Investing 101

Chapters

Investing 101

The basic concepts of investing

Balancing risk and reward ⚖️

First thing to consider, investing is all about balancing risk and reward. If an investment is paying a good return, it’s usually coming with higher risk than one paying a modest return. That’s just life. Sorry. 🤷🏻♀️

The return is literally compensation for you taking on that risk. If anyone tells you they’re getting a great return from investing in a sure thing, be very suspicious.

You need to figure out what level of risk you find acceptable. In general, if you see the investment as a long-term endeavour, you should be able to tolerate higher risk. You’ll have more time to recover from any short-term losses.

Think of liquidity 💦

Next, the concept of liquidity. Plenty of investments require you to lock away money where it’s hard to get at, or where you might struggle to sell quickly. Professional investors would say these are illiquid. In practice, this means it’s always a good idea to keep some cash on hand for emergencies. 💷

Many financial advisors suggest the emergency fund should be around three months’ salary.

The power of compounding 📈

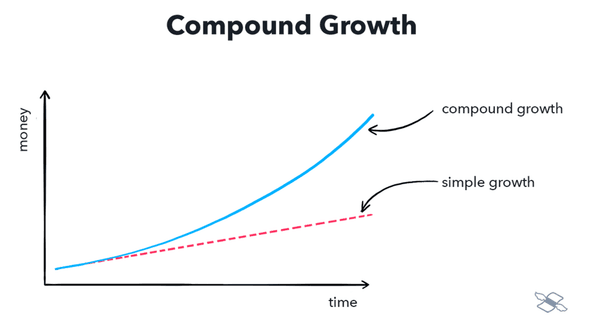

Third, be aware of the effects of compound interest. What’s compound interest you say?

Let’s take an example. If you invested £100 in an asset paying a 10% return. After a year you’d have £110. Then after the second year, you’d be sitting on £121, because you’d get interest on the original £100 and also on the £10 interest from the first year. And if you left that £100 alone for 10 years, you’d have amassed an impressive £259.

Your pot will grow exponentially over time, as each year, the returns build on each other. 🚀

I’m sure you’ve heard it alllll before… “Start investing as young as possible!” That’s usually to capture the power of compounding. As Albert Einstein would say, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it!” 💪🏼

In our next session, we will show you the best ways to approach the investing game.

-

Keep in mind that when you invest, your capital is at risk. Although this material is intended to be educational, it may promote the services provided by Wealthyhood.