Investment apps in the UK have become indispensable tools for investors, primarily because they simplify the process of investing in stocks, shares, and ISAs.

In this article, I will be reviewing the best investing apps for stocks, ETFs, Index Funds, ISA accounts, and trading. Follow me in this in-depth review.

Quick List of the Best Investment Apps in The UK :

Moneybox - Best Investing App Overall

AJ Bell Youinvest - Best Stock Investing App

Trading 212 - Best App for Trading in the UK

Interactive Investor - Best Investing App for ISA and Sipp

Wealthyhood - Best Investment App for Beginners

Freetrade - Most Affordable App for Investing

Nutmeg - Best Robo Advisor App

Moneyfarm - Tailored Portfolio Management

Hargreaves Lansdown - Best App for Stocks and Shares ISA

eToro - Great Stocks Trading App

Wealthify - Good For Automated Investing

Updates as of May 23rd

Moneybox was indicated as the best investment app during our testing.

Freetrade added interest on cash balances

Trading 212 remains the highest Interest on the cash app of the list

Wealthyhood adds real-time execution and interest on cash on April 23rd

Disclosure

To create this list I had to download each one of those apps and test them personally through my accounts. This article is an effort to provide you with an unbiased review of the best investment apps in the uk and I maintain no affiliated partnerships with the brands presented. I am also reachable to discuss or answer any pottential questions related to investing apps. Feel free to reach me at george@wealthyhood.com, through LinkedIn or Twitter.

Best Stocks, ETFs and ISA Investment Apps Comparison

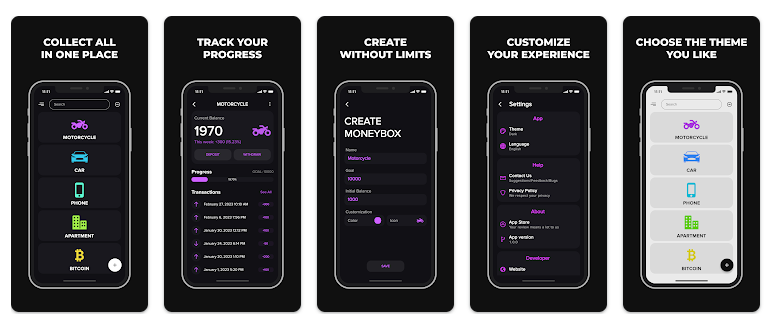

App | Costs | ISA | Interest | Instruments | Best For | Trustpilot Score |

|---|---|---|---|---|---|---|

Moneybox | £1 per month, 0.45% Annual Fee | Yes | 3.5% | Stocks, Funds, ETFs | Overall | 4.4/5 @ 1981 Reviews |

AJ Bell | £9.95 flat fee per trade | Yes | 3.2% | Stocks, ETFs, CFDs, Investment Trusts | Best Stock Investing App | 4.8/5 @ 5518 Reviews |

Trading 212 | Commision Free | No | 5.2% | CFDs, Stocks, ETFs, | Best trading app | 4.6/5 @ 26851 Reviews |

Interactive Investor | £9.99 per month, £7.99 per trade | Yes | 2%-4.85% | ETFs, Stocks, Funds, Investment Trusts | Best ISA Investing app | 4.7/5 @ 24272 Reviews |

Wealthyhood | Commision Free | No | 5.1% | Stocks, ETFs, Commodities, | Best Beginner investing app | 4.4/5 @ 100 Reviews |

Freetrade | Free or £3 per month | Yes | 1%-5% | Stocks, ETFs, Investment Trusts | Best free investing app | 4.0/5 @ 3894 Reviews |

Nutmeg | 0.75% Management Fee | Yes | No | Managed Portfolios | Best Robo Advisor | 3.9/5 @ 1913 Reviews |

Moneyfarm | 0.35%-0.75% | Yes | No | Managed Portfolios | Long Term Investors | 4.1/5 @ 1104 Reviews |

HL | £11.95 per trade | Yes | 3.76% | Stocks, ETFs, CFDs, Investment Trusts | Best stocks & shares ISA investing app | 4.2/5 @ 9867 Reviews |

eToro | 0 commisions | No | 5.3% | CFDs, Stocks, ETFs, Commodities, Forex, Crypto | Best low-cost trading app | 4.2/5 @ 23036 Reviews |

Wealthify | 0.40% to 0.60% of investment | Yes | 4.91% | Fully Managed Portfolios | Best Junior ISA App | 4.0/5 @ 2308 Reviews |

Remember, the best investment app for you is one that aligns with your investment goals. You can also consider an investment platform instead that can offer more functionality and investing options or a robo-advisor. It's always a good idea to do your research and compare several apps before making your choice.

Top 11 Investment Apps in the UK

1. Moneybox - Best Investment App Overall

Moneybox Review

Moneybox is a user-friendly stocks and shares investing app that makes investing in a range of portfolios very easy. Its ease of operation is more than welcome and I love the feature on the app called "round-up," where the additional change from daily purchases is rounded and invested in a selected portfolio. Moneybox also provides tax-efficient ISAs which makes it the best all-around investing app on this list.

Costs:

Subscription Fee: £1/month, so it is not much to consider if you're a price-sensitive user.

Platform fee: Moneybox charges a fee of 0.45% per annum for investments up to £100,000, and for investments over and above, there is a discounted rate of 0.15%. This should be something to bear in mind, in particular, if someone is beginning with a small investment.

Pros:

"Round-up" feature: It invests my change seamlessly, almost to the point that saving money seems easy.

