Table of Contents

Picking up the best investment platform in the UK can be a tricky task due to the regulatory environment. Since the UK has exited the European Union investing platforms have to make sure that they comply with UK laws. It's also important for UK investors to pick a platform that can assist them with their taxes, or can enable them to open an Individual Savings Account (ISA). Moreover, we are going to explore what are the best platforms for ETFs, for ISAs and which of them are the best for beginners.

Best Investment Platforms in the UK as of May 2024:

Hargreaves Lansdown - Best Stocks and Shares ISA Platform

Invest Engine - Best ETF Investing Platform

Fidelity - Best For Professional Investors

Best Invest - Best for SIPP & Pension Accounts

Vanguard - Best Platform for Share Dealing

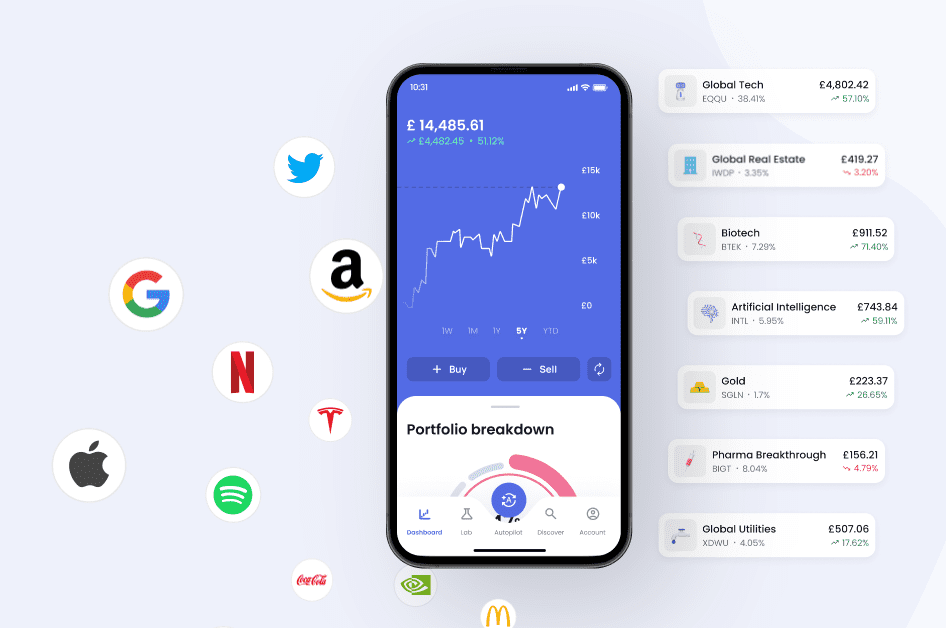

Wealthyhood - Best Investing Platform for Beginners and Long-Term Investors

Interactive Investor - Best For Experienced Investors

Nutmeg - Best Robo Advisor Platform

AJ Bell - Best Investing Platform in the UK

Trading 212 - Best Trading Platform in the UK

eToro - Best for Social Trading

Disclosure To compile the list presented in this article, I personally signed up for each of the platforms discussed. The purpose of this blog post is to offer informative and impartial reviews of every platform featured. While I have no affiliate ties to the brands mentioned, I am a member of the Wealthyhood team. Feel free to reach me on email (george@wealthyhood.com) or on LinkedIn to ask me questions about the platforms presented in this article.

Best Investment Platforms Comparison Table

Platform Name | Fees | ISA Accounts | Minimum Deposit | Best For | Rating |

Hargreaves Lansdown | 0.45% annual custody charge for funds; £11.95 per transaction for shares/ETFs | Multiple ISA Accounts | £1 for Fund and Share account; £25-50 per month for individual funds | Extensive investment options, powerful tools, and education | 9/10 |

Invest Engine | Zero platform/account fees; 0.25% for managed portfolios | Yes | £100 | Low-cost, diversified ETF investing with DIY or managed options | 9/10 |

Fidelity | £7.50 to £30 per trade | Multiple ISA Accounts | £100 | Proffesional Investors | 8/10 |

Best Invest | 0-0.4% Per trade | Yes | £50 | SIPP & Pensions | 8/10 |

Vanguard | 0.15% Annual Fee | Multiple ISA Accounts | £500 for most accounts; some funds from £100 | Long-term, cost-effective index fund investing | 8/10 |

Wealthyhood | Free Plan, Commission free, | No | £1 for fractional shares | Beginners, fractional investing, and guided education | 8/10 |

Interactive Investor | From £3.99/month; additional dealing fees for ETFs/commodities | Stocks & Shares ISA | £0 to open; £25-£100 for regular investing | Self-directed investors, comprehensive tools, and fixed pricing | 7/10 |

Nutmeg | 0.45-0.75% based on portfolio size | Yes | £500, or £50 with a monthly plan | Hands-off investors seeking fully managed portfolios | 7/10 |

AJ Bell | £9.95 per share No fees for account opening/transfer/closing; 0.25% annual platform fee; | Multiple ISA Accounts | £0 for share dealing; £500 for SIPPs and ISAs | Comprehensive investment products, easy-to-use interface. Good for serious investors | 8/10 |

Trading 212 | Commission-free; small bid-ask spreads; no minimum charges or monthly fees | No | £1 | Low-cost trading, diverse instruments, and beginners | 6/10 |

eToro | Zero commission on stocks/ETFs; small spread on other assets; $5/month inactivity fee; $5 withdrawal fee | Stocks & Shares ISA | $10 | Social trading, diverse asset range, and beginners | 8/10 |

How to Choose an Investment Platform?

With the breadth of investment platforms available, it’s important to assess which aligns with your investing strategy and preferences. Key factors to evaluate include:

Available Assets - Platforms vary considerably in available asset classes, products and services. Outlining your goals helps narrow suitable options. Picking a platform with a wide range of investment vehicles as well as different ETFs and stocks will help you expand and diversify your portfolio.

Features – Every investment platform has different features. Some platforms offer automatic investing, others offer the option set up stop losses and some even have live customer support. Before signing up and depositing money to an investment platform make sure that it features all the tools you will need.

