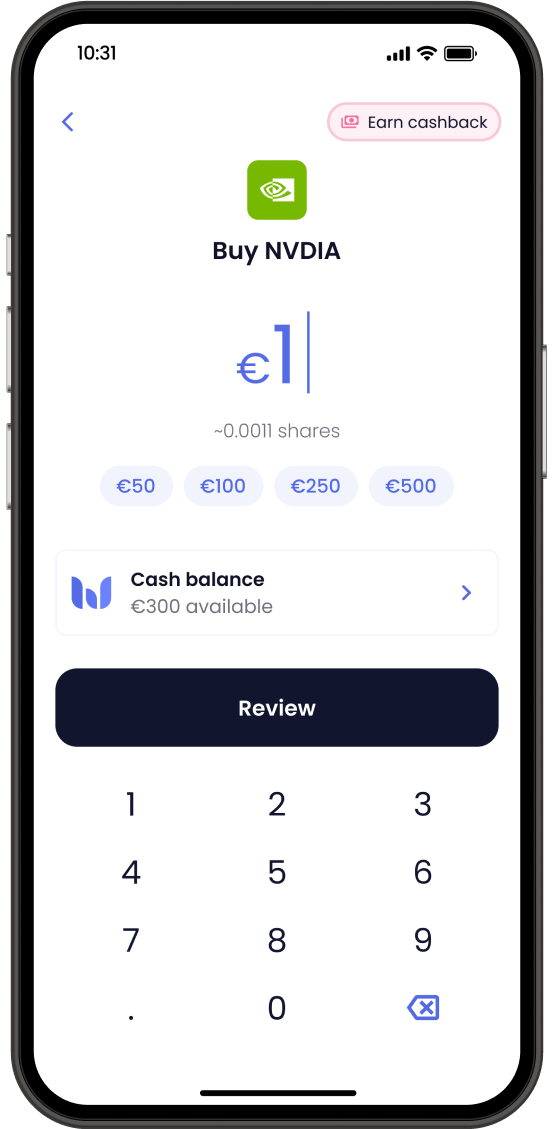

Earn up to 1.91% interest

Grow your savings fast! Earn up to 1.91% interest depending on your plan, with money market funds. That's an alternative to traditional savings accounts. Keep your investments on the safe side compared to stocks and ETFs, maintain instant access with no lock-up periods. This is an investment product with variable rates.