ISA Options- Great boon to managing savings effectively.

User Interface: The app is easy to navigate, which works excellently for somebody like me who is all about simplicity in any financial tool.

Security and Regulation: The Financial Conduct Authority regulates the system and uses bank-level security measures, which provide me with peace of mind.

Cons:

Limited investment options: The range of investments should be widened.

Subscription Fee: The monthly fee will be a dealbreaker for some. High fees for low balance accounts: The structure of the fees might not be attractive to the young ones just starting with small capital. While Moneybox offers reasonably practical features for daily investing, the costs and limited options somehow still present some questions in my mind before committing.

Moneybox links:

Overall, Moneybox provides a unique and accessible investment experience, making it an ideal choice for beginner investors looking to build their portfolios over time.

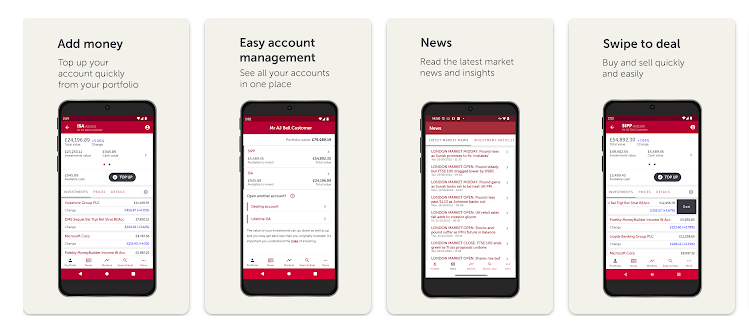

Go to Moneybox2. AJ Bell Youinvest - Best Stock Investing App

AJ Bell Review

AJ Bell Youinvest is an investment app that provides versatility in meeting the varied requirements of investors. It offers a wide range of investment options, such as equity, ETF, funds, or bonds, so that a user can diversify investments very easily. The app features full-fledged research and analytics instruments to arm investors with all the necessary tools to make well-informed decisions based on more detailed insight into the market.

Another tremendous help for beginner investors of the most novice level is AJ Bell's Dodl, which has an even more convenient user interface.

AJ Bell is regulated by the Financial Conduct Authority (FCA), ensuring that all the legal customers' fairness and security standards are observed. The group is also a member of the Financial Services Compensation Scheme (FSCS), which offers protection to the investment and cash made by the clients.

Costs:

Trading Fee: AJ Bell Youinvest charges £9.95 per trade

Annual Platform Charge: The platform charges will be levied annually and amount to 0.25% of the investment for portfolios up to £250,000. For larger portfolios, the percentage is diluted to 0.1%, making it cost-effective for both small investors and institutional investors.

Pros:

Offers a wide range of investment opportunities, meeting the needs of variance among and preferences of investors.

Research and Analysis Tools: These include tools with useful information that helps a person make a decision.

Value on Larger Port: Decreasing fee structure on larger portfolios gives value.

Cons:

Flat Fee for Trades: This might appear to some a bit expensive for people who frequently indulge in trading.

AJ Bell Youinvest links:

The complexity of AJ Bell is too much for a beginner to wrap their head around, though it might be a great platform for experienced investors. The only thing AJ Bell Youinvest does seem to be well-known for is the complete, wide investment services that the platform offers. In the meantime, the user experience will depend, in a very broad sense, on your level of experience. AJ Bell Youinvest, therefore, offers a very strong alternative to Moneyfarm for those interested in a broad selection of investments and detail in its research tools. But this comes at a higher flat fee per trade and may, in fact, not be clear enough or easy to use for someone new to the practice.

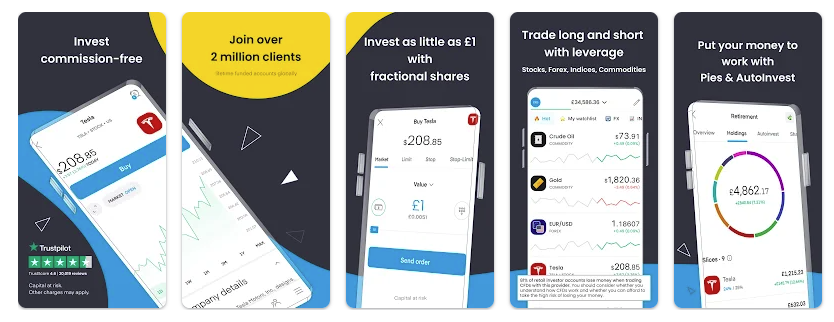

Go to AJBell3. Trading 212 - Best Trading App

Trading 212 Review

Trading 212 is an all-in-one trading and investing app with many available tradable assets. It is an easy-to-use, feature-laden application for seamless trading execution. This is because even though I am not a trader, I feel that the detailed facts, real-time market data, deep research, and educational resources provided by Trading 212 can be an excellent fit for the trading fraternity to support them in making informed investment decisions.

Costs:

Commission-Free Trading:

Trading 212 offers commission-free trading of stocks and ETFs, and this becomes a great plus point because it helps investors save costs.

Spread Markup:

In foreign exchange and cryptocurrency trading, there is a small markup on the spread, but overall, the fees remain competitive to deliver maximized returns for the user.

Pros:

No Commission Fees:

Not charging a commission on stocks and ETFs can make the trading costs drastically lower.

Market Tools:

User-friendly real-time data of the markets and analytical tools allow the user to make informed investment decisions.

Easy to Use:

The application interface is straightforward to use for novices or advanced investors.

