Real estate

Chapters

Real estate

Intro to real estate investing

The benefits of property investing

What are your property investing options? From your own home to real estate ETFs, here’s the perfect place to get started in real estate investing. 🏘️

If there’s one thing many investors love, it’s property, and if you’re looking at this guide you might love it too. We’ll guide you through why property investing is so popular, and the various ways you can do it – from buying physical property, to stocks, funds and ETFs that let you become a part-owner.

What’s going on?

As well as your common stocks and bonds, a balanced investment portfolio may well include “alternative investments”. These often higher-risk (but potentially higher-reward) investments include hedge funds, crowdfunding, art, cryptocurrencies, private equity, and venture capital.

But one group of alternative investments that has both a real-world utility and, compared to others, comparatively low risk, is real estate – or property. 🏠

Property investments tend to be considered more “slow and stable” because apartments and office blocks aren’t directly traded on an exchange (even if big property-owning companies can be). This helps insulate real estate from daily swings in value.

For example, the UK commercial real estate (i.e. offices and shops) saw total returns of 6% in 2018 and UK residential real estate (i.e. houses and apartments) returned around 3% – although there were regional variations, naturally.

Why invest in property?

If you’ve got a big mountain of cash 💰 lying around, you might buy a property outright. Less Alpine cash piles might make up the typically sizable deposit with which you can get a mortgage – a long-term loan secured against the real estate you want to buy. But more on this later.

As the owner of a property, you stand to benefit from any rise in its value when it comes to selling, from the income it can generate if you rent to tenants – and, of course, from the utility you get from living in or using it yourself. 😌

Interestingly, the attractiveness of outright property ownership is partly dependent on culture. In the UK, for example, property ownership is fetishised: “an Englishman’s home is his castle”. But in countries like France and Germany, the idea of someone not owning any real estate isn’t unusual at all.

What about real estate stocks?

Easy there, partner. Yup: some investors may prefer to invest in real estate via the stock market, buying shares in companies which own properties and act as landlords, generating income in the form of rent. Because they’re listed companies, of course, the values of their stocks are subject to daily swings… 🏌

But these companies are also “asset-backed” 🏢 – i.e. they own real estate, which investors can see and touch, which has a relatively stable value – and which the company can sell if it needs additional cash.

That means their investors should be less likely to take flight in times of market turbulence than if they were backing, say, some tech companies whose assets aren’t as tangible (how do you touch a cloud service?).

In an economic downturn, however, it’s worth remembering that property prices may fall as well as stocks’ – potentially hitting you with a double whammy.

How has real estate performed as an investment?

Let’s take the UK 🇬🇧 for example.

It’s no secret that the value of land – and, by extension, property – in the UK has increased over time. Islands have limited space, after all – and a growing population means more demand for the same supply. But just how has that affected prices?

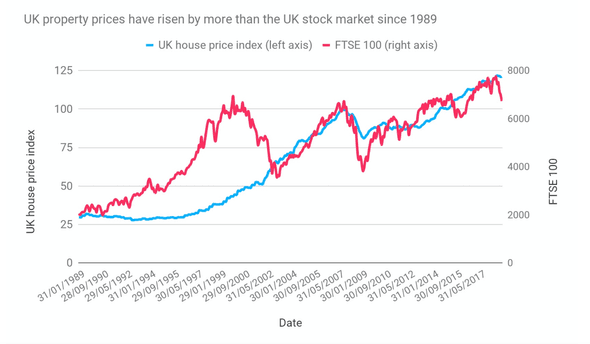

Source: Finimize, FactSet, Land Registry. Keep in mind that past performance is not a guarantee of future returns.

It depends on your frame of reference. But if you begin in 1989 (when you, dear reader, were likely a babe in arms, if that 👶 ), UK house prices have risen 308% – while the UK stock market has only risen 228%. Along the way, of course, there have been significant dips in the value of both.

For example, starting your measurement in 2000 (just after the burst of stocks’ dotcom bubble) would make house prices the clear outperformer to date – whereas the returns from buying a house in 2008 would have been outshone by stocks’ come 2014.

Note that in the above chart, we haven’t included the income some property owners would’ve generated from renting out their properties. But to make it fair, we’ve also only shown the change in the price of FTSE 100 stocks – and not included the additional return investors would’ve received from dividends. 💰

If you needed any more evidence that it’s all about timing, look no further than analysis from investment bank Credit Suisse. By one measure, investing in the UK stock market in 1900 would’ve averaged an annual 5.5% return over the subsequent 118 years, compared to property’s 1.8%.

-

As always, when you invest your capital is at risk and this learning guide is for information purposes only and is not intended as investment advice. Although this material is intended to be educational, it may promote the services provided by Wealthyhood.