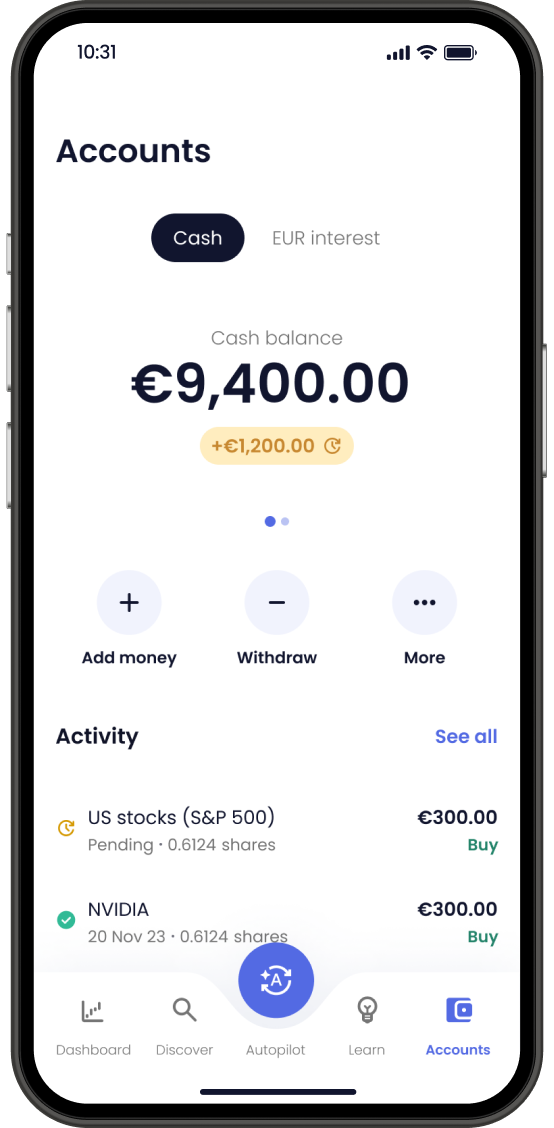

Portfolio builder

Don't know where to start investing? Our portfolio builder will help you craft your custom, diversified portfolio in a few simple steps. From tech stocks and AI, to biotechnology and clean energy, create a strategy that matches your goals and risk appetite.