Account Minimums & Fees – Platforms have differing minimum deposits to open accounts. Fees also vary, with charges for trading commissions, account maintenance, fund dealing, withdrawals and advice services. Comparing overall costs is crucial

ISA Availability - An investment platform offering Individual Savings Accounts (ISAs) empowers investors with a tax-efficient way to save and invest, as it allows earnings from interest, dividends, and capital gains to grow tax-free. An ISA is a type of savings account in the UK that offers generous tax benefits, enabling individuals to allocate a portion of their income into a range of investment options, including stocks, bonds, and funds, without paying tax on the returns.

Ease of Use – The user experience can significantly impact your investing journey. If you are an experienced investor or you mostly care about DCA consider using an investment platform that also offers an app. Investing apps are generally easier to use and can offer investing on the go.

Customer Support – From questions to issues, access to reliable support is vital. Review response times and communication channels like live chat, telephone, and online knowledge centers.

Regulation and Safety - In my articles I’ve always stated the importance of choosing brokers or platforms that are compliant and regulated by the FCA (Financial Conduct Authority).

Doing thorough due diligence allows finding an investment platform aligned with your financial situation and preferences. Ultimately, the right option comes down to your goals, desired involvement and budget. Evaluating multiple choices using the criteria above can lead you to the best fit.

The list provided below was created after testing each of those platforms with my personal accounts to provide you with an honest and unbiased review of the best investment platforms in the UK.

Best Investing Platforms in the UK for 2024 for ISA or GIA

1. Hargreaves Lansdown - Best For ISA Accounts

Platform Name | Fees | ISA Accounts | Minimum Deposit | Best For | Rating |

Hargreaves Lansdown | 0.45% annual custody charge for funds; £11.95 per transaction for shares/ETFs | Multiple ISA Accounts | £1 for Fund and Share account; £25-50 per month for individual funds | Extensive investment options, powerful tools, and education | 9/10 |

Why We Picked It

Hargreaves Lansdown is a giant name in DIY investing, renowned not only for a wide range of investment opportunities, including inclining shares, funds, ETFs, and corporate bonds but also for offering tax-efficient solutions such as Individual Savings Accounts (ISAs). From Stocks & Shares ISAs to Lifetime ISAs and Junior ISAs, their individual saving accounts cover a product that one might need at different stages of life for different purposes. This range of ISA account choices underscores our commitment to ensuring flexible, tax-efficient investment opportunity management. Coupled with a redesigned app that is easy to use and delves deep into comprehensive financial insights, Hargreaves Lansdown is best for those seeking a holistic platform coupling powerful tools with seamless tax planning.

Pros

In-depth investment advice and full-market insights available in data for shares and funds.

A choice of tax-effective investment products, including some different types of ISAs.

Exclusive offer: This is a choice with negotiated fees that are lower than those available to other customers.

We also bring you innovative ways to invest your money with services such as Wealth 50, Master Portfolios, and Portfolio +.

Cons

Higher fees versus some competition, more so for smaller portfolios.

If at all there is a weak point, it would probably be the pricing: many options in their complex fee structure might be enough to drive away new investors.

Fractional share investing is offered on a limited basis.

Fees

Funds: 0.45% on the total investment up to £250,000; 0.25% to £1 million; 0.1% to £2 million; no charges above that.

Shares and Investment Trusts: 0.45% p.a. on the whole holding, with a maximum annual cap of £45.

Trading Costs: £11.95 per trade for shares, investment trusts, corporate bonds, and ETFs. Rates reduce for frequent traders and on a tiered basis. The lower costs apply to regular investments and for those investors who decide to reinvest their dividends.

In fact, these offers add value by removing exit fees and generally lowering other costs, so they are prime for any investor looking into the platform as full-service and offering a wide array of tools and resources for effective management of investments.

Go to HL2. Invest Engine - Best Platform for ETFs

Platform Name | Fees | ISA Accounts | Minimum Deposit | Best For | Rating |

Invest Engine | Zero platform/account fees; 0.25% for managed portfolios | Yes | £100 | Low-cost, diversified ETF investing with DIY or managed options | 9 /10 |

Why We Picked It

Since its establishment in 2019, Invest Engine has made significant strides in the ETF market, appealing due to its dual approach catering to both DIY and managed portfolio investors. Its intuitive platform supports over 600 ETFs globally, coupled with fractional investing that democratizes access to diversified portfolios regardless of capital size. With more than £300 million managed for thousands of clients, Invest Engine's commitment to providing unbeatable value through low-cost, automated tools is evident. The platform's regulatory compliance with the UK's Financial Conduct Authority and the safeguarding of client assets with custodian banks underscore its reliability and security. Moreover, its user-friendly design is focused on technology, facilitating quick account setups and easy management, making it ideal for investors who value simplicity and efficiency.

Pros

Access to over 600 commission-free ETFs covering global markets

Fractional investing allows for comprehensive portfolio diversification with lower capital

No account, platform, or trading fees, enhancing its cost-effectiveness

Managed portfolios available for a minimal fee of 0.25% annually

Cons

Limited options for trading individual stocks and shares

Fewer research tools compared to more traditional investment platforms

Narrower overall asset selection beyond ETFs

Fees

Invest Engine stands out for its transparent and highly competitive fee structure:

Zero Platform Fees:

No charges for account maintenance or trading on the platform.

ETF Charges:

Embedded fund charges within ETFs average between 0.15% to 0.50% annually.

Managed Portfolio Fee:

A modest 0.25% annual fee for managed portfolios, covering rebalancing and optimization efforts.

The minimal investment requirement of £100, combined with fractional investing capabilities, makes starting and scaling an ETF portfolio accessible for a wide range of investors.

Go to Invest Engine

3. Fidelity - Best for Proffesional Investors

Platform Name | Fees | ISA Accounts | Minimum Deposit | Best For | Rating |

Fidelity | £7.50 to £30 per trade | Multiple ISA Accounts | £100 | Proffesional Investors | 8 /10 |

Why We Picked It

Today, one of the biggest worldwide financial companies—and their brand is recognized far from the United States. For 75 years, Fidelity has been gathering experience and a trustful reputation, which allows one to seek its services in investments that range from mutual funds to stocks, bonds, and ETFs. Its attractiveness is also added by the available tax-efficient accounts, including General Investment Accounts (GIAs), ISAs, and Stocks and Shares ISAs, designed to offer flexible investments with no annual limits attached or tax benefits. This then makes Fidelity a very compelling choice for anyone looking to have in their repertoire a well-rounded platform supporting active trading but still wanting to have that long-term wealth managed with a single firm.

