Investing can be complicated, time-consuming, and expensive.

Quality automatic investing apps simplify everything, efficiently growing your wealth in the background for remarkably low fees.

I've created this guide to spotlight the top set-it-and-forget-it platforms in the UK, detailing the specialized strengths setting each apart.

Learn which solution best suits your investing experience level, financial objectives, and hands-on involvement preference to start progressing toward your goals on autopilot.

Key Takeaways:

Wealthyhood is the best automatic investing apps for beginners.

Wealthfront is the best automatic investment app overall.

Chip is the best automatic savings app

Pick Plum if you are looking to automate your investing by using the round up method.

Betterment allows constructing multiple portfolios each targeting unique objectives, timelines and risk appetites for life’s changing priorities.

Overview of Top Automatic Investing Apps in the UK (2024)

App Name | Best For | Key Features | Fee Structure | Additional Notes |

Overall Best Automatic Investing | Customizable portfolios, Dynamic educational components, User-friendly design | 0.18% annual custody fee | Ideal balance between autonomy and automation, Offers fractional share trading | |

Wealthfront | Beginners | User-friendly interface, Customised investment options, Extensive educational materials | 0.25% Annual advisory fee | Offers high-yield cash accounts and automated municipal bonds for tax advantages |

Chip | Automatic Saving | Auto save, save streaks, Interest on Savings | Not Transparent | Limited investment options compared to other platforms |

Plum | Rounding Up | Budgeting, Bill analysis | £2.99/month for the pro or £4.99/month for the Ultra | Limited research tools |

SoFi Automated Investing | Low Fees | No advisory fees, Free access to financial planners | 0% management fee, Modest quarterly account services fee | Reimburses ATM withdrawal fees, Offers tax-advantaged retirement offerings |

Freetrade | Portfolio Diversity | Wide range of investment choices, Fractional share trading | £3 monthly for Freetrade Plus membership | Offers access to international stocks and bespoke ETFs, Community-centric platform |