Cons:

Overwhelming:

A plethora of options and data can easily overwhelm a new investor who is not accustomed to trading.

Too Trading-Centric:

The app leans too much toward active trading and not enough toward long-term investment strategy, which may not appeal to everyone.

Trading 212 links:

Trading 212 is perfect for those who care about fees and trading. Although it may not appeal to traditional long term investors, this is an app that can save you a lot of money on fees while it still offers many different assets to invest in.

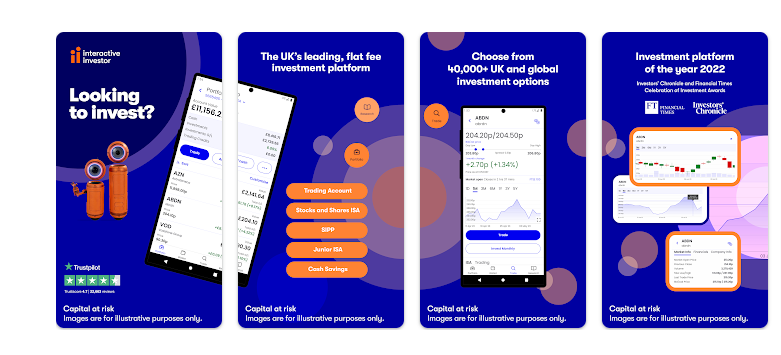

Go to Trading 2124. Interactive Investor - Best ISA App

Interactive Investor Review

Interactive Investor, renowned for its platform catering to both seasoned and novice investors, offers a comprehensive range of investment options including stocks, ETFs, funds, and bonds.

This diverse selection is perfect for diversifying ISA and SIPP portfolios. The platform's advanced research and analysis tools, provided at no extra cost, empower users with the latest market data and trends, making it particularly beneficial for SIPP investors focused on long-term growth and stability. Interactive Investor ensures client funds are kept safe in segregated accounts, separate from the company's funds. In case of insolvency, the platform is covered by the UK's Financial Services Compensation Scheme (FSCS), which offers compensation to eligible investors.

Costs:

Flat Fee Structure: Interactive Investor charges a flat monthly fee of £9.99, which includes one free trade per month. Additional trades are priced at £7.99 each. This pricing model allows investors to tailor their trading activities to fit their personal investment strategies.

Pros:

Wide Spectrum of Investment Options: The platform offers a broad array of investment choices, aiding in portfolio diversification and the exploration of new investment avenues.

Robust Research and Analysis Tools: These tools provide a significant advantage by helping users stay ahead of market trends and make informed investment decisions.

Cons:

Monthly Fee: The monthly fee might be burdensome for some investors.

Additional Trade Costs: Charges apply for trades beyond the included monthly free trade, which can accumulate for those with high trading volumes.

Interactive Investor links:

Interactive Investor provides a versatile platform with a broad range of investment options and advanced tools, ideal for diversifying portfolios and informed trading, secured by FSCS and structured with a clear flat fee system, making it appealing for both new and experienced investors.

Go to Interactive Investor5. Wealthyhood - Best Investment App for Beginners

Wealthyhood Review

WealthyHood is designed to make investing straightforward and accessible, especially for those new to the financial markets.

The app features a simple interface tailored for first-time investors and offers a range of investment options, including exchange-traded funds (ETFs). One of the key highlights is the ability to invest in fractional shares, allowing users to buy stakes in preferred companies affordably. Wealthyhood excels in providing a seamless experience with functionalities like automated portfolio customization based on individual risk profiles, regular investment plans, and a comprehensive educational hub for learning about investments.

Costs:

Zero-Commission Investing: Wealthyhood offers the advantage of zero-commission on investments, which helps users invest without the worry of transaction costs.

Other Fees: While the trading is commission-free, users should be aware of possible currency conversion fees for transactions involving non-GBP assets.

Pros:

No Commission Fees: Allows for cost-effective investing without the burden of additional charges.

Variety of ETFs: Provides a good selection of ETFs, catering to various investment preferences.

Fractional Shares: This makes it possible for all users to invest in high-value stocks with smaller amounts of money.

User-Friendly: The minimalist design and intuitive interface make it very accessible for beginners.

Automated Features: Includes scheduled investments, automatic top-ups, and automated investing based on the user’s risk profile, simplifying the investment process.

Cons:

Currency Conversion Fees: Potential fees on non-GBP assets could be a concern for those investing internationally.

Wealthyhood links:

Wealthyhood is an excellent choice for first-time investors who want a straightforward, educational, and cost-effective way to enter the world of investing. The blend of zero-commission trading and user-friendly features makes it appealing, though potential currency conversion fees are something to keep in mind.

Try Wealthyhood6. Freetrade - Top Free Investment App

Freetrade Review

Freetrade is an up-to-date app for investing: trading stocks and ETFs with zero commissions. This means that customers using their services will have a chance to access tools for analyzing market data in real-time within a simple interface that makes them make accurate decisions about their investments. More so, Freetrade offers socially responsible investment opportunities, therefore attracting users who would like to make their investments in companies that reflect their ethical values.

Freetrade in the UK is authorized and regulated by the Financial Conduct Authority (FCA) and is, therefore, a member of the Financial Services Compensation Scheme (FSCS). This includes users' funds protection of up to £85,000.

Costs:

No Commission: With Freetrade, the company doesn't charge typical commissions, which makes it easier and cheaper to invest.