Having an excellent reputation with regards to the management of investment and comprehensiveness of offerings, Fidelity stands preferred by many across the world who would like to venture into the complexities of investing through a reliable and supportive platform. This continues to solidify their position as an emphasis on educational resources and user-friendly technology in the financial services industry.

Pros

Wide range of investment products suitable for diversification.

Tax-efficient savings options with ISAs and Stocks and Shares ISAs.

Renowned for strong customer service and extensive investor education resources.

Robust online tools and mobile app for convenient account management and trading.

Cons

Higher fees compared to some discount brokers.

Some users find the platform interface less intuitive than simpler, newer platforms.

International trading options may be limited compared to specialized global trading platforms.

Fees

Annual Service Fee:

Generally, it usually varies concerning the account balance and the type of assets invested in, between 0.35% and 0.75%.

Trading Fees:

Reasonable costs for trades, with discounts available for frequent traders.

No Account Fees:

No charges for account opening, closing, or transfers, enhancing its appeal for long-term investors.

4. BestInvest- Best SIPP & Pension Accounts

Platform Name | Fees | ISA Accounts | Minimum Deposit | Best For | Rating |

Best Invest | 0-0.4% Per trade | Yes | £50 | SIPP & Pensions | 8 /10 |

Why We Picked It

BestInvest is best described as the most comprehensive approach to investment management, one characterized by a robust platform that serves everyone from neophytes to the professional investor. The platform itself has a user-friendly interface and a number of options for investment, which are presented in the form of shares, funds, and bonds. BestInvest has the ISAs and Stocks and Shares ISAs in combination with General Investment Accounts (GIAs) to give you an ideal setting for tax-efficient ways of investment. This, therefore, leaves it as the best idea for one who has ambitions to get the best out of his investments within a tax-efficient structure. BestInvest's reputation is built through reputable professional advisers who offer insight for investment advice and tools to enable clients to make well-informed portfolio decisions.

BestInvest offers a very strong option for the holistic approach to investing, which any serious investor will value, given expert advice combined with the choice of account options that will suit all their investment needs. This investment site is best suited to any investor who would like to manage their portfolio in an informed way.

Pros

Extensive range of investment options including stocks, mutual funds, and bonds.

Offers tax-efficient accounts like ISAs and Stocks and Shares ISAs for long-term savings.

Known for high-quality investment advice and strong customer support.

Provides detailed research and educational resources to aid investment decisions.

Cons

Fee structure may be higher compared to some budget-friendly platforms.

The platform can be complex for absolute beginners without prior investing experience.

Limited international trading capabilities which may restrict global investment opportunities.

Fees

Annual Service Fee:

Typically ranges from 0.2% to 0.4%, depending on the type and size of the account.

Trading Fees:

The fees that are charged in the buying and selling of investments are competitive, while trading rates may be charged on the volume of transactions and kind of assets traded.

No Additional Account Fees:

All services related to account opening and maintaining are free; for example, ISA Transfer: no charges for transfer-in or out. This further enhances its attractiveness for long-term investment strategies.

5.Vanguard - Best Share Dealing Platform in the UK

Platform Name | Fees | ISA Accounts | Minimum Deposit | Best For | Rating |

Vanguard | 0.15% Annual Fee | Multiple ISA Accounts | £500 for most accounts; some funds from £100 | Long-term, cost-effective index fund investing | 8/10 |

Why We Picked Vanguard

Vanguard is a giant in the investment management arena, known for its pioneering role in low-cost indexing and a steadfast commitment to long-term investing. Since its inception in 1975 and its expansion into the UK market in 2009, Vanguard has attracted investors with its unique mutual ownership structure, allowing it to offer some of the industry’s lowest fees. This approach suits buy-and-hold investors who prioritize minimal costs and market-aligned returns over the long haul. The platform’s focus on indexed funds and ETFs that mirror market segments appeals to those looking to avoid the risks and expenses associated with active management.

Pros

Ultra-low expense ratios through its at-cost structure

Broadly diversified offerings like LifeStrategy funds tailored to different risk levels

Strong emphasis on security and regulatory compliance

Educational resources support long-term investment strategies

Cons

Fewer tools and features for active trading

Limited selection beyond core index funds and ETFs

Relatively high minimum investment requirements

Fees

Vanguard's fee structure highlights its commitment to affordability:

Annual Charges:

Extremely low expense ratios, such as 0.06% for the FTSE UK All Share Index Unit Trust.

Operational Efficiency:

By operating at cost, Vanguard minimizes expenses across administration and advisory services, directly benefiting investors.

Vanguard’s model is ideal for those who prefer a straightforward, long-term approach to investing, with safety measures like segregated custody and stringent oversight ensuring a secure environment. Its simple and educational platform design makes it accessible, especially for those new to investing or those who appreciate a no-frills investment experience.

Go to Vanguard6. Wealthyhood - Best for Long Term Investors

Platform Name | Fees | ISA Accounts | Minimum Deposit | Best For | Rating |

Wealthyhood | Free Plan, Commission free, | No | £1 for fractional shares | Beginners, fractional investing, and guided education | 8/10 |

Why We Picked It

Wealthyhood was selected for its commitment to making investing straightforward and accessible, especially catering to first-time, long-term investors. Launched in 2019, Wealthyhood is part of a new wave of investment platforms leveraging technology to democratize access to financial markets. As an appointed representative of RiskSave Technologies Ltd, Wealthyhood operates under the UK’s Financial Conduct Authority authorization and oversight. The platform focuses on providing a jargon-free, educational approach to investing, which is highly appealing to those new to financial markets. It allows users to build and customize diversified portfolios through fractional share investing, starting from as low as £1. By reducing traditional barriers to investment and offering guided education, Wealthyhood positions itself as an ideal platform for beginner investors.

