Table of Contents

- Should You Be Investing or Saving?

- Is 10K Enough for Investing?

- How to Start Investing if You Have £10,000 Pounds?

- Different Ways to Invest £10K

- Is it Possible to Invest in Property with £10,000 Pounds?

- What are the Best Ways to Invest £10K in the UK?

- How Can You Double Your £10K Investment?

- How Can You Get a 10% Return?

Well, well, well... seems we've got a bit of a loaded mate in the room, eh? £10,000 pounds to invest may not be Warren Buffet money, but it's a great start!

What should you do? Go for property and real estate? Maybe try passive investing via ETFs? Should you aim for high returns or go with low risk? Is £10,000 enough to begin with?

If you are ready to turn this nest egg into a golden goose, grab yourself a coffee and start reading. This is going to be a long one!

Let's dive into the best ways to invest your £10k in the UK.

TL;DR

Best Ways to Invest £10K:

Stock ETFs

Bond ETFs

Property

REIT ETFs

Savings Accounts

ISAs (Individual Savings Accounts)

Stocks and Shares ISAs

Keep in mind that successful investing goes hand-in-hand with a long-term time horizon, consistency and a high degree of diversification.

How to Start Investing with £10K:

Decide on your time horizon: short-term (1-3 years), mid-term (5-10 years), or long-term (10+ years).

Determine a risk profile that aligns with your comfort level and investment goals.

Create a roadmap with specific goals that align with your aspirations and unique circumstances.

Consider tax-efficient accounts like ISAs to optimise returns.

Construct your portfolio ensuring a well-balanced mix of assets to achieve a desirable risk-reward ratio.

Choose a broker or an investing platform to start investing.

Is £10K Enough for Investing?

Yes, 10K is a solid start for investing!

Safest Way to Invest £10,000:

Stay diversified: An ETF can help you lower the risk by diversifying across different asset classes like stocks and bonds

Be mindful of taxes: Tax-advantaged accounts like ISAs can help your gains... stay in your pocket.

Invest for the long haul: Focus on the long-term and avoid high-risk, "get rich quick" investments.

Investments with Highest Return:

According to historical data, global equities provided real returns of approximately 5.5% per year for the period 1900-2022.

Higher-risk options, such as individual stocks, growth stocks, junk bonds, leveraged ETFs, art, and collectables, may yield higher returns.

Should You Be Investing or Saving?

This reminds me of the salsa and guacamole dilemma every single time I order my favourite movie-night tacos. I can never decide - so I go for both!

Jokes aside, good financial health requires saving and investing. But without the first, you can't have the latter: saving money is the cornerstone of personal finance.

And if this phrase is not copyrighted, I claim the rights, right now!

Investing has to take the back seat when:

There is an outstanding debt of high interest

Think of it this way: The only way to prioritise investing over paying off your credit card debt is to be able to consistently achieve higher returns than the interest rate you pay. With the this August, that's a pretty difficult goal if you ask me. While this may sound plausible if you are a beginner falling for the , not even hedge funds from Wall Street can consistently achieve that kind of performance. Believe me.

There isn't an emergency fund in place

Cars break down, plumbing goes wrong, and people do lose their jobs. Everyone needs some money on the side for unexpected rainy days. An emergency fund is just that... a fund for emergencies. Generally speaking, the size of your emergency fund is highly correlated to the volatility of your income. The higher the volatility, the larger the fund. A good rule of thumb is to have at least 3 months' worth of your expenses that can be reached easily.

You are after a short to mid-term financial goal

Maybe buying a new car, moving to a new country or sending your kid to college. If you know you are going to need the money, don't invest them. Instead, you could consider using a high-yield savings account. Won't do much for inflation but, something is better than nothing... I guess.

If you want me to share some tips on debt repayment strategies (that do work), as well as extra content on the emergency fund thing, shoot a comment below or reach out to me on Linkedin. I have written extensively about those topics in my blog and I would love to share it with you.

If you are still wondering whether you should , take a look at our learning guide.

Key takeaway: Before even considering investing you should be sitting on a "fat" emergency fund and be - high-interest rate - debt-free

Is 10K Enough for Investing?

If you are looking for a quick answer, then yes, 10,000 pounds can be enough for investing... as a start!

I stumbled upon a very interesting survey conducted by M. Boyle & S. Barber on behalf of Finder UK. According to their findings, as of 2023, the average person in the UK has £17,773 in savings, half of the population have £1000 or less while almost a quarter (23%) of Brits have no savings at all.

