Government bonds

Chapters

Government bonds

What makes prices move?

How interest rates, inflation, and risk affect government bond prices

Government bonds get issued all the time. The US Treasury Department, for example, auctions off new bonds every few days, with maturity dates ranging from four weeks all the way up to 30 years. 📅

The initial yield of a new bond is determined when it’s first auctioned, with investors submitting bids based on the prevailing central bank target interest rate at the time.

In general, the longer the maturity, the higher the yield investors demand: we have no idea what the world will look like 30 years from now, so a bet on the US government’s long-term stability typically carries more risk than a bet on it still being around one year from now.

As ever, investors need to be compensated for that increased risk with an increased return. At the time of writing, a one-year Treasury bill offers a yield of ~2.08%, while a 30-year bond yields ~3.07% (the US uses different terms – bill, note, bond – to denote different debt maturities).

Once the bonds are in investors’ hands they start trading on the secondary market, where their prices move 📊 based on macroeconomic factors.

Interest rates

The primary driver, again, is the interest rate set by a central bank, which in turn affects the rate of interest available throughout an economy. If rates fall lower than a bond’s yield, that bond (depending on its maturity) may be a good investment: why put money in a bank account if the government will pay you more?

Investors will likely buy those bonds, driving their price up 📈 and their yield – the coupon payment as a percentage of that price, remember – down.

Similarly, if the government wants to issue new bonds after rates have gone down, it’ll want to take advantage of the new environment – so they’ll be issued at lower yields than the last batch. Of course, rising interest rates tend to have the opposite effect.

As a basic cheat sheet:

Falling interest rates → higher bond prices → lower bond yields

Rising interest rates → lower bond prices → higher bond yields

Ιn reality, prices tend to move before things actually happen – so bond prices often indicate what investors think is going to happen next to interest rates. That also explains why falling rates don’t always lead to lower yields.

Inflation

Investors might worry that lower interest rates will overstimulate the economy and spark excess inflation, which erodes the value of money. Inflation is toxic ☠️ for bonds, as it makes their coupon payments and maturity repayment worth less over time.

So when rates are lowered, longer-term bonds might see their prices fall as investors demand a higher yield to compensate them for the anticipated extra inflation.

If inflation does eventually overshoot, however, the central bank will usually raise interest rates again to rein it in – meaning that long-term bond yields should end up reflecting long-term interest rates. 🤗

Inflation-protected bonds? Because of the threat that inflation poses to bonds, some have protection built in: their coupon payments change according to inflation. These bonds, called Treasury Inflation Protected Securities or TIPS in the US, actually become more popular when inflation is high, driving their prices up.

Risk & fear 😱

The other big mover of bond prices is risk. Because the UK and US have never full-on defaulted on their debt, their bonds are considered an extremely safe investment. So when uncertainty is high – if, for instance, investors expect an imminent recession to cause the stock market to plunge – people retreat to that safety.

Bond prices go up, and their yields go down (which, if a recession does hit, makes sense: the central bank will likely cut interest rates).

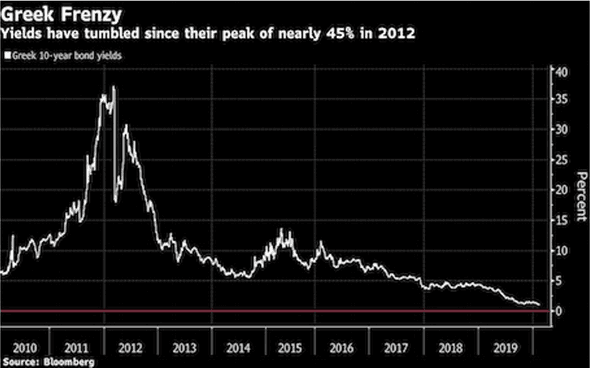

Investors are also sensitive to the individual riskiness of any given bond. If a country stops looking safe and a default becomes more likely, investors will demand a better return to compensate them for the added risk.

So when a credit rating agency downgrades a country’s rating, its bonds’ prices will fall until their yield looks suitably juicy.

Greek 🇬🇷 government bond yields had to grow very juicy indeed to tempt investors in 2011. As always, past performance is not a guarantee of future returns.

Supply & demand

Bond supply is another factor that affects prices. If governments embark on big spending projects and issue lots of bonds to fund them, prices might be driven down.

And if a central bank, trying to stimulate the economy, starts a quantitative easing program of buying up bonds, that’ll restrict supply and boost prices – part of the reason why bond prices have been on a tear since the last financial crisis and up to 2022. 😉

As maturity comes…

All these factors influence a bond’s price between its issuance and its maturity date. But as that maturity nears, the bond’s price will gradually return to its par value: a week before maturity and with no coupon payments left, a $100 bond is only worth $100.

Unlike stocks, which can gain in price and stay that way, bond price movements are transient – you can only benefit from them by selling before maturity.

Over time, you’ll spot recurrent patterns. Bonds are a “counter-cyclical” investment: they’re most popular in times of economic slowdown, as discussed – less popular during booms, when stocks offer better potential returns – and then back in vogue as the bustman comeths.

And there are also longer-term trends. Bond yields seem to be stuck permanently lower than they were 40 years ago; a return to the 15% yields of the ‘80s seems unlikely.

But low yields don’t mean bonds aren’t worth investing in. In the next session, we’ll look at how investors can analyse a given government bond to see if it’s right for you. 🤓

The takeaway

Higher interest rates, inflation, and increased risk drive bond prices down – which means bond yields rise. But price changes for any given bond are transient: at maturity, it’ll simply be worth its par value.

-

Never forget that when you invest, your capital is at risk. This learning guide is for information purposes only and is not intended as investment advice. Although this material is intended to be educational, it may promote the services provided by Wealthyhood.