Pros

Fractional Share Investing

Allows building a diversified portfolio from just £1, making it accessible to investors with limited budgets.

Intuitive Tools

Features like auto-rebalancing, dividend reinvestment, and recurring top-ups simplify portfolio maintenance.

Educational Support

Wealthyhood provides tailored guides, courses, and virtual portfolios to help new investors understand investing fundamentals.

Regulated and Secure

Operates under the UK’s Financial Conduct Authority and partners with trusted global custodians to ensure asset security.

Cons

Limited Investment Options

The platform offers a specific set of investments, which might be restrictive for some users.

Not Suitable for Advanced Traders

Lacks advanced trading functionalities, focusing more on beginners.

Relatively New Platform

As a newer platform, it has a shorter track record, which might concern some investors.

Fees

Wealthyhood structures its fees to keep investment costs minimal, enhancing the value it offers to its users:

Subscription-Based Model: Offers different pricing tiers.

Free Plan

: No commissions, allowing beginners to start without upfront costs.

Paid Plans

: Two options available at £2.99 and £12.99, respectively.

No Trade or Currency Conversion Fees

: These fees are eliminated in the paid plans, reducing the cost burden on investors.

Focus on Low Costs: By minimizing fees, more of the investors' money remains invested and potentially growing.

Try Wealthyhood7. Interactive Investor - Best for Experienced Investors

Platform Name | Fees | ISA Accounts | Minimum Deposit | Best For | Rating |

Interactive Investor | From £3.99/month; additional dealing fees for ETFs/commodities | Stocks & Shares ISA | £0 to open; £25-£100 for regular investing | Self-directed investors, comprehensive tools, and fixed pricing | 7/10 |

Why We Picked It

Interactive Investor has firmly established itself as a robust platform for self-directed investing in the UK, offering a wide array of investment options including pensions, ISAs, SIPPs, and GIAs. Launched in 1995, the platform provides comprehensive tools and accounts that allow investors to effectively manage global portfolios under a single umbrella. The availability of both DIY investment tools and managed services, including ethical investment choices, appeals to a broad range of investment preferences and skill levels. Its extensive suite of products from international markets, coupled with effective educational resources, makes it a top choice for investors looking to expand and control their financial portfolios in a tax-efficient manner.

Pros

Wide variety of investment options, including stocks, ETFs, bonds, and socially responsible funds.

Access to both self-directed tools and managed investment services like Quick Start Funds.

Competitive fixed pricing structure, making costs predictable.

Extensive educational resources and a strong regulatory framework ensuring safety and compliance.

Cons

Higher trading fees compared to discount brokers.

Limited options for fractional shares, which may affect flexibility in investment amounts.

The platform's cryptocurrency offerings are still developing and may not satisfy all crypto investors.

Fees

Interactive Investor uses a transparent and straightforward fee model:

Admin Fee:

Starts at £3.99/month, covering unlimited trades in stocks, funds, and investment trusts.

Dealing Fees:

ETFs and exchange-traded commodities are charged at £7.99 and £1.99 per trade, respectively.

International Trading:

Efficiently structured to avoid excessive forex fees, enhancing the appeal for trading in over 25 overseas markets.

Interactive Investor's structured approach to fees, combined with its comprehensive tools and services, supports a broad spectrum of investment strategies, from novice to seasoned investors. Its commitment to providing a user-friendly experience with educational support and a variety of account types, including tax-efficient ISAs and SIPPs, makes it a compelling choice for those looking to maximize their investment potential.

Go to Interactive Investor8. Nutmeg - Best for Robo Advising

Platform Name | Fees | ISA Accounts | Minimum Deposit | Best For | Rating |

Nutmeg | 0.45-0.75% based on portfolio size | Yes | £500, or £50 with a monthly plan | Hands-off investors seeking fully managed portfolios | 7/10 |

Why We Picked It

Nutmeg stands out as a pioneer in the robo-advisor space, particularly appealing for those who prefer a hands-off approach to investing. Since its inception in 2011, Nutmeg has been dedicated to making professional investment management accessible and easy to understand, leveraging technology to simplify the entire investment process. Nutmeg offers fully managed portfolios, including options for socially responsible and Sharia-compliant investments, making it a versatile choice for a wide range of ethical and financial preferences. Although it doesn't offer a Stocks and Shares ISA directly focused on active trading, its managed ISA portfolios provide a tax-efficient way to invest, appealing to those looking for a blend of simplicity, performance, and tax savings.

Pros

Offers fully managed portfolios, ideal for those who prefer not to manage day-to-day investment decisions.

Provides socially responsible and Sharia-compliant investment options.

User-friendly online platform and mobile app enhance the investment experience.

Features like the Path financial planning tool help users project and plan their financial future.

Competitive management fees for larger portfolios over £100k.

Cons

Higher management fees compared to self-directed platforms.

Limited investment customization compared to traditional brokerage services.

Managed portfolios may offer less tax efficiency than some self-directed Stocks and Shares ISAs.

Fees

Nutmeg's fee structure is clear and straightforward, based on the size of the investment:

Annual Management Fees:

Range from 0.45% to 0.75%, decreasing with the portfolio size, providing cost-effective management for larger investments.

No Trading Fees:

Fees are not tied to trading volume, simplifying cost expectations for investors.

Nutmeg's approach to investment management is designed for ease and effectiveness, suitable for first-time investors and those who value a guided, technologically driven investment strategy. Its commitment to continuous improvement and responsible investing aligns well with the values of a growing segment of investors looking for ethical investment opportunities.

Go to Nutmeg9. AJ Bell-Reputable Investing Broker in the UK

Platform Name | Fees | ISA Accounts | Minimum Deposit | Best For | Rating |

AJ Bell | £9.95 per share No fees for account opening/transfer/closing; 0.25% annual platform fee; | Multiple ISA Accounts | £0 for share dealing; £500 for SIPPs and ISAs | Comprehensive investment products, easy-to-use interface. Good for serious investors | 8/10 |

Why We Picked AJ Bell

AJ Bell, established in 1995 and managing over £72 billion in assets, is a standout on the UK's investment platform scene due to its comprehensive offerings and user-friendly technology. Both new and seasoned investors find AJ Bell's interface accessible, with tools that cater to a variety of investment strategies and preferences. The platform's strengths are particularly notable in retirement planning, offering SIPPs and ISAs that allow for tax-efficient saving—crucial for long-term financial health. Moreover, the addition of AJ Bell's Dodl app caters further to the modern investor with a streamlined, low-cost approach to share and fund investing, simplifying the process for everyone involved.