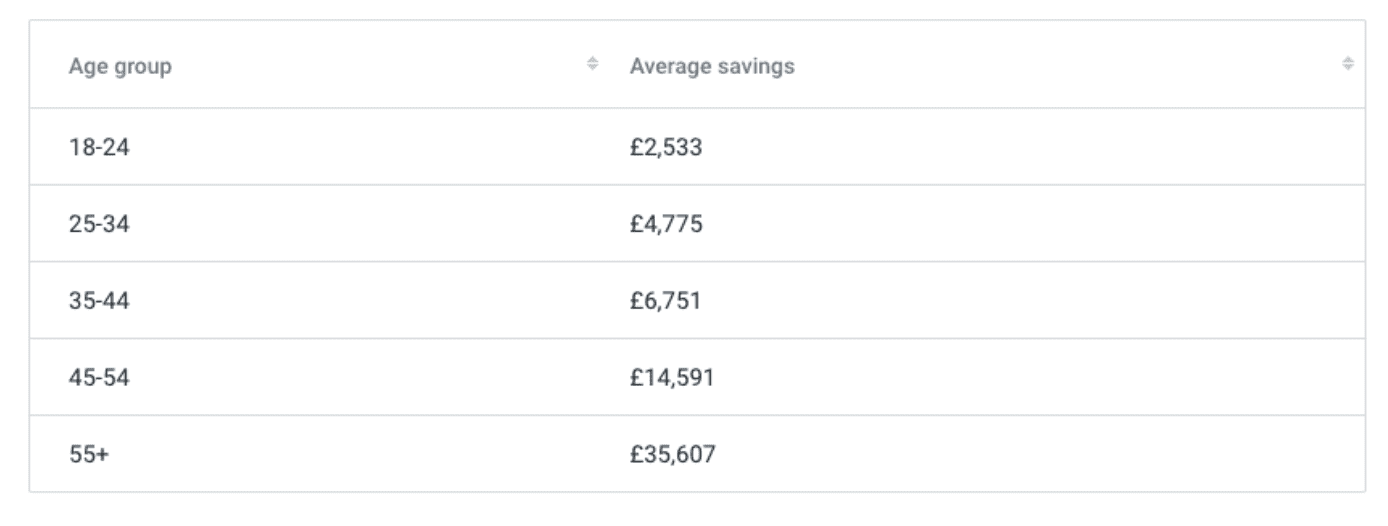

Average savings by age in the UK - Image source: finder.com

Well... two things are clear:

Brits need to level up their savings game and

by being able to put aside £10k, you're already a step ahead of the others - give yourself a well-deserved pat on the back!

Back to your initial question: Can £10,000 be enough for investing?