Premium Version: Of course, where a normal version of the app is provided that any would be able to enjoy without fees, Freetrade also offers a premium one with advanced features for a more complete control of the investment strategies for £3 per month.

Pros:

No Commission Fees: This translates to lower transaction costs that would be sustained by the users, making trade much cheaper.

User-Friendly Interface: It is uniquely friendly for every type of investor, whether a novice or experienced investor, thus easily becoming every beginner's favorite.

Real-Time Market Data and Tools: Access important market data and powerful analysis tools that will make your experience in trading even more valuable with decisively decision-making information in your investments.

Socially Responsible Investing: Offers a variety of investment options matching not only personal ethical values but also benefiting similar-minded investors.

Cons:

Limited Investment Options: The number of different investments Freetrade offers is fewer compared to some other platforms, which could be a limitation for some users.

Monthly Fee for Premium Version: The app offers a standard free version but gives the user the option to purchase the premium version within the app for some monthly fee, which really won't be worth it for every investor.

Freetrade links:

Freetrade, comes as a much simpler offer of low-cost trading than other investing apps, but with a real focus on simplicity. It should be great for those starting out investing. The socially responsible investment choices and the interesting commission-free promise. The potential users will have to factor in the low variety of investment options and cost that comes in with using the premium features in their decision if Freetrade is the platform meant for them.

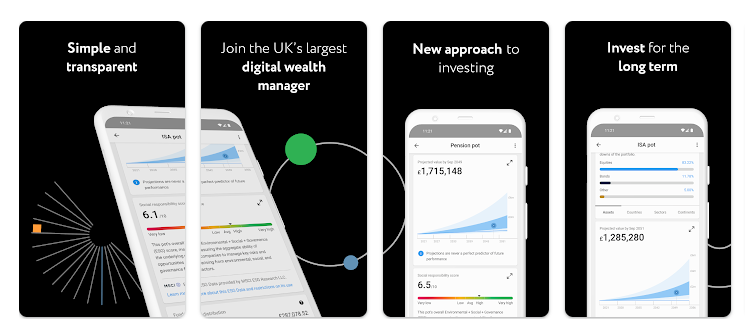

Go to Freetrade7. Nutmeg - Best Robo Advisor

Nutmeg Review

Nutmeg is the UK's first and the best-known robo-advisor. Regarded as the leading, most trusted robo-advisor in the country, it makes the investment process accessible to everyone. Nutmeg offers optimal risk rates for favorable returns and serves cautious, moderate, and aggressive investors alike. This UK-based app allows everyone from first-timers to professionals to invest by providing adaptive portfolios that respond to market conditions.

Furthermore, Nutmeg is regulated and authorized by the Financial Conduct Authority (FCA) and is additionally covered by the Financial Services Compensation Scheme (FSCS), safeguarding investments up to £85,000.

Costs:

Management Fees: Nutmeg charges management fees ranging from 0.25% to 0.75% based on the service level and investment amount.

Additional Costs: ETF charges average around 0.19%. Exit fees are non-existent, making it financially transparent and predictable.

Pros:

Low Entry Threshold: Just £100 is enough to start investing.

Automated Portfolio Management: Nutmeg automatically rebalances your investments based on your risk profile to maximize returns.

FCA Regulated and FSCS Covered: Provides a high level of protection and confidence for your investments.

Ethical Investing Options: Offers portfolios that are socially responsible, appealing to ethically-minded investors.

Cons:

Higher Fees for Smaller Investments: Fees are relatively higher for smaller investments. As the investment amount increases, the percentage of fees decreases.

Limited Customization: Portfolios are tailored to your risk level, with little room for further personalization.

Nutmeg links:

As an ethical investor who appreciates a hands-off approach, Nutmeg is presented as an easy and robust platform suitable for those beginning their investment journey without the complexity of traditional options. Its transparent fee structure and the security of being regulated by the FCA make it a trustworthy choice. However, it might not appeal as much to those seeking a highly customizable investment experience or to those investing small amounts who may find the fees higher. Nutmeg's simplicity, security, and commitment to making investing easy and accessible for everyone are its standout features.

Go to Nutmeg8. Moneyfarm - Best App for Long Term Investors

Moneyfarm Review

Moneyfarm, based in London and established in 2011, has shown excellent results as a robo-advisor. Its digital investment service caters well to both new and advanced investors. On the platform, clients can easily find diversified investment opportunities tailored to various financial goals and preferences, such as ISAs, pensions, and general investment accounts. I appreciate how Moneyfarm focuses on developing tailored investment plans that fit the specific financial situations of individuals, making it a preferred choice for investors looking for a personalized approach.

Costs:

Fee Structure: Moneyfarm's fees are based on the investment amount and are tiered. The fees range from 0.75% to 0.35%. This tiered approach is designed to encourage larger investments, although it may be less ideal for those starting with smaller amounts.

Pros:

Personalized Investment Portfolios: Moneyfarm offers personalized investment portfolios that match individual risk profiles, providing a tailored investment experience.

Lower Fees for Larger Investments: The fee structure decreases as the investment amount and duration increase, rewarding long-term and substantial investments.

Regulatory Compliance and Security: There is strong adherence to FCA regulations and FSCS protections up to £85,000, ensuring peace of mind. Advanced security systems are used to protect personal and financial information.

Cons:

Higher Fees on Small Investments: The fee structure can be relatively high for smaller investment sums, which might discourage new investors.

Limited Control for Investors: The platform may not suit those who prefer a more hands-on approach to managing their investments, as it does not offer the same level of control as self-directed plans.