Pros

Wide array of investment products including shares, funds, ETFs, and managed portfolios.

Tax-efficient accounts such as SIPPs and ISAs enhance retirement savings.

User-friendly online and mobile platforms that simplify investment management.

Competitive pricing with low platform fees, especially beneficial for larger portfolios.

Recognized with awards for customer support and platform functionality.

Cons

Limited options for direct international share dealing.

Some services incur higher fees, potentially affecting cost efficiency.

Fewer customization options available compared to more specialized trading platforms.

Fees

AJ Bell promotes transparency and affordability in its fee structure:

Platform Fees:

Start at 0.25% annually, decreasing for portfolios over £250,000 to a capped rate of £375 per year.

Transaction Charges:

Reasonable rates for buying and selling investments, with no fees for opening, transferring, or closing accounts.

AJ Bell's approach combines broad investment options and efficient tools with a focus on cost-effective and tax-efficient investing. Its platforms, including the innovative Dodl app, are designed to support a wide range of investment needs and preferences, making it an excellent choice for those looking to manage their investments actively or passively.

Go to AJBell10. Trading 212 - Best for Trading

Platform Name | Fees | ISA Accounts | Minimum Deposit | Best For | Rating |

Trading 212 | Commission-free; small bid-ask spreads; no minimum charges or monthly fees | No | £1 | Low-cost trading, diverse instruments, and beginners | 6/10 |

Why We Picked It

Trading 212 is basically one of the best and most innovative platforms ever made for affordable and accessible trading. This is the way to go for an investor looking forward to kick-starting their finances or diversifying without involving large fees. Founded in 2011, eToro has already attracted over 1.5 million users worldwide through its commission-free structure on a wide range of over 10,000 instruments: including shares, cryptos, forex, and commodities. Trading 212 has basically revolutionized the art of investment; it offers friendly technology, and almost zero bills cost-wise, and offers provisions like ISA and GIA accounts which, to some extent, can allow someone to manage their portfolio with very minimal tax deduction. Empower your easy-to-use interface, from fractional shares to practice accounts, for both new and pro traders with safe skill-building tools. No wonder: from convenient usage and a wide array of investment products offered to the tax efficiency and safety of accounts, it is quite a sell why one should opt for Trading 212 as a modern investor.

Pros

Access to over 10,000 commission-free instruments, from popular stocks to niche cryptocurrencies.

User-friendly mobile experience that’s both intuitive and engaging.

Strong regulatory framework with FCA oversight and top-tier security measures.

Supports fractional shares and offers practice accounts to help new users develop trading skills safely.

Cons

Limited customer support options, lacking phone service.

The offering of complex products like CFDs may be daunting for novices.

Advisory services are more limited compared to full-service brokers.

Fees

Trading 212 offers a highly competitive fee structure:

Commission-Free:

No trading commissions across shares, ETFs, and cryptocurrencies.

Other Costs:

Minimal costs come from bid-ask spreads, primarily on currency conversions and asset CFDs, providing transparency and maintaining low overall trading costs.

Trading 212 is especially suited for individuals who value ease of use, technological innovation, and a supportive learning environment in their trading platform.

Go to Trading 21211. eToro- Best for Social Investing

Platform Name | Fees | ISA Accounts | Minimum Deposit | Best For | Rating |

eToro | Zero commission on stocks/ETFs; small spread on other assets; $5/month inactivity fee; $5 withdrawal fee | Stocks & Shares ISA | $10 | Social trading, diverse asset range, and beginners | 8/10 |

Why We Picked It

eToro initially stood out to me due to its pioneering role in social trading, which continues to set it apart in the investment world. The platform offers the unique feature of copy trading, allowing investors to mirror the strategies of successful traders—ideal for both beginners and experienced market players, although caution is advised due to its inherent risks. Unfortunately, eToro does not offer ISA accounts, which might be a drawback for UK investors seeking tax-efficient options. Importantly, eToro is regulated by top-tier authorities such as the UK's Financial Conduct Authority, ensuring a high standard of investor protection. The security measures include segregated client funds and encrypted technology, providing a safe environment for trading a wide array of assets.

Pros

Innovative social investment network and copy trading functionality

Zero commission on stock and ETF trades

Diverse asset offerings, including cryptocurrencies

Robust regulation and strong security measures

Educational resources and intuitive platform for all user levels

Cons

Absence of ISA account options

Fees for withdrawals and inactivity could accumulate

Variable performance with copy trading, not guaranteed

Fees

eToro's fee structure includes:

Zero Commission:

No commission fees on stock and ETF trades.

Spreads:

Charges a spread on trades for assets like cryptocurrencies and CFDs.

Withdrawal Fees:

A fixed charge of $5 per withdrawal.

Inactivity Fees:

A $5 monthly fee applies after a period of inactivity, encouraging regular trading activity.

These fees are competitive, particularly for active traders who will benefit from the zero-commission model on stocks and ETFs, though the additional fees for inactivity and withdrawals necessitate prudent account management.

Go to eToro

Additional Noteworthy Platforms

While the platforms reviewed thus far make up some of the largest and most widely used options, the market continues expanding with competitive upstarts looking to carve out value propositions around unique offerings, next-gen experiences and differentiated pricing models.

Below we explore two such examples in Capital.com and Fidelity, that have made notable waves with UK investors through their transparent zero commission trades and multifaceted support across small and large portfolios respectively.

Capital.com

As one of the fastest growing investment platforms in Europe, Capital.com has captured attention for enabling commission-free trading on over 6,000 global markets. From popular stocks, commodities and indices to niche currency pairs and crypto, Capital.com opens affordable access to an extensive range of assets.

