Investing in gold

Chapters

Investing in gold

Why invest in gold?

Always use protection against…

Inflation

You’ll have already begun to appreciate why gold sits alongside the likes of stocks and bonds in many investors’ portfolios. First, investing in gold can provide you with protection against rising inflation.

Take the “All-Weather ⛈️ Portfolio” created by legendary money manager Ray Dalio, for example, which is designed to perform well in all economic environments. It’s split across assets suited to different parts of the economic cycle, defined by rising/falling economic growth and rising/falling inflation.

Gold’s inclusion is intended to help the portfolio do well during those economic environments where inflation is increasing.

Geopolitical tension 🌍

Second, recall gold’s perceived safe-haven status. That means it can help compensate for losses elsewhere in your portfolio during times of economic and/or geopolitical turbulence.

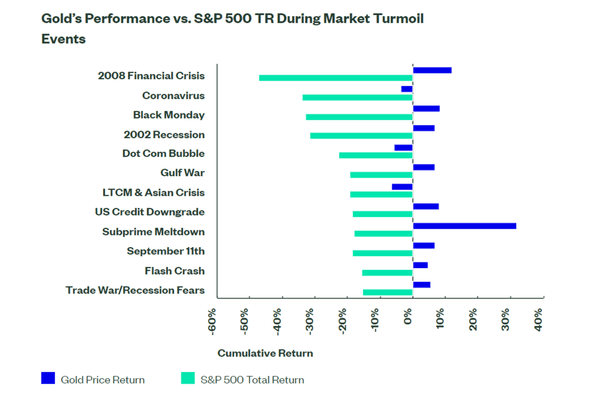

The chart below illustrates how gold’s price has performed during historical periods of significant stock market decline; in most instances, gold went up – and on the few occasions where it did decline, it did so by only a minimal amount.

Source: State Street Global Advisors. Keep in mind that past performance is not a guarantee of future returns.

Governments and central bank policies

Some investors see gold as protection 🛡️ against not just short-term market upheavals but also the potential long-term unintended consequences of government and central bank policies.

Authorities’ cash-splashing attempts to battle the economic fallout of the coronavirus pandemic were being funded by unprecedented peacetime levels of bond issuance. Many of these bonds have been bought by countries’ own central banks as part of “quantitative easing” programs.

Essentially, central banks are printing money and lending it to governments. This is called “debt monetisation”, and it’s a risky business – the risks in question being runaway inflation and loss of faith in the monetary system. Gold represents a bulwark against such potentialities, however unlikely their occurrence – which may be one reason why it’s proved so popular in 2020.

An uncorrelated asset

A final point worth mentioning is gold’s lack of correlation with other asset classes. Adding the metal to your portfolio can provide you with a source of return (via price appreciation rather than investment income, obviously) that’s unlikely to move closely in sync with stocks and bonds beyond the macroeconomic factors outlined above.

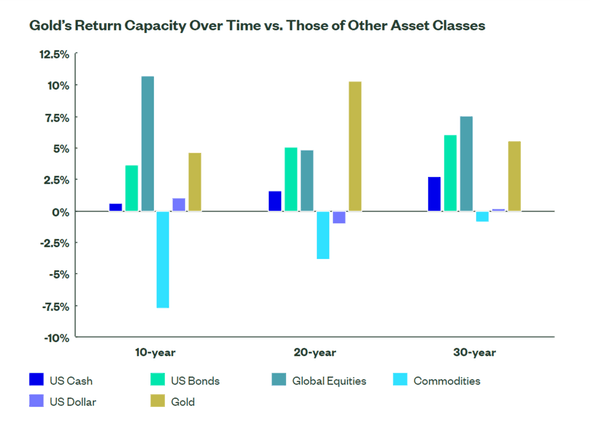

Gold’s presence can increase diversification, lower volatility, and therefore lead to higher risk-adjusted returns. The chart below compares gold’s average annual return to those of other major investments over the past few decades.

Over the past 30 years, this was an impressive 5.6% – and at the same time, the gold price exhibited a 0.00 and 0.07 monthly correlation to the US stock and bond markets respectively.

Keep in mind that past performance is not a guarantee of future returns. As always, when you invest your capital is at risk and this learning guide is for information purposes only and is not intended as investment advice. Although this material is intended to be educational, it may promote the services provided by Wealthyhood.