Moneyfarm links:

In summary, if I were not looking for an app with high fees I would choose Moneyfarm as it stands out as a personalized, and user-friendly investment platform, particularly suited for those who value a tailored investment approach. It’s an excellent choice for investors who prefer a guided experience with their financial growth.

Go to Moneyfarm9. Hargreaves Lansdown - Best Stocks and Shares ISA App

Hargreaves Lansdown Review

Hargreaves Lansdown is one of the most popular investment apps for UK users. Everything on this platform, from shares and funds to ETFs and highly specialized accounts like SIPPs and Junior ISAs, is available to offer asset variety. It is meant for the new and experienced investors. Renowned for its quality research and insights that back informed investing, this user-friendly platform is backed by solid customer service. Famous for quality research and insights that back informed investing, the platform is easy to use and has good customer service backup.

This is the reason Hargreaves Lansdown is governed by the Financial Conduct Authority (FCA), with solid links to them when it comes to strict industry standards.

Costs:

There will be no charges on transactions with funds: There will be no charges for purchases or sales of funds.

The tiered fee structure on shares: Applicable to the fees for the share dealing, they are actually based on the monthly trading volume that one is involved in. The structure is such that the cost per trade is £11.95 for 0-9 trades, £8.95 for 10-19 trades, and £5.95 for 20 or more trades.

Pros:

Comprehensive research and learning resources: In-app, comprehensive detailed aids to keep users abre of the market trend and empower their knowledge in making smart investments.

Tiered Fee Structure: Cost-effective for the more active trader, the Thisjson model is designed.

Cons:

Higher Cost Per Trade at Basic Level: With relatively fewer trades in a month, thus it might disappoint an infrequent trader against some of its competitors. This can be pretty overwhelming to a new investor since many features may be available on the platform.

Might be overwhelming for new investors: Its platform is extensive and, if not essential in nature; hence, new investors might find it overwhelming.

Hargreaves Lansdown links:

The platform, while comprehensive, is not the simplest on the market, which might challenge new investors. However, the mobile app enhances accessibility, allowing users to manage their investments conveniently on the go. This makes Hargreaves Lansdown a robust option for those looking to engage deeply with their investment strategy, although the cost and complexity may deter some potential users.

Go to HL10. eToro - Best Low Cost Trading App

eToro Review

eToro is the world's leading social trading platform, offering a unique feature that allows users to follow and copy the trades of successful investors. This feature enables investors like me to learn from others' strategies. eToro offers a wide range of investment options including social trading, stocks, currencies, commodities, and cryptocurrencies, catering to a diverse investor base.

The platform adheres to high security and regulatory standards, operating under the oversight of major financial regulatory bodies. It employs advanced security measures to protect user data and prevent unauthorized access.

eToro's trading app is designed to be user-friendly for both novice and experienced investors, combining a sleek interface with robust analytical tools and extensive educational resources. As a social trading platform with broad capabilities, eToro does not charge fees for spread and withdrawal, making its comprehensive offerings and unique features a fair consideration for potential users.

Costs:

Zero Commission for Stocks: I offer stock trading at zero commission.

Spread Fees: Other than that, I also charge spread fees for every other trade type, with the exact fee being charged depending on the trade type and the asset being traded.

Withdrawal Fees: A small fee will apply for every withdrawal, over and above the users needing to abide by a minimum withdrawal limit in transaction planning.

Pros:

Innovative Social Trading: CopyTrading introduces my innovation where users can copy the trade of great investors, therefore providing them with excellent learning opportunities.

Broad Range of Investments: I offer a wide diversity of options for investors, with a range of tradable assets.

User-Friendly Interface: My platform includes details of advanced analytical tools and a very wide range of educational materials suitable for both newcomers and professionals.

Cons:

Spread and Overnight Fees: These do add up, particularly in the case of a frequent trader, and may eat into profitability.

Withdrawal Fee: An extra fee might be imposed on the withdrawal, acting as more of a dampener, especially for low-balance account holders or those wishing to withdraw frequently.

eToro links:

In conclusion, eToro's approach to social trading, coupled with its array of tradeable assets, makes it a strong contender in the world of investing apps. The platform's commitment to regulation, safety, and user-friendly experience further enhances its appeal. However, users should consider the platform's fee structure when evaluating its overall suitability for their trading needs.

Go to eToro11. Wealthify - Best App for Junior ISA

Wealthify Review

Wealthify is a digital investment service designed to simplify investing for everyone, from beginners to experienced investors. The platform offers various investment plans including ISAs, general investment accounts, and junior ISAs to meet different financial goals. Notably, users can start investing with as little as £1, making it particularly appealing for first-time investors and those with limited funds. Wealthify provides fully managed, ready-made portfolios, allowing investors to be completely hands-off.

The user interface of Wealthify is straightforward and intuitive, suitable for novices. Its mobile app is compatible with both iOS and Android devices, enabling easy management of investments on the go. However, Wealthify may not satisfy those seeking more sophisticated, high-risk investment options.

Wealthify ensures high safety standards and is regulated by the Financial Conduct Authority (FCA).

Costs:

Annual Fee Structure: Wealthify provides a clear and transparent annual fee structure offered from as low as 0.40% up to 0.60% per year, depending on the investment plan a customer chooses. The fee is levied annually at the end of the month, which the customers have invested in for the first time, and it remains constant over the period.

Pros:

Low Minimum Investment: Investment can be started with as low an amount as £1, making it very open for investors of all types.