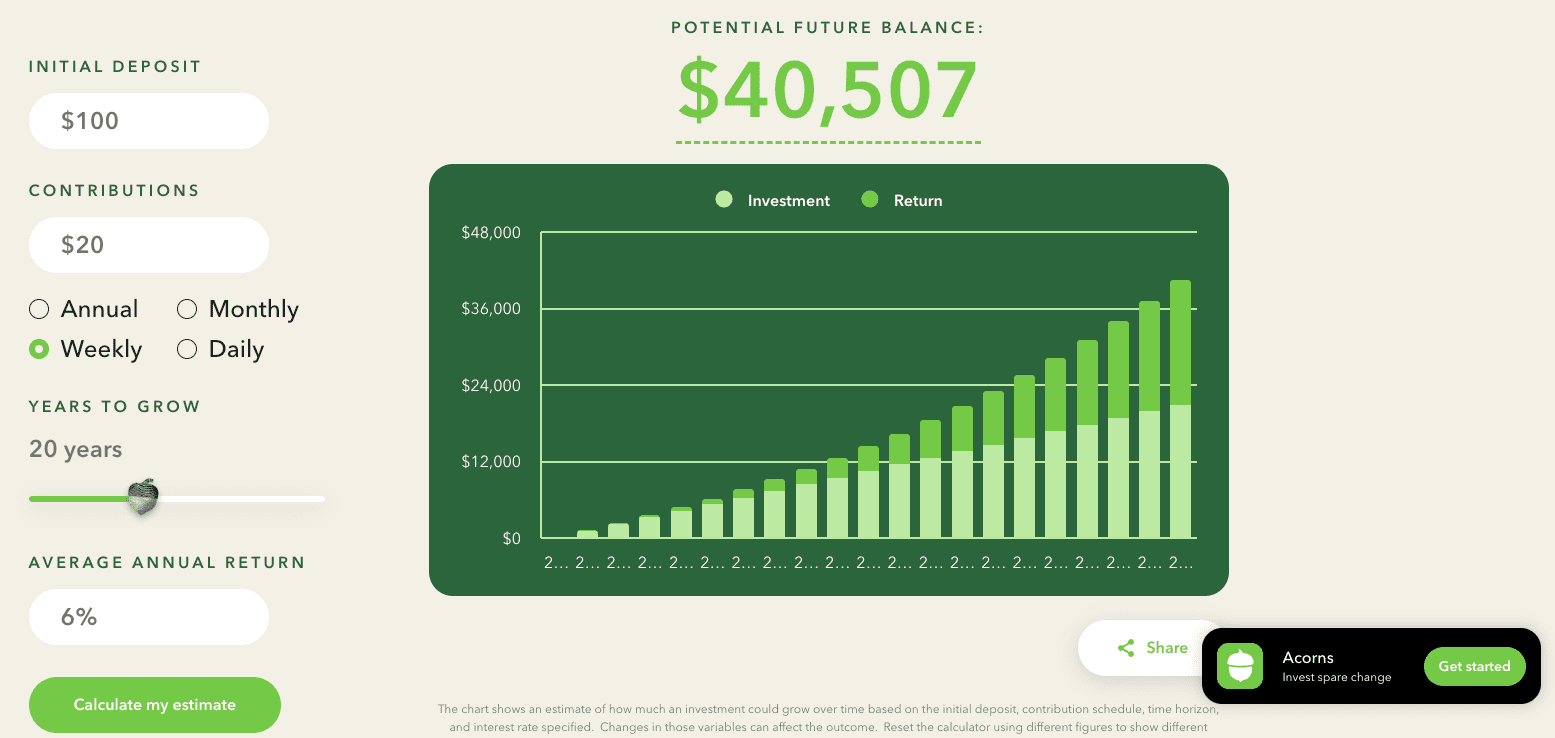

Acorns | Automated Micro-Investing | Round-Ups feature, Diverse portfolio options | 3$/month | Turns transactional change into investments, Offers a debit card for everyday spending |

Betterment | Goal-Based Investing | Customizable investment goals, Tax strategies and portfolio management | No commisions | Access to human financial advisors, Ideal for multi-goal customization |

Vanguard Digital Advisor | Long-Term Investment Strategies | Personalised retirement planning, Broadly diversified ETF portfolios | 0.20% Advisory fee per year | Focus on passive strategies, Retirement planning support, Low expense ratio |

Moneybox | Savings and Investment Integration | Automated Round-Ups, Range of investment and savings products | 0.45% per month | Integrates transactions, savings, and investments, User-friendly mobile app |

What is Automatic Investing?

Automatic investing utilizes advanced algorithms and artificial intelligence to remove the complexity and time requirements typically associated with investing. These apps provide a simple and convenient way for individuals to grow their wealth by automatically managing diversified investment portfolios on their behalf. In fact many of them are robo-advisor apps!

Rather than having to manually select investments, rebalance portfolios, and decide when to buy and sell, automatic investing apps handle everything behind the scenes.

After completing a brief questionnaire about their financial situation and goals, users simply set up automatic transfers from their bank account into their investment account on a schedule that works for them.

As the portfolio grows over time, the algorithm will automatically rebalance as needed to make sure the asset allocation stays in line with the original targets. This helps remove emotion from investing decisions and enables compound growth. The app also handles tax considerations along the way, utilising strategies like tax-loss harvesting to maximise after-tax returns.

Automate your InvestingBest Automatic Investing Apps Right Now

1. Wealthyhood - Best Auto-Investing App for Beginners

Wealthyhood, is one of the best investing apps that simplifies investing for beginners and emphasizes long-term wealth building. It's designed to remove the complexity of investing, offering tools and guidance for users at every step. The content highlights Wealthyhood's unique approach to investing, focusing on its user-friendly interface, personalised portfolio options, and commitment to low fees.

Description

When it comes to investing, Wealthyhood is the perfect investing platform to help me get started. The interface is clean and intuitive, with educational resources that explain core concepts in simple terms. When building your portfolio, Wealthyhood offers recommendations based on your risk appetite and investment timeline and you can explore over one million premade portfolio templates for inspiration.

Wealthyhood is also focused on long-term wealth creation. There are tools to help automate good investing habits, like auto-investing spare change and setting up monthly deposits. Over time, these small actions compound which is how automatic investing can be beneficial for an everyday investor.

Automatic Investing Features

Key features that automate investing on Wealthyhood:

Custom Portfolios - Select from expert templates or easily build your own diversified portfolio. Automatically maintain your target asset allocation.

Fractional Shares - Invest in slices of stocks/ETFs starting from just £1 so you can fully diversify.