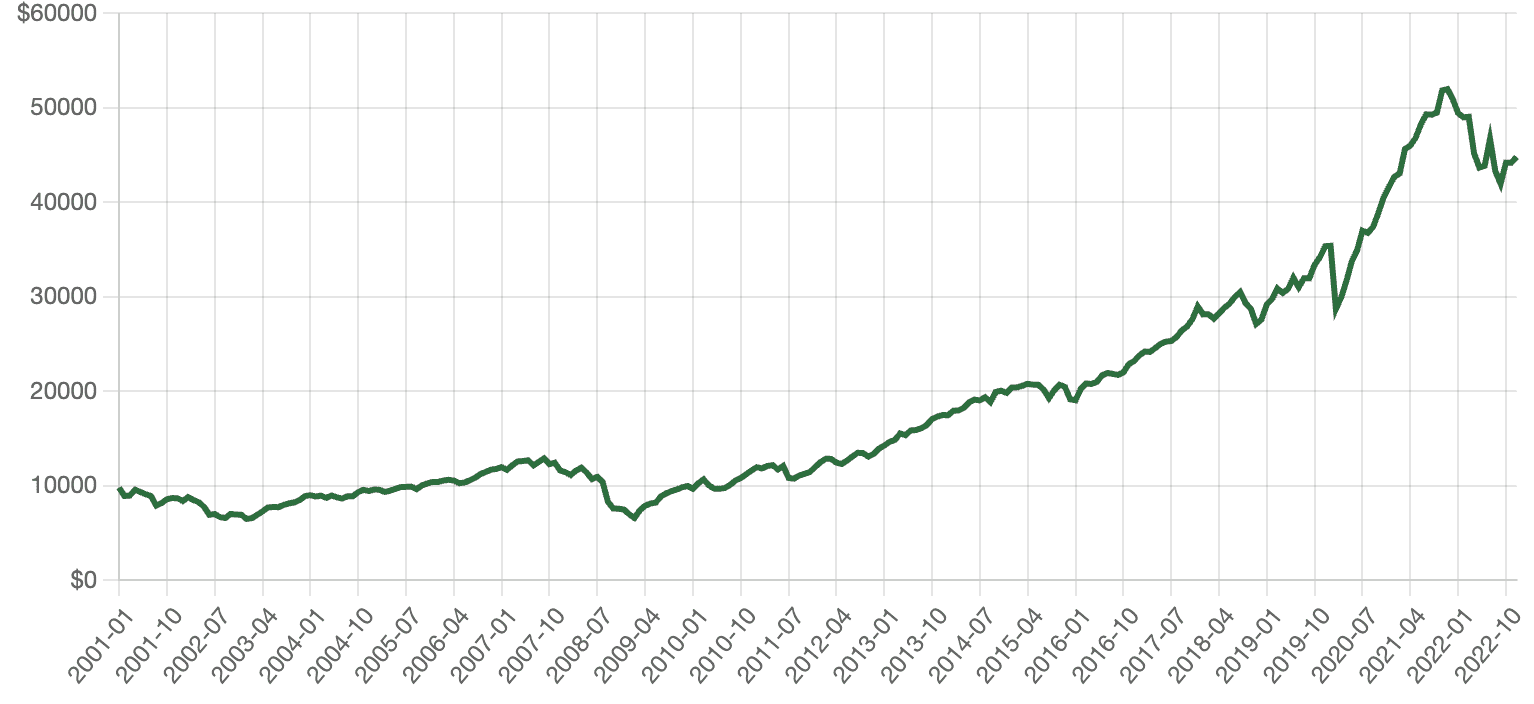

An example can give us some hints: Let's say you had invested £10,000 in the S&P 500 on the first day of January 2001. 20 years later, by the end of 2022, you decide to take a look at your portfolio only to find out that those £10k are now worth around £44,792.

That’s a total return north of 340%, or around 7% per year.

So, yes, it seems that £10,000 can take you a long way!

£10k invested in the S&P500 for 21 years - Image source: official data.org

If you are wondering what the heck the S&P 500 , it is an "index" tracking the performance of 500 of the largest companies listed in the United States. If "index" doesn't ring any bell, then it's just a more sophisticated way to describe a "big basket" containing the 500 largest US companies. Investing in this basket is, in a way, like investing in the US economy as a whole.

Don't forget the #1 rule of investing: Past performance does not indicate future gains. The fact that SP500 did well in the past 20 years does not guarantee it will do so in the next 20 years.

While £10,000 can be a great kickoff point for your investment portfolio, you have to understand that successful investing isn't a one-and-done process.

Think of it as a garden: You don't just go out there, plant a seed and expect a marvellous garden full of flowers waiting for you right the next morning.

If a blooming garden is what you are after, you need to constantly plant seeds, take care of them as they grow and be patient, as time is required for them to flourish.

Weirdly, investing is quite similar to cultivating a garden.

If you want to become a successful investor you need time, regular capital contributions and proper risk management.

On the positive side, passive investing can prove to be much easier than gardening because it requires less monitoring, tweaking and adjusting than someone might think.

Key takeaway: £10K can be a magnificent start! But success requires more than a great kick-off: a long time frame, consistent capital investments and adjusting your risk level when necessary. Those factors will be crucial to whether your investment will... pay dividends in the future - no pun intended

How to Start Investing if You Have £10,000 Pounds?

If you're still with me, I assume that there's an emergency fund ready to be utilised and you have successfully liberated yourself from any high-interest debt.

So now, to the good stuff: How to invest £10k?

Before rushing ourselves to the stock market risking potential reckless mistakes, we have to develop an investment strategy.

This is a crucial first step for every investor since it will act as a roadmap, set the milestones and provide the necessary guidelines for this long journey ahead of us.

Think of it as your guiding light.

Having no investment strategy is like trying to get out of a maze, blindfolded, and without a map - I mean, you could be lucky and escape but why risk it?

Key takeaway: Lay the foundations of your investment journey by setting up a well-defined strategy that includes a timeframe, a clear risk profile, specific goals, tax considerations, and a well-balanced portfolio.

Try Wealthyhood#1 Decide Timeframe

It's high time to decide on your time horizon. In other words, for how long are you willing to invest that £10k?

The timeframe is one of the most important elements since it determines the level of risk you are comfortable taking and, therefore, the most suitable investment vehicle that will construct your portfolio.

Ask yourself this question: How do you feel about locking up those £10,000? Are you going to need it?

Although you can sell anytime you want, investing implies locking up capital for a set amount of time.

This means that you should not count on that money for any upcoming expenses or any unexpected financial bumps that may occur - you have an emergency fund for that, remember?

What should I do? A mental model that has always worked for me is considering any amount of money invested as lost. It's not there... poof... gone! And, then, one day I get to cash out my investment which feels like airdrop money that comes with a huge bonus (called investment returns).

Generally, the 3 most common timeframes in the investing world are:

Investing for the short-term: 1 to 3 years Your goal as a short-term investor is to preserve your capital and ensure high liquidity.

Investing for the mid-term: 5 to 10 years Your goal as a mid-term investor is to achieve balanced growth.