Automated Portfolio Management: Enjoy a frictionless investing experience that's still personal but now with human experts at the helm.

Transparent Fee Structure: Priced competitively with a clear and transparent fee structure.

Cons:

Limited Investment Customization: The investment choices are rather fixed, something that might not fancy too many potential investors who feel more in control of their investment choices.

Not Fit for High-Risk Seekers: Thus, Wealthify may not be the best fit for investors who are looking to place their money in extremely high-risk, high-reward kinds of investments.

Wealthify links:

Overall, Wealthify stands out as a straightforward and accessible investment platform, ideal for those looking to start their investment journey or for experienced investors seeking a hands-off approach to growing their wealth.

Go to WealthifyHow to Choose Your Investment App

So, it's pretty critical to choose the right investment app that matches your investment goals, experience level, and personal preferences. Here are a few things that matter the most:

Fees:

Know what the costs of using the app are. This could be transaction fees, maintaining the account fees, or even withdrawal fees. While some apps offer free trading, they will likely compensate through other fees. Always look into the fee structure in detail before making a decision.

Investment Choices:

Evaluate the range of investment opportunities the app offers its users. From stocks, bonds, mutual funds, and exchange-traded funds (ETFs) to even cryptocurrencies, such an app would offer quite several options for one to invest his money. The most versatile investment apps will make it possible to invest in many different areas of the market so that users can diversify their portfolios.

Usability:

It should provide intuitive user interaction, especially to new and uninitiated investors. The app should have learning resources that will enable you to make more informed decisions regarding your investment and an interface that is easy to maneuver.

Account Minimums:

Check if the app requires a minimum balance in the account to start investing. It would be the best case for beginners if the app allows an investor to invest through minimal starting amounts.

Customer Service:

Good customer service is critical to financial transactions. Ensure that the app can guarantee good customer service and that it is easily accessible in your hour of need.

Reliability and safety:

These two should be humanly maintained at the utmost level for the app. It should have a strong reputation for being secure and efficient. Do use those apps that provide strong security for your personal and financial information. Also, understand the working of the app when the time comes for high volume trading so that it is consistent.

ISA Availability:

If the investment app offers an ISA to UK-based investors, then that is a factor to consider. Most important an ISA should be a tax-advantaged savings account, hence promising great benefits toward long-term saving and investing.

Best Investment Apps for Beginner UK Investors

I've also done a full review of the best investment apps for beginners in a full article but here is a quick list of some of them:

1. WealthyHood

Wealthyhood is offering an accessible entry point for UK investors, WealthyHood is one of the best investment apps out there that specializes in guiding beginners through investing in diversified, low-cost portfolios of exchange-traded funds (ETFs).

The app provides a selection of portfolios, each designed to align with various risk preferences and investment goals. To further support its users, WealthyHood offers a wealth of educational resources and tools, enabling users to make knowledgeable investment decisions.

2. Wealthify

Wealthify offers a user-friendly robo-advisor platform for UK investors, specializing in ISAs, general investment accounts, and Junior ISAs. Users can choose from various risk-level portfolios, mainly consisting of ETFs.

It's regulated by the FCA, ensuring security. While the platform charges fees between 0.6% and 0.7% and might have slightly higher costs than some rivals, it provides diverse portfolios, including socially responsible options. Ideal for beginners, but it's wise to consider the fee impact on investments.

3. Nutmeg

Nutmeg is an ideal investment platform for beginners, offering user-friendly features and a range of investment options. It provides easy setup, a smooth mobile and desktop app, and diverse account types like ISAs and pensions. Nutmeg's clear, straightforward approach suits long-term investors, not day traders, with a choice of portfolios including socially responsible investments.

Although it has slightly higher fees and a £500 minimum deposit, its safety is assured by FCA regulation and FSCS protection. Additionally, its extensive educational resources, including a comprehensive investment glossary and blog, make it a top choice for novice UK investors.

4. Moneybox

Moneybox is also one of the most beginner-friendly investing apps offering stocks, shares ISA, Lifetime ISA, general investment accounts, and Junior ISAs. FCA-regulated, secure money custody. Flat £1/month fee for accounts under £5,000, 0.45% annual fee for balances above. Easy-to-use interface, educational resources. Wide fund range, round-up feature for spare change. Consider fees when evaluating cost-effectiveness.

5. Acorns

Acorns is one of the most user-friendly micro-investing apps in this list that rounds up spare change from everyday purchases to invest in diversified ETF portfolios. With three subscription plans and an intuitive interface, it's ideal for beginners.

While fees may seem higher for smaller portfolios, the round-up feature can offset costs over time. Pros include automatic savings and a cashback program, but cons include limited control over investments. Overall, Acorns is an attractive option for beginners to start investing with small amounts.

Best Robo Advisors in the UK

I’ve already created an in-depth Robo Advisor guide for investors who are looking for their next platform.

You might notice that some investment apps are also listed in the main section of this article, but this is because the available investing apps in the UK are not infinite, and naturally there is some overlap between the lists.

With that said here is an overview of the best 5 Robo-Advisors I’ve included in full comparison review guide:

Nutmeg: Renowned for its diverse portfolio types and user-friendly interface, Nutmeg caters to a wide range of investors. It offers portfolios like fully managed, fixed allocation, socially responsible, and smart alpha, each designed to suit different investment styles and goals.

Wealthyhood: As discussed above Wealthyhood is great for beginners due to its user-friendly platform, no minimum investment requirement, and customizable investment options, making it an accessible choice for new investors.