Auto-Invest - Schedule recurring deposits and set rules to regularly invest spare cash.

Rebalancing - Wealthyhood dynamically rebalances your portfolio to match targets.

Projections - See forecasted returns over custom timeframes based on your investments.

Together, these create true set-and-forget simplicity.

Pros

As an investing platform designed for beginners, Wealthyhood has compelling advantages:

Extremely user-friendly interface and educational resources

Personalised portfolios tailored to your goals

Effective long-term wealth building tools and guidance

Fractional share investing unlocks full diversification

Low fee structure makes cost-effective investing achievable

Wealthyhood demystifies investing so anyone can start building wealth through smart automation.

Cons

Potential drawbacks to note:

Relatively new with not so many reviews compared to the competition.

No access to exotic assets or sophisticated trading strategies.

The platform purposefully simplifies investing for beginners, which could frustrate more advanced investors. But for beginners, Wealthyhood provides an ideal mix of easy access and effective wealth building.

Fees/Pricing

Wealthyhood offers three pricing plans:

Basic - Free

Plus - £2.99/month

Gold - £12.99/month

All plans provide fractional shares, automation, 1+ million portfolio templates, guides, free deposits/withdrawals, and commission-free investing.

The Basic plan includes a 1% bonus dividend and 0.25% cashback, while the Gold plan offers a 4% bonus dividend and 0.40% cashback

Additional fees in the free plan:

0.35% currency conversion

0.45% per order

0.18% annual custody fee

With tailored plans for every budget, Wealthyhood ensures investing stays affordable.

Reviews

With 5/5 stars on App store, Wealthyhood users highlight the investing simplicity, quality portfolios, and wealth building tools as major benefits. Many reviewers are investing beginners who found the platform unintimidating and effective.

Constructive feedback notes the lack of exotic assets, manual trading, and restrictions for sophisticated investors - all sacrifices made to focus squarely on long-term, passive wealth creation.

For hands-off investors prioritizing simplicity, Wealthyhood delivers. It excels in guiding beginners on their wealth creation journey.