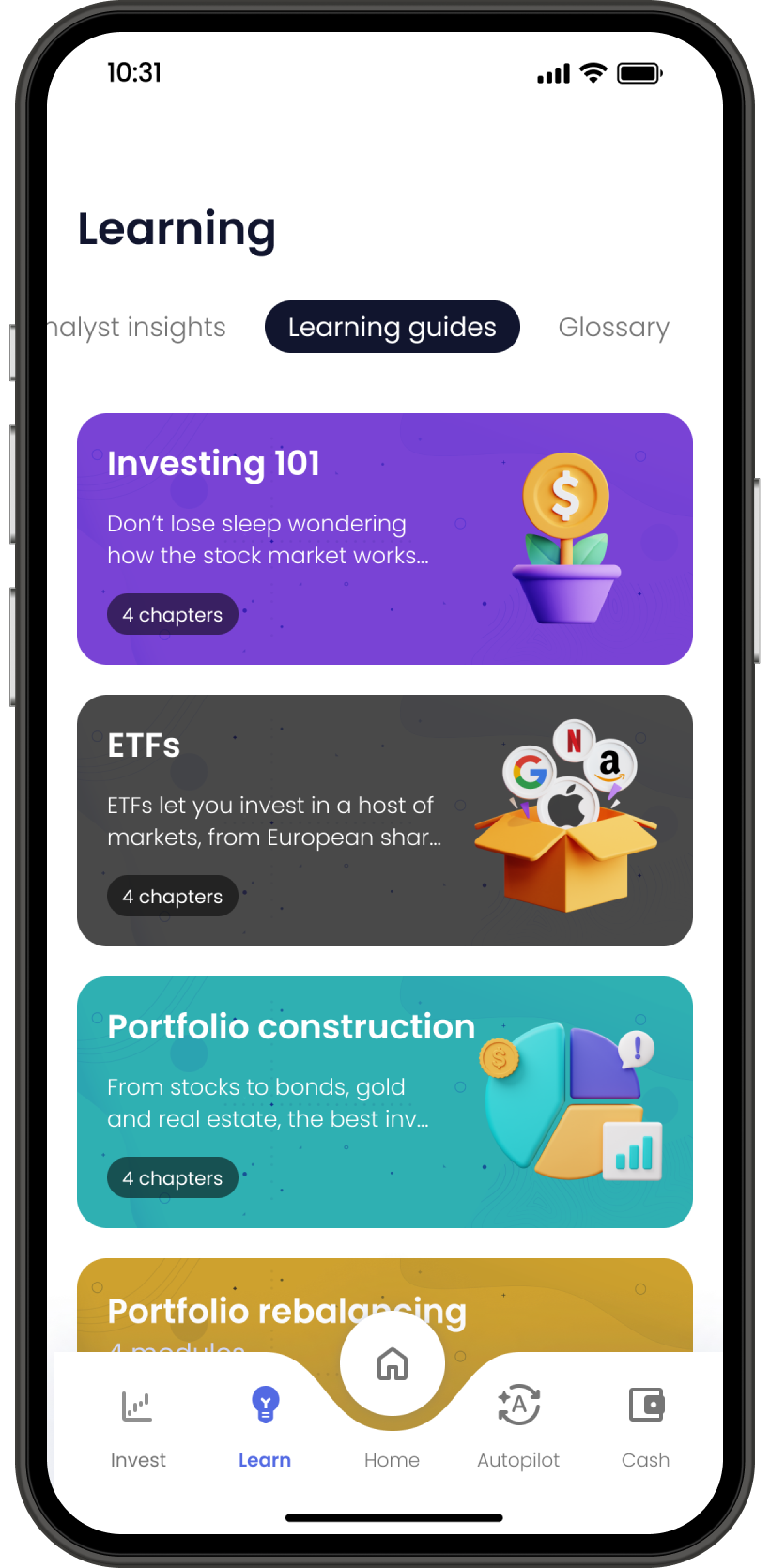

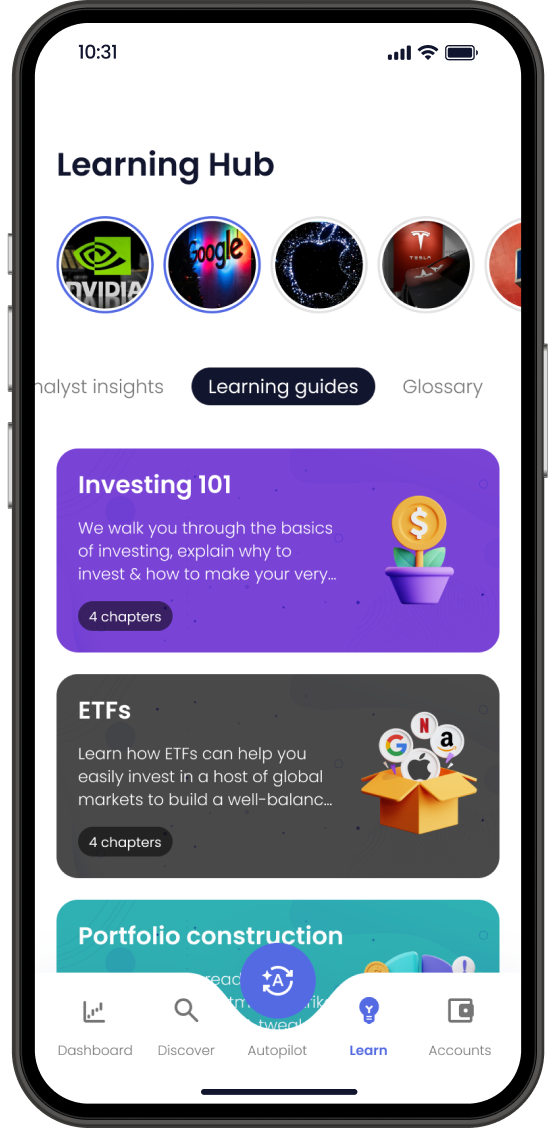

Become a better investor

Our learning guides will help you get started investing, build a diversified portfolio and potentially become a better investor! Level up with our analysts' views, daily market news and bit-sized insights, all seamlessly integrated into one app!