Useful tools like custom screeners, risk management suites and AI-based analytical insights further empower informed traders of all skill levels to discover and react to opportunities. Hands-on educational features like video tutorials, webinars and demo accounts also support continuous skill development in navigating different markets.

While the platform appeals to active traders appreciative of diverse markets and functionality, Capital.com equally services long-term investors through auto-investing in stocks, ETFs and CFDs based on customized criteria and risk metrics. This dual service offering provides growth pathways for portfolios of any size.

As a regulated broker authorized by top-tier European agencies, Capital.com maintains stringent policies surrounding investor protections like segregated accounts, investor compensation schemes and data privacy that one would expect from an established global platform.

What is an ISA

An ISA is essentially a savings or investment account that shields your money from taxes. No income tax is paid on interest, dividends, or capital gains in an ISA. What has made ISAs so appealing for saving and investing is that under the tax benefits of an ISA, your money can grow at a faster clip than it might within a taxable account.

One whose life and interest lie so deeply in the optimization of personal finance, I have come to appreciate ISAs. In fact, I now deeply appreciate ISAs for what they are: tax-efficient vehicles available to UK residents. Understanding the kind of ISAs that ISAsOnline offers and how you can use them to best serve the health of your financials is such a big point.

Exploring Stocks and Shares ISAs

Against the ISA cash, Lifetime ISA, and the Innovative Finance ISA, the Stocks and Shares ISA is ideal for someone looking at the prospect of increasing returns. This type of ISA allows you to invest in a wide array of financial products, including stocks, bonds, funds, and more. The main benefit that a Stocks and Shares ISA reaps over an ordinary Cash ISA is, in reality, scope for superior returns but with increased risk. However, the tax savings could be substantial, hence really another matter for long-term investors.

Opening an ISA Account

Open one easily: Most major banks and building societies in the UK offer ISAs. Typically, it involves filling out an application form and producing some personal identification documents. Most of them have the provision for online availability, making it fast and easy.

Researching ISA Providers: Key Considerations

When deciding where to open your ISA, it’s crucial to consider several factors:

Fees and Charges:

Fee structure varies from one provider to another. Some may charge you a flat annual fee, while others have a percentage cut from your assets. In addition, investment transactions bought or sold within your ISA will also be subject to transaction fees. Get to know the charges—it's one of the pieces of the puzzle with regard to your overall returns.

Investment choice:

the number of choices given is a big factor, especially for a Stocks and Shares ISA. Some providers give a pretty big amount, while others are more selected. Make sure that what is offered to you fits within criteria of investment strategy and risk tolerance.

Convenient:

Interface usability is another crucial factor. The friendly one may come to be the very solution for ease in ISA management, and it will not require spending much time. Today, most providers offer their clients mobile applications to view and manage their investments on the go.

Customer Support:

Nothing could be more important than this, especially for a first-time investment. Seek assistance from good and quick-response providers.

Reputation and Security:

check if the provider is regulated by the Financial Conduct Authority (FCA) and part of the Financial Services Compensation Scheme (FSCS). Always remember that it is likely that the coverage may be only up to a given ceiling if the platform fails.

Why Should You Care About ISAs?

Investing through an ISA offers significant tax advantages that can enhance the growth of your investments over time. Whether you are a sophisticated investor or just a beginner, you will find an ISA a very useful tool in your overall financial planning kit. They not only inculcate the habit of saving and investment but also make sure that your investments remain efficient since they are tax-efficient in nature. In my experience, taking the time to research and choose the right ISA provider definitely paid off, actually making a world of difference for me in growing the investment and my financial well-being. This is a step that I would highly recommend for anybody who is truly seriously about setting up a financial future in the UK.

3 Best Investment Platforms for Beginners

Below we explore three highly recommended options for UK beginners based on core strengths around educational resources, intuitive tools and affordable account minimums.

1. Wealthyhood - For Beginners Who Want to Learn

Wealthyhood is by far the best investment platform for beginners on this list largely thanks to its approach that simplifies the investing process. It makes entering the world of investing straightforward, especially for first-time investors, by offering tools designed for easy portfolio construction.

With options like fractional share investing starting from just £1, it enables even those on limited budgets to build a diversified portfolio. Additionally, Wealthyhood places a, offering courses and tools that help beginners understand and manage investments effectively. The platform's user-friendly design, combined with its focus on minimal fees and strong regulatory compliance, ensures a secure and cost-effective environment for novice investors. This approach of blending accessibility, education, and affordability makes Wealthyhood particularly appealing to those starting their investment journey.

2. Nutmeg - For Beginners Who Like Passive Investing

Nutmeg stands out as one of the best investing platforms for beginners due to its straightforward and user-friendly approach to investment management.

The platform offers a variety of managed portfolios, including socially responsible options, which are ideal for those who prefer a hands-off approach to investing. Its intuitive interface simplifies the investment process, making it accessible even to those with little to no financial background.

Furthermore, Nutmeg's educational resources provide valuable insights, helping beginners understand the basics of investing and make informed decisions. Combined with its competitive fee structure and robust regulatory compliance, Nutmeg presents a well-rounded, beginner-friendly option for entering the world of investing.

3. Freetrade - For Those Seeking Guidance

As a modern "neo-broker" focused on accessibility and affordability, Freetrade has appealed to new investors since launching in 2018 through its free share incentive scheme. Account minimums start at £3 for a limited General Investment Account (GIA) or £9 for an ISA enabling tax-efficiency.

Curated stock collections, bitesize FAQs and fractional investing into over 6,000 US stocks also simplify getting started. Dynamic charts and prices empower users to explore assets, while tracking dividends and performance history build know-how over time.

While functionality remains narrower than full-scale brokers, Freetrade delivers a transparent, low-friction foundation for investing rookies to progressively develop skills and returns under a trusted brand.

The platforms profiled above make starting investing more welcoming through unique combinations of education, guidance and incentives aimed at first-timers. Trying out multiple using available practice accounts allows determining the best initial fit aligned to your capital and motivations.

Beginners should also look into micro-investing applications that help you invest by rounding up your payments or gathering spare change.

3 Best Investment Platforms with an App

I’ve already written an in-depth comparison review on the best investment apps in the UK but I will list the 3 best here in case you are in a hurry.