Investing for the long-term: 10+ years Your goal as a long-term investor is to maximise growth while managing the risk.

Key takeaway: It is advisable to aim for longer time horizons when deciding the timeframe of your investments.

#2 Choose your Risk Profile

Repeat after me:

There cannot be any investing without risk

There cannot be returns without risk

Totally eliminating risk is more of an illusion than reality - even safer deemed investments like government bonds come with some amount of risk

The right question to ask yourself is: Do I feel okay tolerating this level of risk for the given potential returns of this investment?

Risk expresses the possibility that the outcome of an investment will be different from the one we expect. The higher the potential returns, the higher the risk.

What can you do to lower the risk while aiming for higher returns?

I asked John C. Bogle, the famous founder of Vanguard, and he replied: "Where returns are concerned, time is your friend."

I am just kidding, that's a of his.

The narrower the time frame, the more vulnerable your investment is to the sudden ups and downs of the market. The longer, the less the daily volatility holds any influence. Additionally, you have more time to recover from looming recessions.

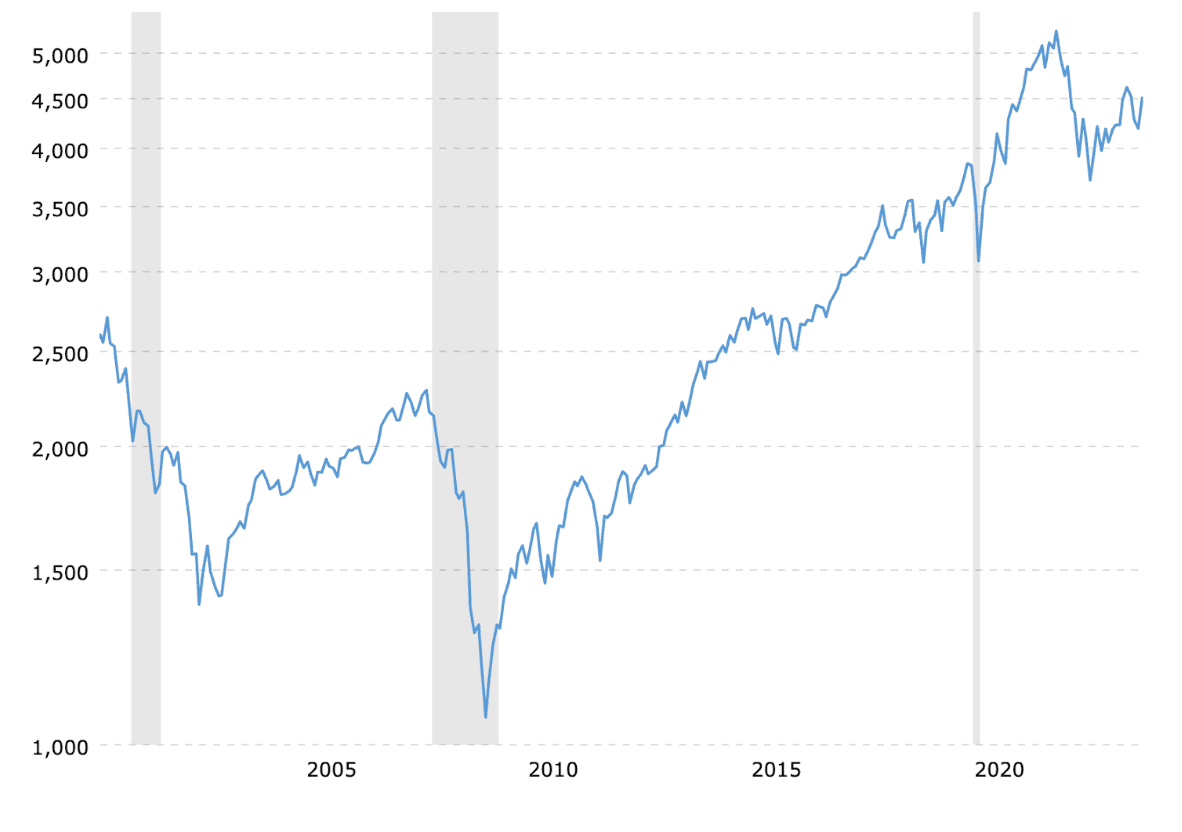

Imagine investing right before the Great Financial Crisis and being forced to sell the next year. The value of your investment capital would have plummeted.

Now imagine that you stayed invested in the markets for 10 more years.

SP500 2000 till 2023 Image source: macrotrends

A great tool that can help you determine your risk profile is the investor questionnaire by Vanguard.

#3 Choose your Goals

Nobody invests because it's fun.

You deliberately decide to sacrifice the short-term joy of spending your money now for a greater reward in the long term. This concept is called delayed gratification and it proves to be another great mental model in investing.