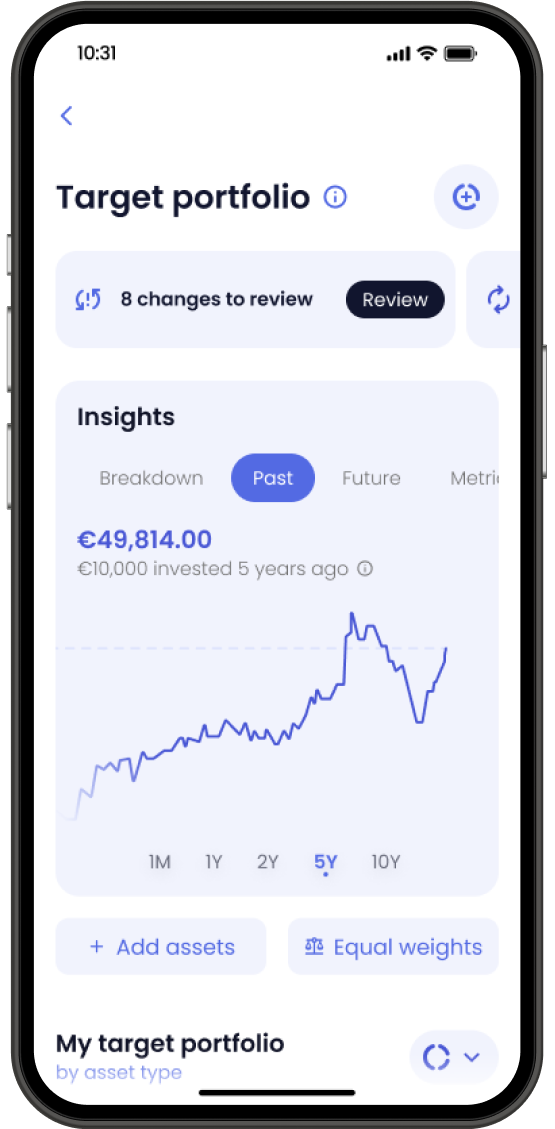

No more napkin math

Set your target allocation, check out how it performed in the past, what you might expect in the future, or how diversified it is. Keep building with 1-click portfolio buy and 1-click rebalance. We'll automatically figure out the breakdown based on your allocation. Keep in mind, past performance is no guarantee of future returns.

Your money handled with care

Regulated in the EU by the HCMC

Wealthyhood Europe is authorised and regulated in the EU by the Hellenic Capital Markets Commission (3/1014).

Regulated in the UK by the FCA

Wealthyhood is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the FCA (FRN 775330).

Stop gambling, start growing

Start Small

You don't need much money to get started. But you need a balanced portfolio, a consistent plan, and the right tools.

Start Early

For long-term investing, early is more, as your monthly investments add up over time. And compound! Capital at risk.

Investing vs saving over 30 years

Capital at risk. Past performance is no guarantee of future returns.

Be consistent

Consistent monthly investments (aka Dollar-Cost Averaging or DCA) pave the way for sustained growth in the unpredictable world of investing.

Build long-term

Start your wealth-building journey today and take control of your financial future with Wealthyhood!

Find the right plan and build wealth

on your own terms

What you get:

Unlimited commission-free

Fractional shares

Portfolio automation

1M+ portfolio templates

Free deposits & withdrawals

Zero custody fees

Earn 1.91% interest with MMFs

Premium insights & learning

Plus FX rate (0.35%)

Priority customer service

What you pay:

- Stocks: €0

- ETFs buys with Smart Execution: €0

- ETFs without Smart Execution: €1 per ETF

- 0.35% when investing in different currencies

Capital at risk.

Flexible, personalised and automated.

Intelligently invest your way, commission-free.

You are not alone

Talk to a human being!

Our dedicated support team is just a click away. Whether you have a question about your portfolio or need help with a transaction, we're here to ensure your investing experience is smooth and hassle-free.

Capital at risk.

FAQs

Wealthyhood is a wealth-building app helping younger investors learn, save, invest and build wealth privately. We are committed to making investing easier, more accessible and transparent for our generation by delivering the best investing app you could ask for!

The Wealthyhood experience revolves around:

- Learning: Our Learning Hub includes daily news, analyst insights, learning guides, a glossary, a daily newsletter with bit-sized summaries, and real-time past and future simulation to guide you on every step.

- Saving: Our Savings Vaults are high-yield accounts to help you earn market beating interest on your cash.

- Investing: We offer a 360 investing experience for beginners, busy professionals, and more experienced investors with:

- DIY investing in global stocks & ETFs from €1 with zero commissions and fractional shares.