1. Moneybox

Moneybox is an innovative investment app designed for both experienced and beginner investors. It offers a range of portfolios including stocks, ETFs, and cash savings, and is known for its user-friendly interface and "round-up" feature, which allows users to invest spare change from purchases.

Regulated by the FCA, Moneybox ensures user funds' safety and uses bank-level security for data protection. It charges a £1 monthly subscription fee and a tiered annual platform fee, based on the investment amount. While it offers a convenient way to build an investment portfolio, it has a limited range of investment options and a subscription fee.

2. Trading 212

Trading 212 is not only a comprehensive trading and investing app offering a wide range of assets like stocks, ETFs, forex, and cryptocurrencies but it also has a great investing app. It's known for its intuitive interface, real-time market data, analysis tools, and extensive educational content.

Since it’s regulated by the UK's FCA, it provides a secure trading environment it’s also safe.

The app's standout feature is commission-free trading for stocks and ETFs, making it cost-effective, although it applies a small markup on forex and cryptocurrency trades. Its simplicity and user-friendly design cater to both novice and experienced investors, although its focus on trading might be overwhelming for new investors or those interested in long-term investments.

3. Wealthyhood

Wealthyhood's investing app stands out due to its unique combination of user-friendliness and innovative features. Tailored for both novice and seasoned investors, it offers fractional share investing, allowing users to start with small amounts and gradually build a diverse portfolio. The app is designed with an intuitive interface, making it easy for beginners to navigate the world of investing. Furthermore, Wealthyhood offers educational resources and tools such as auto-rebalancing and dividend reinvestment, enhancing the investment experience. Its focus on low fees and a customizable investment approach makes it a great choice for those seeking a smart and accessible way to manage their investments.

Best Investing Platforms for ETFs

For investors interested only in ETFs I've created a dedicated list of the best ETF brokers in the UK. These were selected based on the available ETFs range, platforms' costs, features, platform UX and customer support.

1. InvestEngine

In my full ETFs platforms review InvestEngine impressed me with its expansive selection of over 600 ETFs, covering a wide range of sectors and geographies.

This platform is particularly appealing for investors aiming to diversify their portfolios across various markets. Its user-friendly interface and robust tools make it an excellent choice for both beginners and seasoned investors seeking to navigate the complexities of ETF investing with ease.

2. Wealthyhood

Wealthyhood is known for its smart investing approach, offering a DIY investment platform that combines the flexibility of investing on your own with the guidance typically associated with robo-advisors.

Wealthyhood's focus on low-cost investing and user education makes it a compelling choice for investors who prefer a hands-on approach to building their portfolios.

3. Interactive Investor

Interactive Investor stands out for its flat-fee subscription model, which can be particularly cost-effective for investors with larger portfolios.

The platform offers a comprehensive array of ETFs alongside extensive research tools and resources, making it suitable for investors who value a depth of information and a broad selection of investment options.

4. Interactive Brokers

Interactive Brokers is renowned for its global reach and depth of market access, providing investors with the ability to trade ETFs across international markets.

With competitive pricing and a powerful trading platform, Interactive Brokers is ideal for experienced investors looking for advanced trading capabilities and extensive market analysis tools.

5. Lightyear

Lightyear merges the appeal of commission-free trading with a focus on international investments, allowing UK investors to access a global selection of ETFs without worrying about high fees.

Its user-friendly platform and the absence of foreign exchange fees on trades make it an attractive option for those looking to invest abroad without incurring excessive costs.

6. Freetrade

Freetrade offers a straightforward, user-friendly platform that champions commission-free trades, making it an excellent entry point for novice investors.

While it may not boast the extensive market analysis tools of more advanced platforms, its simplicity and focus on cost-effective ETF investing are perfect for those just starting or looking to invest with minimal fuss.

7. Saxo Bank

Saxo Bank provides access to an impressive range of over 7,000 ETFs, catering to investors seeking a comprehensive selection of investment opportunities.

Though its platform may present a steep learning curve, the depth of available ETFs, competitive pricing, and advanced trading tools make Saxo Bank a top choice for serious investors committed to diversifying their portfolios.

How Should a Beginner Invest?

Getting started in investing can seem daunting, but sticking to core principles around financial planning, education and regularly contributing to the market provides emerging investors the best chances for sustainable wealth building.

As a beginner, the key starting point sits with clearly defining your investment goals and time horizon for needing the money. This determination then guides suitable asset types and portfolio risk levels. Those with longer runway focusing on retirement or property can sustain more equities exposure by investing in stocks given the decades ahead for riding market swings. In contrast, investors needing funds more immediately may allocate more to stable, income-producing bonds.

It also pays tremendously to self-educate on foundational topics like asset classes, risk metrics, compounding and financial concepts determining returns. Even grasping basics around stocks, ETFs and common terminology goes a long way over misperceptions. Useful resources like online courses, books, podcasts and demo trading platforms enable learning the ropes while developing your own risk tolerance and strategy.

Once comfortable with the fundamentals, many beginners thoughtfully start participating in the market through low-cost, diversified index funds or ETFs. These vehicles provide broad exposure to asset classes like US stocks or global property rather than betting on individual picks. Small regular investments also harness the power of compounding over years by reinvesting market returns back into the principal amount. Platforms with fractional shares further democratize this approach.

The platforms you use in your investing journey also require due diligence as your gateway to financial markets. Parameters like fees, available assets, account minimums, tools and educational resources vary tremendously. Prioritizing needs around target markets, involvement preferences and costs leads to prudent choices. Don't be afraid to try multiple platforms using demo accounts in the process.

While self-directed investing may suit some newcomers, also remain open to seeking supplemental guidance from financial advisors equipped to evaluate your full situation and objectives. Their insights can pay dividends in your financial literacy and portfolio construction. In total, immersing yourself across knowledge, participation and access remains fundamental for investing rookies. There will always be volatile periods testing resolve along the path. But maintaining perspective by focusing on long-run personal growth empowers breaking through early barriers over time.