The kind of reward you are seeking from your investments is solely based on you, your aspirations and your unique circumstances.

Ask yourself: Why are you investing the £10k? What is your goal?

Are you planning to buy a home? Maybe save for retirement? Finance your child's tuition fees? Trying to create a supplementary passive income stream? Or are you going for long-term wealth accumulation?

Key takeaway: Whatever your goal might be, make sure it is crystal-clear in your mind before investing. A well-defined goal serves as a milestone, keeps you on track and allows you to visualise the future as you want it to be.

#4 Take taxes into account

Benjamin Franklin once said that there are only two things in life that are certain: death and taxes. Apparently, good old Benjie was not aware of ISAs in the UK.

ISA stands for Individual Saving Accounts and any investments made through them are exempt from taxes on interest and capital gains profits.

If you want to protect the returns of your invested £10k from the tax collector, choose one of the following:

a Lifetime ISA (LISA): It allows you to invest up to £4.000 per year for your retirement or the deposit of your first house. The best thing? You get an extra £1.000 per tax year as a bonus from the state.

a stocks and shares ISA: You can fund this account up to £20.000 per year. Any dividend, capital gains or income derived from your investments will be tax-free.

If you want to know more about , take a look at this guide.

Key takeaway: The fewer taxes you pay, the better your overall returns will be. Optimization is of paramount importance which is another way to say... Don't neglect the ISAs!

#5 Construct your Portfolio

Unfortunately, there can not be a one-size-fits-all solution to investing.

Every investor has to create a portfolio by choosing the right assets and ensuring a well-balanced mix based on their risk profile and goals.

The two most common asset classes are:

Stocks

Bonds

Stocks represent partial ownership of a company.

Investing in stocks can earn you money by capital appreciation and/or dividends. They carry higher risk and higher potential rewards.

Bonds represent loans issued by companies or governments to fund their operation and growth.

Investing in bonds can earn you a fixed yearly amount of money (coupon). They carry lower risk and lower potential returns.

Does "Don't put all your eggs into one basket" ring any bell?

It's a famous proverb that emphasises the importance of diversification. To minimise the possibility of significant losses, one should spread their capital into many different assets that also tend to behave in opposite ways.

Investing in a single stock carries the risk of this single investment going south (bankruptcy), thus the total loss of your capital. Holding many different stocks makes you invulnerable to a single company defaulting.

Since stock and bond prices tend to behave differently, holding stocks and bonds decreases the risk of a whole stock market decline.

Key takeaway: Diversification is essential to reduce the risk of losing your entire investment of £10k - but it does not eliminate it.

Lacking confidence? No need to worry! Wealthyhood tools allow you to customise a tailor-made portfolio that perfectly matches your risk profile in a few simple steps.

Buy Your First StockDifferent Ways to Invest £10K

So you have £10,000 to invest, but where do you start? Investing can be intimidating and overwhelming, especially for beginners. But don't worry, with some knowledge and a solid plan, you can make your money work for you.

Start by laying the foundation – determine your risk tolerance and investment goals. This will help guide your decisions and ensure you feel comfortable.

Investing £10K for Passive Income

Quick answer: One of the best ways to invest £10,000 pounds for passive income is choosing a dividend ETF.

Passive income, eh? Such a dopamine-inducing word that makes us fantasise about sipping piña coladas by the beach on a warm afternoon while our bank accounts are getting fatter and fatter.

And while you may need a lot of capital to make a living out of your passive income, you can definitely steer your strategy towards acquiring it.

What do you need? A portfolio of income-generating assets such as bonds or dividend stocks.

As we have previously discussed, picking single stocks or bonds carries a lot of risk. If you want to dramatically increase diversification (thus lowering the risk) you can do it with a single investment vehicle. And that's an ETF, more specifically, a dividend ETF.

A dividend ETF is a fund that holds a portfolio of stocks that consistently pay dividends. If you invest in such a fund, simply, you get a part of every single dividend payment that takes place.

Example: Take a look at (UKDV) which tracks the performance of some high dividend-yielding equities by companies from within the UK.

If you want to broaden the geographical parameter, you could have a look at the (VHYL) which includes large and mid-sized company stocks (in developed and emerging markets) that tend to pay higher than average dividends.

Buy ETFsInvesting £10,000 for Retirement

Quick answer: The most effective way to invest £10k for retirement is via a broad index ETF using a tax-free account, such as a Lifetime ISA.

Already thinking about retirement, right? That's the spirit!

Although the State provides a pension, it may be insufficient to support the post-work lifestyle of many British citizens. So, you have to take matters into your own hands and create the future you want to live in - after all, you've worked so hard all those years so you deserve a comfortable retirement!