- Our portfolio builder to help you get your fully personalised, well-diversified portfolio in minutes, depending on your preferences and risk appetite.

- 'Ready-made' actively managed, diversified investment portfolios.

- Automation: Set it and forget it. Our Autopilot helps you set up repeating monthly investments, savings and automated rebalancing to automate your wealth-building journey.

We are on a mission to help you get started investing, become a better investor day by day and build wealth under your own terms!

Yes, Wealthyhood Europe AEPEY, the provider of investment services in the European Union, is authorised and regulated to operate as an investment firm by the Hellenic Capital Markets Commission (HCMC) under activity licence number 3/1014.

Wealthyhood Ltd (FCA Register: 933675), the provider of investment services in the UK, is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Trusting us with your investments is something we take very seriously. As a licensed investment firm, Wealthyhood follows strict regulatory requirements to protect your assets. Here’s how we safeguard your money and investments:

- Your investments and uninvested funds are kept completely separate from our own and those of other clients in segregated accounts.

- These funds and investments are held with authorised custodians and regulated credit institutions.

- Unlike banks, we do not lend out customer funds or investments to third parties neither we use them for any of Wealthyhood’s business activities, meaning your money is always available to you.

- You are the legal owner of all your investments and cash holdings and everything is kept in separate accounts under your name.

These steps ensure that your money and investments remain fully protected and inaccessible to creditors under any circumstances and in any situation, everything will be safely returned to you.

Yes, your investments with Wealthyhood are protected.

For European investors, your money and investments are protected under the Hellenic Investment Guarantee Fund (ΣΚΕΕΥ) up to €30,000 per investor. For more information on the Hellenic Investment Guarantee Fund you can visit https://www.syneggiitiko.gr/.

For UK investors, your money and investments are FSCS-protected, up to £85,000 subject to the conditions set out by the FSCS at https://www.fscs.org.uk/.

Your protection doesn't cover losses incurred through investment performance or if you get back less than you originally invested.

Wealthyhood offers a wide range of stocks, ETFs and money market funds from all around the world.

- ETFs: You can invest in ETFs from all asset classes, including stocks, bonds, commodities and real estate, different sectors and geographies. You can also access a wide range of thematic ETFs, including Biotechnology, Cloud Computing, Artificial Intelligence, Digitalisation, Clean Energy, Video Gaming and many more.

- Stocks: Wealthyhood also offers a broad range of individual stocks, from the US, UK, European and global markets, like NVIDIA, Apple, Amazon, Tesla and many more.

- Money Market Funds: MMFs are an alternative to traditional savings accounts, offering competitive interest rates, allowing your savings to grow faster – all while keeping your money on the safer side.

The minimum order for individual stocks and ETFs is €1. However, you can always sell the full amount of a holding, even if it is less than €1. For portfolio buys, the minimum order is €20.

Some of the investments available on the Wealthyhood app can be bought and sold in amounts smaller than a whole share. These are fractional shares. Fractional shares are portions of a whole share in a company or an exchange-traded fund (ETF).

These shares allow investors to own a smaller portion of a single share, making it more accessible for those with limited capital or who want to diversify their investments across multiple assets.

For example, if a company's stock price is $1,000 per share, an investor could buy a fractional share worth $100, representing 1/10th or 0.1 of a share. This enables them to invest in high-priced stocks without needing the full amount for a whole share.

Fractional shares represent a portion of a full share in a company, which means they carry the same risks as entire shares. However, fractional shares are non-transferable, but you can always buy and sell them through the Wealthyhood app.

The Savings Vault allows you to invest your funds in money market funds through the Wealthyhood app. Money Market Funds (MMFs) are an alternative to traditional savings accounts, offering higher interest rates, and allowing your savings to grow faster, all while keeping your money on the safer side.

You can set up separate vaults for each supported currency, depending on your country.

Repeating investments help you automate investing in your portfolio every month. This process (aka dollar-cost averaging - DCA) allows you to consistently build wealth and navigate the ups and downs of the markets.