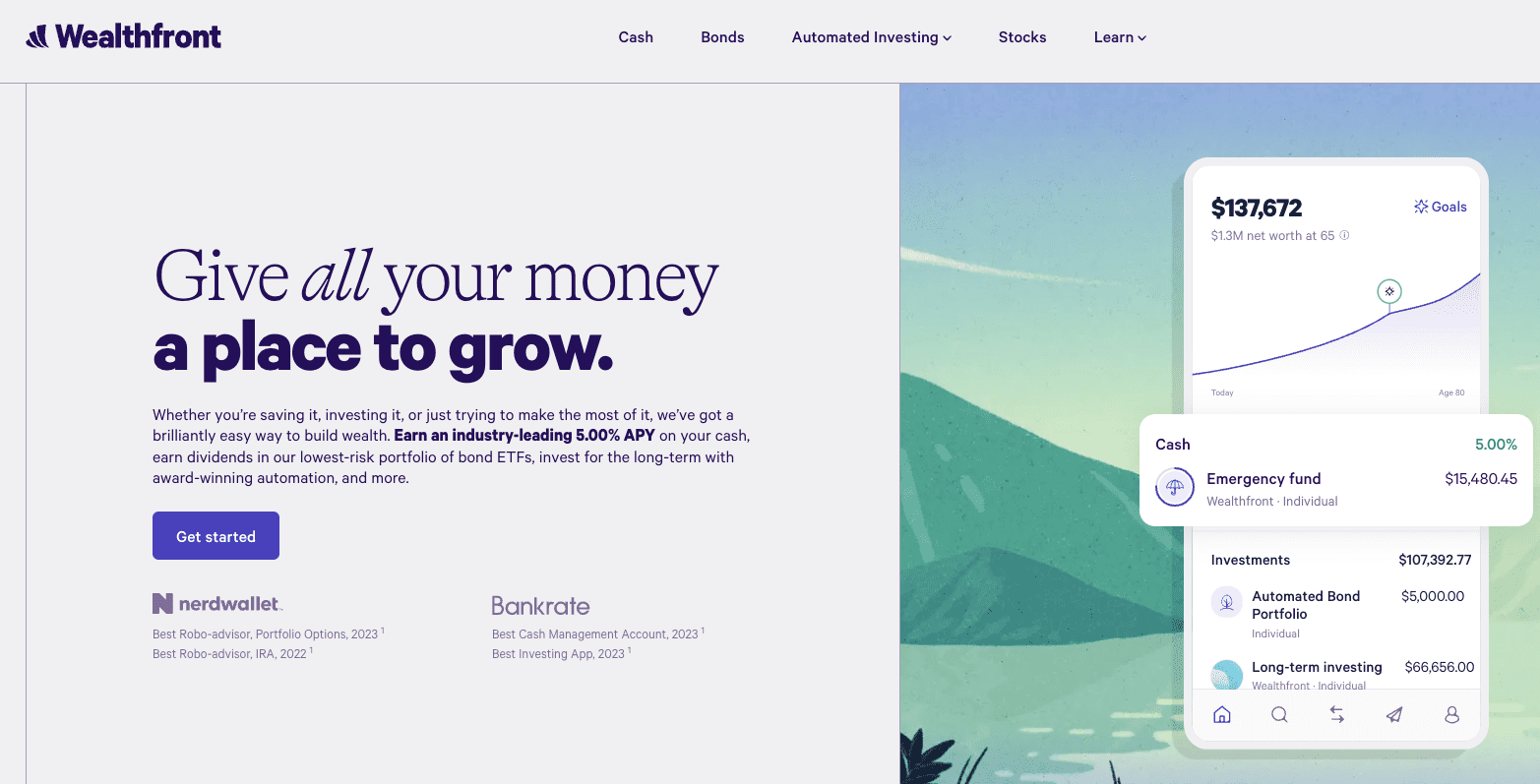

Try Wealthyhood2. Wealthfront - Best Overall

Wealthfront is at the top of my list of automatic investing apps, as it offers a range of automated investment services.

It's known for its high-yield cash account with a 5.00% APY, a diversified bond portfolio, and long-term index investing. Wealthfront has been recognised for its excellence in various categories, including best robo-adviser and best cash management account.

Description

As someone who wants to grow my money but doesn't have the time or expertise to actively manage investments, I found Wealthfront to be a great solution. Setting up an account was quick and easy – I just linked my bank account, got recommended a portfolio based on my risk tolerance, and Wealthfront took care of the rest. The intuitive dashboard gives me a clear picture of my investments and performance at any time.

I particularly appreciate Wealthfront's set-it-and-forget-it approach. Features like automatic rebalancing, dividend reinvesting, and tax-loss harvesting take the hassle out of investing and help me maximise returns. Over time, I've seen my money grow steadily with little effort on my part. The platform even optimises my portfolio as I get closer to retirement. Hands down, Wealthfront takes the stress out of investing.

Automatic Investing Features

Wealthfront offers several key features to automate investing:

High-Yield Cash Account – This functions like a savings account, offering an industry-leading 5.00% APY with no account fees or minimum balances. It's a great place to park cash and earn significantly more interest than traditional options.

Diversified Bond Portfolio – Wealthfront builds you a personalised bond portfolio featuring high-quality, low-fee municipal, government, and corporate bonds. The algorithm optimises for diversification and tax efficiency. There's also flexibility as there are no lock-up periods or maturity dates.

Long-Term Index Investing – This is Wealthfront's core share investing strategy, which automatically invests your money into a globally diversified portfolio with up to 17 asset classes. Everything is managed on autopilot – dividend reinvesting, periodic rebalancing, and tax-loss harvesting to maximise returns.

Pros

Wealthfront has several advantages as an automatic investing platform:

Excellent interest rates on cash accounts (5.00% APY)

Personalised, diversified portfolios spanning shares and bonds

Award-winning automated services like rebalancing and tax-loss harvesting

Easy to use interface and user experience

Recognised as a top robo-adviser service

The automation makes growing wealth completely hassle-free. Wealthfront handles everything from portfolio creation to ongoing optimisation so you can sit back and watch your money compound.

Cons

Potential limitations to consider:

Hands-on investors may find the platform too restrictive if they want to pick individual shares or actively tweak asset allocations.

No access to direct trading, crypto, or other complex assets – just shares, bonds, and cash.

Monthly account fees apply below £100,000 in invested assets.

For most passive, long-term investors, however, Wealthfront delivers an affordable and effective automated solution.

Fees/Pricing

Wealthfront charges an annual advisory fee based on a percentage of assets under management. The fee typically ranges from 0.25% - 0.40% based on account size and services used.