What do you need? Time is your friend. The earlier you start, the more time your investment will have to grow. You can later thank the power of compounding.

Let's say you invest your £10k and get an annual rate of 5%. This means that by the end of the first year, you would earn £500 in interest (5% of £10,000) bringing the total value of your investment to £10,500.

In the second year, things go much better in the market and you manage to get 6%. This 6% is calculated on the new total of £10,500 which means you earn £630 in interest (6% of £10,500), bringing your total investment to £11,130.

Compounding refers to earning interest not only on the principal amount but also on the interest earned in the past. A simple yet powerful concept.

Also, make sure to choose a well-diversified investment vehicle to keep the risk low.

Example: Start, tax-free. If you are between the ages of 18 to 39, you are eligible for a Lifetime ISA to which you can contribute up to £4k per year and get an additional 25% government bonus on top. The rest 6k can go to stocks and shares ISA.

Investing £10K for Inflation Protection

Quick answer: The only way to protect your £10,000 pounds against inflation is by trying to beat it. And the best way to achieve that is by investing.

Inflation is an economic phenomenon that answers why the purchasing power of money declines over time or, at the same time, why prices tend to rise.

What does this mean? The £10k in your pocket can buy you more products and services today, than it could have two years ago, but less than it will be able to in two years.

Having your money sit comfortably in a bank account would, slowly but surely, expose them to erosion by inflation.

How can you combat this? Putting your money to work for you, by investing!

Take the FTSE 100 for example. It is an index that tracks the 100 highest market-cap companies listed on the London Stock Exchange and has been beating inflation over the long term.

You can verify that by looking at the average long-term real returns of the index. A real rate of return takes into consideration the effect of inflation by deducting it from the actual returns.

Other examples: You can try to hedge against inflation with assets that are traditionally known to hold their value during times of rising prices. Some of them include gold, commodities and real estate.

Investing £10,000 for Wealth Building

Quick answer: Yes, £10k can be a great starting point. Just make sure you follow my secret formula for wealth building.

Just kidding, there is no secret sauce here! Success can be boiled down to the following three fundamental principles:

Be sufficiently diversified

Have a long-term horizon in front of you

Don't take too much risk

Just like Rome wasn't built in a day, building wealth is a gradual process that requires time and patience.

It's tempting to try to attain fabulously rich status, very early in life. But this will probably lead to more trouble than benefits.

Successful wealth building is not a get-rich-quick scheme, it's a slow and (most of the time) boring process. A marathon, not a sprint.

Is it Possible to Invest in Property with £10,000 Pounds?

Quick answer: Yep, it is possible to invest in property with £10k! However, not all options may be well suited for you, let me explain.

Some traditional ways to invest in real estate are:

Buy-to-let Properties: - You buy a property with the sole intention of renting it out to other tenants. - This generates regular cash flow income from rents.

Real Estate Flipping: - You buy a property at a good price, increase its value (by renovating it) and resell it at a higher price at the right time - It's like trading, but with property

As you can imagine, both ways grant you ownership of the physical real estate.

But, there's a catch. All the aforementioned ways, demand a considerably larger initial capital than the £10,000 you have in your pocket right now.

How to invest in property with £10k?

The answer you might be looking for is called Real Estate Investment Trusts (REITs).

As discussed before, a REIT is a company that owns income-generation properties. An investor with stocks in a REIT company gets the right to a small percentage of the rents it collects from the properties it manages. That income is distributed to investors in the form of dividends.

Instead of owning the physical property (that goes hand in hand with the headache of broken boilers and faulty electrics), you own a piece of a company that owns physical properties.

If you want to spice it up by adding even more diversification to the mix, you can go for a REIT ETF: A "basket" containing a wide variety of REITs.

Best ways to invest in Property with 10,000 pounds

One of the most famous choices for Brits is (IUKP) which tracks the performance of an index composed of UK-listed real estate companies and Real Estate Investment Trusts (REITS).

If you want to go international, you can take a look at (REET) tracking an index of real estate equities in developed and emerging markets.

Key takeaway: You can invest in real estate with £10k. The most suitable choices for your budget include REITs and REIT ETFs.

What are the Best Ways to Invest £10K in the UK?

Quick answer: If you ask me, the best way to invest £10,000 in the UK is via a broad index ETF. Make sure you have a long-term investment horizon and use an ISA wrapper to protect your gains from the taxman.

But last time I checked, you are not me and I am not you.

Let's explore the best ways to invest those £10k in various time frames:

Best Ways to Invest £10K for the Long Term

If you are here for the long run (you should be), and willing to commit £10k for more than 10 years ahead, those are some of the best ways to approach the market:

Stocks

A stock (equity or shares) is a security representing partial ownership of the issuing company. By owning stocks, one is entitled to a proportion of the corporation's assets and profits.

