Government bonds

Chapters

Government bonds

Investment strategies

The laddered portfolio

Just like with stocks, there are several major strategies for bond investing. Laddered 🪜 portfolios distribute money equally across bonds with different maturity dates: an investor might have 10% in bonds that mature in one year, 10% in two-year bonds, 10% in three-year bonds, and so on. As the shorter-term bonds mature, the strategy suggests buying longer ones to maintain the ladder.

This is a relatively conservative 🏖️ approach, as it reduces exposure to interest rate risk: because the bonds are continuously maturing and the proceeds being reinvested, the strategy will be investing across a range of interest rate environments rather than parking a monolithic chunk in a potentially unfavourable market.

And there’s also regular income coming in, meaning it could be suitable for people like retirees who want predictability. 👵🏼

The barbell portfolio

With a barbell 🏋🏽♂️ portfolio, money isn’t split across the whole spectrum of maturity dates. Instead, the strategy invests at either end: for example, half the money in short-term bonds (with a maturity of less than five years) and half in long-term bonds (those maturing in more than 10 or 15 years’ time).

This dual-pronged strategy aims to take advantage of the better yields offered by longer-term bonds, while also giving the freedom to adapt to the current interest rate situation when the short-term bonds mature.

It’s a particularly useful strategy when interest rates are rising because the short-term bond holdings can be rolled over into new, higher-yielding issuances.

The bullet portfolio

Then there’s the excitingly named bullet 🚄 portfolio, which invests everything in bonds with the same maturity date – typically intermediate-duration bonds (so it’s the exact opposite of the barbell approach). The bonds are usually bought over a period of time, rather than all at once, in order to reduce exposure to any one interest rate environment.

For instance, one five-year bond may be bought today, and then next year, some four-year bonds. If rates have gone up in between, it would have been the right decision to have waited.

So if a big sum of money is required on a particular date – for buying a house in five years, for instance – a bullet portfolio aims to ensure the money is available when required. But it does mean that there will be no exposure to higher-yielding long-term bonds that the other strategies offer. 😔

The yield curve

Choosing a strategy that’s right for you depends on your personal circumstances – whether you’re investing for the long term or know you’ll need the money in five years, for instance. But you should also look at the macroeconomic environment.

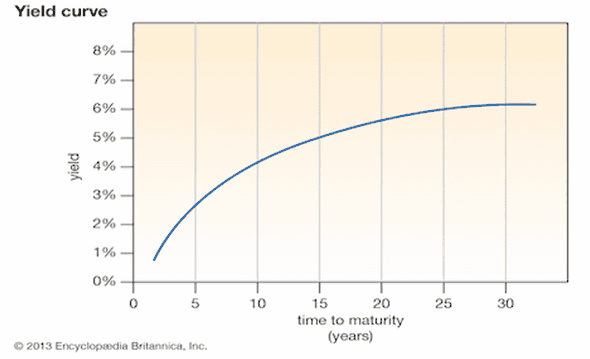

Bond investors will often talk about the yield curve – a chart plotting bonds’ different maturity dates against their yields. When expectations for future inflation are rising, longer-term bond yields will rise more than shorter-term ones, so the yield curve will steepen – and when inflation expectations are falling, the yield curve flattens.

When the yield curve is steepening, a barbell portfolio is very exposed: while half your portfolio is in short-term bonds that’ll gain in value, your longer-duration bonds are falling significantly more in price.

In this scenario, a bullet portfolio invested in intermediate-term bonds that won’t change much should do better. But when the yield curve’s flattening, the opposite is true. A bullet portfolio won’t move much, but a barbell portfolio, which contains long-term bonds that’ll see their prices rise significantly, could do well.

A laddered portfolio, of course, offers a more middle-of-the-road approach by exposing you to more of the entire yield curve. 🏋

Feeling lucky?

All of these are semi-active bond investment approaches, but you can also invest in bonds in a manner more akin to stock trading: making bets on what’s going to happen in the future and how that might affect prices, although, as discussed in our section on trading, this is a high-risk strategy and can lead to large losses 🧨 if your predictions are incorrect.

If you think an emerging market’s about to experience booming growth and become less risky, you might think its bonds are undervalued and buy them now, only to sell in a few years for a higher price. Or you might predict falling interest rates, leading you to buy longer-duration bonds that will gain the most in price when rates fall.

To do any of this, though, you’ll need to actually buy bonds. In our final chapter, you’ll learn how to do just that…

The takeaway

There are different ways to construct a bond portfolio depending on what maturity exposure you want, with ladders, barbells, and bullets all popular.

-

As always, when you invest, your capital is at risk. This learning guide is for information purposes only and is not intended as investment advice. Although this material is intended to be educational, it may promote the services provided by Wealthyhood.

Invest your money with confidence

When you invest your capital is at risk.