Moneyfarm: Moneyfarm stands out for its personalized investment strategies combined with human expertise. It's ideal for those who appreciate a mix of automated technology with personalized advice and direct human interaction for managing investments.

InvestEngine: Unique for its DIY and managed portfolio options, InvestEngine appeals to those who want more control over their investments. It's especially attractive for its low management fees and focus on ETFs.

IG Smart Portfolios: Backed by the robust infrastructure of IG Group, IG Smart Portfolios is known for its professional, automated investment management, appealing to those who trust established financial institutions.

Best Investment Apps for Micro Investing

Micro Investing is the process of regularly investing small amounts of money from spare change or from auto-investing easy to use apps.

Similarly to the best robo investors I’ve also created a guide about the best Micro Investing apps but in case you are in a hurry you can find the best apps for Micro investing bellow:

Moneybox: Favoured for its simplicity and innovative round-up feature, Moneybox is excellent for beginners wanting to start saving and investing small amounts. It offers various investment options including stocks and shares ISAs, making it versatile.

Wealthyhood: This app is designed for ease of use, appealing to those new to investing. Wealthyhood offers personalized portfolios and educational resources, encouraging informed investing.

Wealthify: Wealthify's appeal lies in its diversified and ethically-focused portfolios. It's a good fit for those who want a hands-off investment experience but are also conscious of ethical investing.

Nutmeg: Known for its professional management and tailored investment strategies, Nutmeg is ideal for those who seek a more traditional investment approach combined with the ease of a robo-advisor.

Moneyfarm: Balancing technology and expert advice, Moneyfarm provides a hybrid investing experience. It's suitable for investors who want the convenience of an app with the reassurance of professional oversight.

Best Platforms for ETF Investing

As I've discussed in my ETF platform picking guide if you are particularly looking for a platform that focuses on ETFs you should be looking for a broker that offers a wide range of ETFs, low costs, great platform user experience, large availability of features and investment instruments, and good customer support. Here are my top 3 picks from this guide:

Invest Engine

Invest Engine is celebrated for offering a user-friendly platform that caters to both novice and seasoned investors. With over 600 ETFs available, it provides a wide selection at low fees. Investors have the flexibility to choose between DIY investing and managed portfolios, making it a versatile option for a range of investment strategies.

Wealthyhood

Wealthyhood is tailored for beginners, offering a commission-free model in its paid plans that significantly lowers the cost barrier for investors. It selects the 50 best ETFs, streamlining the investment process for those new to the market. The platform's simplicity and automatic investing features make it an attractive choice for those looking to start their investment journey.

Interactive Investor

Suited for intermediate investors, Interactive Investor boasts a comprehensive selection of more than 1,000 ETFs. Its platform is designed with a user-friendly interface and offers a broad spectrum of investment options beyond ETFs. The flat fee structure is a notable advantage, providing clarity and predictability in costs.

Are Investment Apps Safe?

In short: Investment apps are safe. If you are investing in the UK, make sure that the app of your choice is regulated by the FCA and that funds are FSCS-protected and that it's using advanced encryption technologies.

Safety is a paramount concern for investors, especially when it comes to entrusting your hard-earned money to a digital platform. The good news is that most of the best investment apps in the UK are regulated by financial authorities such as the Financial Conduct Authority (FCA), providing a layer of protection and security for users. These regulations require brokers to adhere to strict standards in terms of transparency and fairness.

Moreover, these apps often use advanced encryption technologies to protect the sensitive financial and personal information of their users from unauthorized access and potential cyber threats. Some even offer insurance coverage on your investments up to a certain limit, additionally safeguarding your assets.

However, like with any financial decision, it's important to do your own due diligence. Check out user reviews, verify regulatory compliance and look into the app's security measures before you start investing.

Users should also thoroughly understand any potential investment and consider diversifying their portfolio to mitigate risk. It is also worth noting that many of these apps are covered by the Financial Services Compensation Scheme (FSCS), which can protect your investments up to £85,000 if the company becomes insolvent.

Most Reliable and Safe Investing Apps Available in the UK

1. Vanguard

Vanguard, founded by Jack Bogle, stands as one of the world's largest investment firms, renowned for introducing the index fund. It has built a reputation on prioritizing investor welfare, offering an array of mutual funds and ETFs without transaction fees, catering to both passive and active investors.

Vanguard's dedication to low-cost funds, transparent pricing, and commission-free ETFs highlights its commitment to affordability and transparency for investors. Regulated and equipped with various resources for portfolio management, Vanguard demonstrates a strong commitment to ensuring investor safety and adhering to regulatory compliance standards.

2. Fidelity

Fidelity, established in 1946, is a well-respected multinational financial services corporation and one of the largest asset managers globally. It has garnered acclaim for its comprehensive investment services, quality of research, and exceptional customer service, managing over 19 million retail brokerage accounts.

Fidelity emphasizes security in its online and mobile platforms, implementing stringent measures to protect personal and financial information. This focus on security, combined with its flat-fee trading structure and extensive range of mutual funds, underscores Fidelity's commitment to both client safety and regulatory compliance, making it a trusted and reliable choice for investors.

3. Hargreaves Lansdown

Founded in 1981, Hargreaves Lansdown has risen to prominence as one of the UK's leading investment platforms, offering a wide array of investment choices and robust customer service. It has earned a reputation for its user-friendly platform and comprehensive research resources.

Emphasizing investor protection with coverage up to £85k and maintaining a clean regulatory record with no major incidents or fines, Hargreaves Lansdown demonstrates its commitment to safety and regulatory compliance.