Example: Apple Inc. is one of the world's most popular stocks traded on the NASDAQ stock exchange under the ticker symbol AAPL.

How to earn money from stocks? Investors who hold stocks earn money with dividends (distribution of profits) and/or capital gains (price appreciation).

You can also dive deeper into how and where to buy stocks with our in-depth guide.

Bonds

A bond is a type of loan issued by a government or company to raise capital. You agree to hand out your money for a set period in exchange for a promised return.

Example: The UK government issues bonds, known as gilts, which can be purchased directly from the Debt Management Office.

How do you earn money from bonds? Bond investors earn a fixed rate of interest, known as the ‘coupon’, and their principal back upon maturity.

ETFs (Exchange-Traded Funds)

An ETF is a basket of securities (such as stocks, bonds and commodities) that can be purchased or sold on a stock exchange and tracks the price of a specific index.

Example: Vanguard's S&P 500 (under the ticker VUSA) is an ETF designed to track the performance of the Standard and Poor’s 500 Index which includes the 500 largest US stocks of all major industries.

How to earn money from ETFs? Just like stocks, you can profit from the accumulation of dividends and capital gains.

Property

Property as an investment can provide long-term rental income or future resale profits.

Example: Buying residential real estate, renovating it and renting it out.

How can you earn money from property? Investors who invest directly in real estate can make money through price appreciation and rental income.

REITs

REITs, or Real Estate Investment Trusts, are companies that own and manage real estate in such a way as to generate income. Unlike direct property ownership, investing in REITs means owning a part of a company and getting rights to its profits.

Example: The PRS REIT (LSE: PRSR) invests in residential real estate by building homes in cities where rental demand is notably high.

How do you make money from REITs? Investors get compensated by a regular income stream, in the form of dividends.

Investment Trusts

Investment Trusts are companies that invest in other companies with the sole purpose of gaining profit for their shareholders. Just like ETFs, they are openly traded on stock exchanges

Example: The Scottish Mortgage Investment Trust (LSE: SMT) aims to identify and own the world’s most notable growth companies.

How do you make money with an investment trust? Investors can see their money grow through capital appreciation and dividend income.

Commodities

A commodity is a natural resource (gold, silver, oil) or a physical good that is grown, mined or processed.

Let's take the example of gold: People tend to invest in gold to hedge against inflation and as a safe haven asset during an economic crisis, financial uncertainties and geopolitical tensions.

Best Ways to Invest £10K for the Medium Term

Even though many people wouldn't dare to use the word "investing" for anything that isn’t long-term, investing for the medium-term is possible.

You can use all the aforementioned options such as stocks, bonds, ETFs, REITs, investment trusts, and commodities but with a slight twist. You should adjust your investment mix to achieve a more balanced approach that is not solely focused on growth but also considers capital preservation risks and liquidity.

Capital preservation is a fancy way to say: “Don’t lose money and, at the same time, try to keep up with inflation”.

Robo Advisors

A robo-advisor is an automated digital platform that provides investment management services without human intervention. As an investor, you will define your financial goals, risk tolerance, and time horizon, and the robo-advisor will create and manage a portfolio specifically tailored to your profile.

Stocks and Shares ISAs

If you want to invest for the medium term, make sure you use a stocks and shares ISA.

This type of account permits the purchase of ETFs, REITs, mutual funds, individual stocks, and bonds without any tax on dividends, income or capital gains.

However, there is an annual limit of £20,000 that cannot be exceeded.

Best Ways to Invest £10K for the Short-Term

Last but not least, if you are looking to invest your £10,000 for the short-term (say 1 to 3 years) you need to prioritize capital preservation and liquidity above all else.

Take a look at the following investment options:

Short term Government bonds (Gilts)

As mentioned before, a short-term government bond is a loan you give to a government. They take your money and they pay you back with interest.

They are considered low risk because:

Governments tend not to default that easily - they can raise taxes to pay what they have to pay

they are considered very liquid - you can sell them pretty easily in the market

You can directly purchase Gilts via the Debt Management Office (DMO), the NS&I, or through online brokers and banks. If you want more information on how to buy government bonds in the UK, this guide can help you immensely.

Savings Accounts

A savings account is a type of bank account where your money earns interest.

Although the interest rates provided are typically low (probably not even matching with inflation), a savings account is a great choice for risk-averse people who need direct access to their money.

As George suggested, you can use a Cash ISA to protect your investment gains from any taxation.

How Can You Double Your £10K Investment?

TL DR: Data from the past has shown that time, patience and a well-diversified portfolio can double your initial £10k investment in 13,42 years.

Ironically, the quick answer on how to double your £10k is by taking the slow path. A rational investor could try to double its initial capital by prolonging the time window.