Types of Investment Platforms and Their Features

There are several types of investment platforms available in the UK, each catering to different investor needs:

Investment Apps are essentially investment platforms that are available on mobile through mobile IOS or Android apps. They are usually simpler to use and make investing an easy task which makes them perfect for beginners.

Robo-advisors use algorithms and automated processes to build and manage investment portfolios based on an investor's goals. They offer affordable access to professional management with minimal effort. Nutmeg and Wealthify are two popular robo-advisor options. Similarly to Robo Advisors, automatic investing apps can also help you invest in autopilot.

Online brokerages focus on efficient self-directed trading and research tools. Hargreaves Lansdown and AJ Bell YouInvest exemplify full-service brokerages, offering everything from shares and funds to ISAs and retirement accounts. Discount platforms like Freetrade and Trading 212 offer low fees but less research and advice.

Investment supermarkets aggregate investment products from different providers on one platform. Bestinvest and Interactive Investor allow users to select from a wide range of assets and managers to customise their portfolio.

Peer-to-peer lending platforms like Funding Circle connect investors directly with small businesses and individuals needing loans. Investors earn interest while providing access to capital.

Each type of platform differs in services, asset choices, account minimums and fees. Considering factors like your investment objectives, desired involvement and account size can help determine the right option. Those wanting hands-off management may lean toward robo-advisors, while active traders need sophisticated brokerage capabilities.

Understanding Investment Platforms

Before closing this article and to avoid any confusion I'd like to make a distinction between Investment apps and Investment platforms.

Investment Apps as we discussed in our previous article are primarily mobile-based applications designed for investing on the go while Investment Platforms, are more comprehensive and are often accessible via web browsers.

Over the years I’ve found myself using online investment platforms more and more and they have become my go-to investing tools when it comes to managing my portfolios to gain access to a wide variety of assets. At their core, investment platforms serve as a gateway, allowing users to conveniently invest in stocks, funds, ETFs, bonds and other securities through a single access point.

F.A.Q.s

How Much Money do You need to Start Investing?

One of the most common questions from new investors centers around determining just how much money enables participating in financial markets. Great news abounds in this regard - platform innovation continues lowering capital requirements making investing more accessible at nearly any starting level.

Fractional share investing platforms now enable buying slices of popular stocks and ETFs for just £1-5 per trade. This means developing a diversified portfolio becomes achievable even on limited budgets by allocating in small chunks. Although some underlying assets carry minimums themselves, sticking to higher volume ones often provides enough runways for exploration.

For those able to allocate more upfront, most traditional brokers drop minimums to between £50-£100 needed to open basic investment accounts. This provides wider access to assets beyond fractional shares, like mutual funds or bonds requiring at least one whole unit purchase. The key advantage is then allowing adequate diversification to mitigate risk rather than concentrating capital in just a couple picks. In reality no definitive rule governs how much money makes sense to start investing. The amount depends significantly on your financial situation, income variability and obligations. Budgeting investing contributions should follow ensuring other critical needs get addressed first.

The biggest pitfall involves allocating so much that it compromises your emergency savings or ability to pay recurring bills. Finding balance through what you can afford to invest over the long-run matters most. Small sums contributed regularly also harness compounding to build account balances gradually.

Best Investment Platform for Trading

For self-directed investors focused specifically on active trading across global markets rather than passive index approaches, Technology, automation and affordability rise as pivotal platform differentiators. This leads me to recommend checking out Trading 212 for seamless market access and dynamic tools enabling informed participation.

The UK-based broker founded in 2011 surfaces deep price transparency and trade execution of thousands of instruments including equities, crypto and commodities. Highly precise charting, financial indicators, risk management suites and news analytics support both long term positions and intraday opportunity capturing for sophisticated traders.

Useful supports like virtual portfolios, investor community forums and demo accounts also guide newcomers in safely building market exposure through practice. Intuitive mobile apps synchronize Trader 212's offerings right to devices for nimble traders needing on-the-go flexibility. Most distinctively, Trading 212 pioneers commission-free trading across mainstream asset classes - a potential game changer lowering barriers for self-directed trading historically weighed down by transaction fees eroding returns. This cost efficiency paired with robust functionality places them as a top choice for investing motivated by active participation.

Best Investment Platform for ISA

For investors seeking to shelter returns from taxes while building long-term wealth, ISAs like the Stocks and Shares ISA provide formidable benefits through both capital gains and dividend exemptions after meeting annual contribution eligibility. This makes identifying platforms not only offering ISAs but efficiently catering to seamless management key.

On this front, I would recommend Invest Engine as a leader in constructed technology, educational resources and intuitive design specifically tailored to ISA investors whether taking traditional self-directed or hands-off ETF portfolio approaches.

The firm's generous ISA account offerings include access to over 580 top ETFs spanning market exposures at ultra competitive costs. With no platform fees and average fund charges of just 0.15%, more investment dollars go directly to compounding returns. Fractional shares also enable precise asset tuning and diversification.

For those less comfortable selecting assets themselves, Invest Engine's managed portfolios provide optimized, diversified ETF selections fully overseen by the investment team for just 0.25% yearly. This blend of affordability, customization and guided options make Invest Engine a formidable ISA wrapper choice for both casual and sophisticated investors.

Conclusion

In conclusion, the UK's investment landscape in 2024 offers a diverse range of platforms catering to different investor needs. From the beginner-friendly interfaces of Nutmeg and Wealthyhood to the comprehensive trading options of Trading 212 and the innovative approach of Moneybox, each platform brings unique strengths. Whether you're a novice looking for educational resources and easy-to-use tools or a seasoned investor seeking advanced trading capabilities and a wide range of assets, there's a platform that fits your requirements. The key is to choose a platform that aligns with your investment goals, experience level, and preferred fee structure, ensuring a tailored and efficient investment journey.

As I always state in my articles, investing is my passion and I love connecting with folks who share the same passion with me. If you have any questions about the article or would like to discuss investing and macroeconomy with me, don’t hesitate to reach me on Linkedin or send me an email at george@wealthyhood.com

Capital at risk. This article is for information purposes only and is not investment advice nor a recommendation. You should consider your own personal circumstances when making investment decisions. Past performance is not a reliable indicator of future performance. Tax treatment depends on your personal circumstances and rules can change.