This dedication to protecting investor interests and adhering to high compliance standards makes it a reliable and secure choice for both novice and experienced investors.

4. IG

IG, established in 1974, is one of the UK's oldest and most trusted brokerage platforms. It offers a comprehensive range of asset classes, including shares, ETFs, bonds, and digital currencies, through a robust trading platform.

IG's longstanding presence in the brokerage industry is bolstered by strict regulation, including a crucial license from the UK’s Financial Conduct Authority (FCA). This extensive experience and adherence to regulatory standards affirm IG's reputation as a reliable and secure investment app, ensuring a safe trading environment for its diverse clientele.

5. Interactive Investor

Interactive Investor, established in 2003, has quickly become a trusted platform in the UK for a wide range of investment options, including shares, funds, and ETFs. Renowned for its flat-fee pricing model, it appeals particularly to investors with substantial portfolios.

The platform's clean regulatory record, with no major incidents or fines, and investor protection up to £85k, underscore its commitment to safety and compliance. This track record of adherence to regulatory standards and focus on investor security makes Interactive Investor a reliable and secure choice for individuals seeking a dependable investing app.

Why Use Investment Apps?

Investment apps offer a convenient and hassle-free way for individuals to invest their money. They eliminate the need for traditional brokers or financial advisors and allow users to manage their investments on their own.

With investment apps, investors have the freedom to choose where and when to invest, without any geographical or time limitations. Additionally, most investment apps offer features such as automatic portfolio rebalancing, tax-efficient investing, and analysis tools that help users make informed decisions about their investments. This makes investment apps a valuable tool for beginner investors who may not have the knowledge or experience to navigate the complex world of investing on their own.

How to Start Investing Money in the UK?

Starting to invest in the UK involves understanding specific factors like taxes, income, and government regulations. Here's a tailored approach:

Define Financial Goals: First, you need to determine your objectives, such as saving for a house, retirement, or education. UK-specific goals might include maximising tax-efficient vehicles like ISAs or pensions.

Educational Foundation: Gain knowledge about various investment vehicles (stocks, bonds, mutual funds, ETFs) and the associated risks. Familiarise yourself with UK-specific investment regulations and tax implications.

Selecting an Investment Platform: Choose a platform that aligns with your expertise. Beginners might prefer apps offering ready-made ETF portfolios, while more experienced investors could opt for platforms allowing personalized portfolio management.

Opening an Investment Account: In the UK, consider tax-efficient accounts like stocks and shares ISAs, general investment accounts, or self-invested personal pensions (SIPPs).

Commence Investing: Begin with an amount you're comfortable with, gradually increasing your investment as you gain confidence. UK investors should be aware of their tax allowances and how these impact investment choices.

Ongoing Investment Review: Regularly assess your investments, keeping in mind that investing is a long-term endeavor. Don't be swayed by short-term market fluctuations.

Patience and consistency are key in the investment landscape. Building a substantial portfolio takes time, and understanding UK-specific investment nuances can greatly aid in this journey.

How to Invest with Little Money in the UK?

Investing with a small amount of money can be a daunting prospect, but it's completely possible and can be highly rewarding. Here are some options:

Micro-Investing with Apps: Apps like Acorns and Moneybox make it possible for you to start investing with just your spare change. They round up your everyday purchases to the nearest pound and invest the difference. And WealthyHood's platform allows you to invest with as little as 1 pound.This is a significantly less intimidating way to start investing and can help you gradually build up your investment portfolio over time.

Invest in ETFs: Exchange Traded Funds (ETFs) are a good option for beginner investors with little money. ETFs are baskets of different stocks or bonds, and buying shares in an ETF means diversifying your portfolio without needing to buy each individual security. Apps like WealthyHood provide the opportunity to invest in low-cost ETF portfolios.

Robo-Advisors: Robo-advisors such as Wealthify automate the investment process and typically require lower minimum investments than traditional financial advisors. They use algorithms to optimize your investment strategy based on your risk tolerance and financial goals.

Fractional Shares: Investing in fractional shares is another excellent way for beginners to start investing with little money. Fractional shares allow you to purchase a portion of a share, which means you can start investing in high-value companies with just a small amount of money. This is a great way to diversify your portfolio and gain exposure to a wider range of stocks without requiring a large upfront investment. Platforms like Trading 212 and Freetrade provide the opportunity to invest in fractional shares with no fees, making it an affordable option for beginner investors. Their platforms are easy to use and provide a vast range of investment options, including ETFs, making it ideal for beginners.

Remember, investing always involves risks. Even though these methods require less money to start, it's crucial to educate yourself about investment strategies, understand your risk tolerance and be patient as investing is generally a long-term game.

Conclusion

In concluding our exploration of the UK's investment apps, it's important to note that we devote considerable time to thoroughly reviewing these platforms, aiming for the most unbiased and honest assessments.

Our goal is to equip our readers with reliable information to make informed decisions. These apps, offering everything from fractional shares to robo-advising, are reshaping the investment landscape, making it accessible to a broader audience. While user-friendly and convenient, remember that investing involves risks. We encourage doing your research and understanding your risk tolerance.

For any further queries, feel free to reach out via comments or reach me on Social Media and I will be happy to help. Happy and informed investing!

Capital at risk. This article is for information purposes only and is not investment advice nor a recommendation. You should consider your own personal circumstances when making investment decisions. Past performance is not a reliable indicator of future performance. Tax treatment depends on your personal circumstances and rules can change.