When activated, a repeating investment is placed once a month as a "Portfolio Buy" order, based on your "Template Portfolio" or your current holdings. You simply decide how much you want to invest and the bank account you want to use.

The repeating investment takes place on the date you define. For example, if you set it up for the 15th of the month, the repeating investment will occur on the 15th of each subsequent month for as long as it is activated.

You can manage your repeating investment from Wealthyhood’s Autopilot section.

Wealthyhood offers three plans for investors with different needs and goals:

- Basic: Our Basic plan is free of charge and is great to get started and set up your personal investment account. It includes 1,000+ commission-free stocks & ETFs, with fractional shares from only €1, access to your Savings Vault, portfolio automation, over 1 million personalised portfolio templates and zero custody fees. The Basic plan comes with a 0.55% FX fee when you want to access products in different currencies.

- Plus: Our Plus plan costs €2.99 / month or €23.99 / year and is ideal to take your wealth-building to the next level. It includes everything in the Basic plan, plus premium learning guides, daily analyst insights & news, premium currency conversion rates of 0.35% and higher interest on your Savings Vault!

- Gold: Our Gold plan costs €12.99 / month or €119.99 / year and is best for savvy wealth-builders to supercharge their investing. It includes everything in Wealthyhood Basic, plus premium learning guides, daily analyst insights & news, premium currency conversion rates of 0.25%, even higher interest on your Savings Vault and priority customer service!

You can read more about our plans at https://wealthyhood.com/eu/pricing/.

With our referral scheme, you can invite your friends to join Wealthyhood and receive free shares up to €200! Whenever you complete a successful referral, both you and your friend will receive a free share (or a fraction of a share).

You can invite a friend by entering their email or sending them your unique referral code or link. You can find the different options from your Wealthyhood app by heading to your Profile > Earn free shares > Invite a friend to Wealthyhood.

To receive your free shares:

- You must set up your Wealthyhood account, verify your details, and make a deposit.

- Your friend must set up their account, verify their details, and deposit at least €100 within 7 days of signing up.

After completing these steps, a free share will appear on each of your accounts!

For individual stocks, if you place an order within market hours, your order will be executed instantly. If an order is placed outside market hours, it will be queued and executed at the opening of the next market session. The regular trading hours for the US stock market, including the Nasdaq and the New York Stock Exchange, are from 9:30 to 16:00 Eastern Time (ET).

ETF orders are executed within a trading window every weekday. The beginning of the trading window is communicated to you before submitting your order confirmation and is dependent on your time zone. If you place an order after the beginning of the trading window, this will be executed in the corresponding trading window of the next business day. Although orders for ETFs are executed within the designated trading window, it may take some time until you receive confirmation of execution and the order status is updated on your Wealthyhood account.

The Portfolio Builder helps you create a custom investment portfolio through a step-by-step process, by selecting asset classes, geography, sectors, and investment style. You can start with a pre-made template and then customise it according to your preferences.

- Creating a portfolio template is easy and involves 4 simple steps:

- • Step 1: Choose your asset classes (e.g. Stocks, Bonds, Commodities, Real Estate).

- • Step 2: Select your geography (e.g. Global, US).

- • Step 3: Include specific sectors and themes.

- • Step 4: Define how your portfolio is weighted (custom or equal weighting across assets).

Once you complete these steps, the Portfolio Builder will generate a portfolio template based on your choices. This will include ETFs from our investment universe that match your selection with the corresponding weighting. At this point, your portfolio template is ready and you can use it as a starting point.

You can then customise it, add or remove stocks and ETFs or edit the weights of the assets in your portfolio as you want.

Using our Portfolio Builder is optional. You can skip it and create your portfolio from scratch, add stocks and ETFs you want to invest in and define their weights manually.

You can also skip the portfolio creation process entirely and just buy the stocks and ETFs you want directly, one by one.