Wait a second, did you assume that there is a fast, easy and risk-free way to double your money? My apologies for ruining your excitement but, there is no magic trick over here.

Ah, and if you encounter someone who is trying to sell you magic secret formulas, politely decline and move along. Your hard-earned money will forever thank you.

Back to the initial question, we can take two distinctive approaches:

the reckless way of an irresponsible gambler

the cautious way of a rational investor

I mean sure, if your goal is just to double your £10k you could pick the next meme coin, penny stock or even go all in on black down at the roulette table in the Hippodrome Casino.

However, let's be realistic. It's extremely likely that you will end up losing every single pound. And by risking losing everything, you agree to take the biggest risk of all: the risk of ruin.

On the other side, a more realistic approach would be to invest for the long term, in a broad index fund that is sufficiently diversified in terms of geography and industry sectors.

Slow and steady wins the race.

And you know what? Let's test the numbers.

According to , the annualised total real return for investing in stocks from all over the world was around 5,3% for the period 1900-2022.

£10k invested in the "global stock market" would double in 13,42 years.

Not that bad, right?

Bear in mind that we have already adjusted for inflation. The nominal value of your money would double much faster!

If you are wondering how to invest in such a diversified way, is an ETF from Vanguard that tracks the FTSE All-World Index - it is comprised of large and mid-sized company stocks both in developed and emerging markets.

This whole assumption should be taken with a grain of salt. Why? Because past returns do not guarantee future results. Nevertheless, history has shown that the stock market tends to appreciate over the long run.

Key takeaway: As shown, it is possible to double your £10k investment without exposing yourself to tremendous risks by taking the long and diversified way.

Is it possible to make £100k from my £10k investment?

Although hard, it is possible! However, you could speed things up by adding regular contributions to the initial amount.

Once more, let's dive into the historical returns:

According to the same Credit Suisse Returns Yearbook, the USA stocks had an annualized real return of 6.7%.

You decide to invest in the US economy with an ETF that tracks the SP500 and for this example's sake, let's assume that this trend will continue.

How long would it take for your £10,000 to reach the mark of £100k? Around 35 years!

Well, this may be almost half of your life but hey, you aimed big over here.

Is it possible to make this faster? Definitely! Just try contributing another £100 per month and your capital will compound to £100k in less than 22 years!

And again, we are adjusting for inflation. If we stick to the nominal value you could tenfold your money, much much faster.

Key takeaway: 10x your investment is not an easy task but it's definitely plausible. Supercharge it with regular capital contributions and watch its growth accelerate.

How Can You Get a 10% Return?

An index fund is the most diversified and rational way that can yield a 10% return. As long as you stay committed for the long term.

Let's let the numbers do the talking once again.

Over the last 50 years, US equities have yielded an annualised nominal return of 10,44%.

This means that returns of around 10% are not only a theoretical possibility but a validated fact of the past. And while the past is not a foolproof predictor of the future, it can provide investors with a historical benchmark.

And this benchmark verifies that returns of 10% are plausible.

If you are seeking a high probability of success (meaning a balanced risk-to-reward ratio), then an index fund could be one of the most effective investment vehicles for you to achieve that kind of return.

Let me be clear with you: although it is very possible to achieve returns of 10% or even higher, no one can guarantee that to you. And anyone who does, he's either lying or trying to scam you somehow.

Can you get higher returns than 10%?

You bet! But not without additional risk.

As long as you are willing to undertake greater levels of risk, you can find investment vehicles to achieve returns north of 10%.

Some of them are:

Individual stocks

Growth stocks

Junk bonds

Leveraged ETFs

Art and collectables

Commodities

Fun fact: I lied. There is a way to achieve higher returns that can reach 20% or even 22%, guaranteed - It's called paying off your credit card debt!

Key takeaway: History has shown that going with a well-diversified equity index fund and staying invested for the long term can provide you with returns of 10%.

Final Thoughts

Kudos for making it to the end of this article! It may have been a long read but now I believe you have a clear understanding of how to start investing if you have £10,000 pounds in the UK.

I feel that I have covered some key topics such as the best ways to invest, how to start as well as different investment options.

What’s the next step? Take a look at the 9 best investment apps in the UK!

Before saying goodbye, a final reminder of the two most important rules of investing:

There is no risk-free investment - that's why you have to learn how to manage it, not fall into the illusion of trying to completely avoid it

Past results do not guarantee future outcomes - just because something happened, it doesn't necessarily mean it will happen again in the future

If you have any questions, drop a comment here or shoot me a message on Linkedin. I'll be happy to help!

Capital at risk. This article is for information purposes only and is not investment advice nor a recommendation. You should consider your own personal circumstances when making investment decisions. Past performance is not a reliable indicator of future performance. Tax treatment depends on your personal circumstances and rules can change.