In addition to the advisory fee, investments are also subject to underlying fund expense ratios averaging 0.07%. Transaction fees and account maintenance fees do not apply.

Compared to traditional investment advisers who charge 1%+ on assets, Wealthfront offers exceptional value as a robo-adviser service. The account minimum is just £500.

Reviews

With thousands of reviews averaging 4.9/5 stars, Wealthfront has stellar feedback across online app stores and consumer sites.

Users highlight the ease of use, quality portfolios, hands-off approach, and high interest cash accounts as major pros. Constructive feedback tends to focus on limitations for active trading or share picking capabilities.

Based on user sentiment, Wealthfront delivers a top-tier automatic investing solution.

Go to Wealthfront3. Chip - Best Automatic App for Saving

Chip is a revolutionary fintech platform renowned for its automated savings and investment services. This automatic investment tool stands out for its ability to adapt to users' financial habits, offering a seamless approach to saving and investing.

Description

As someone always looking to optimize my savings, I was intrigued by Chip's unique approach. The app's AI-driven algorithms analyze my spending patterns, setting aside small amounts frequently, which surprisingly adds up over time. With Chip, I've managed to save funds effortlessly without feeling the pinch on my daily expenses.

Chip goes beyond just savings; its investment options are a standout feature. From low-risk funds to more adventurous options, it caters to a range of risk appetites. I appreciate the simplicity of starting with small investments, making it less daunting for newcomers to the investing world.

Automatic Saving Features

Chip's standout features that automate saving include:

Auto-Save - Using AI to analyze spending and automatically save an affordable amount.

Save Streaks - Motivates consistent saving by tracking and rewarding regular deposits.

Interest on Savings - Offers competitive interest rates, enhancing the value of saved funds.

While Chip excels in automated savings, it also offers straightforward investment options for those looking to grow their savings further.

Pros

Notable advantages of using Chip include:

AI-driven savings adjust to personal spending habits.

Wide range of investment options suitable for different risk profiles.

User-friendly interface, ideal for beginners in saving and investing.

Competitive interest rates on savings.

No minimum savings requirement, making it accessible to everyone.

By integrating AI with financial management, Chip revolutionizes the way we approach savings and investments.

Cons

Some limitations to consider:

Limited investment options compared to dedicated trading platforms.

Dependence on AI might not suit those who prefer manual control over savings.

Primarily UK-focused, with limited options for international users.

Chip's focus on automated savings might not fulfill the needs of users looking for extensive investment portfolios.

Fees/Pricing

Chip offers different plans with varying features:

Free - No Transparent fee strucure

ChipX - A subscription-based plan offering advanced features and higher returns.

Chip aims to provide a cost-effective solution for automated savings and investments, with transparent fee structures.

Reviews

Chip has garnered positive feedback, currently holding a high rating across various review platforms. Users often highlight its ease of use, effective saving mechanisms, and accessible investment options.

However, some users point out the need for a wider range of investment choices and more control over saving settings, suggesting areas for potential improvement.

For those seeking an effortless way to save and dip their toes into investing, Chip offers an innovative and user-friendly platform.

Go to Chip4.Plum - Best for Automated Rounding Up

Plum has made significant strides in the realm of automated savings and investment services. Designed to simplify the financial management process, it caters mainly to investors who are looking for automatic investing. by offering a user-friendly interface and a host of features aimed at enhancing the savings and investment experience.

Description

My personal journey with Plum has been transformative. The app’s ability to connect to my bank accounts and analyze my financial habits is a standout feature. Using AI technology, it suggests saving and investment levels tailored to my financial situation, resembling the traditional practice of saving spare change but in a much more sophisticated manner. I've been trying this app for a couple of months and I've already saved £80 without even thinking about it.

Automatic Investing Features

Plum’s offerings are diverse, making it an all-encompassing financial tool:

Automated Savings: The AI-driven tool calculates an optimum saving amount and automatically sets money aside.

Investments: Access to a wide range of investment options, including stocks and funds from prominent providers like BlackRock and Vanguard.

Budgeting: The app creates personalized budgets based on spending habits and provides insights for better financial management.

Bill Analysis: It identifies potential savings by comparing current bill expenses with available offers in the market.

Overdraft Protection: An innovative feature that prevents overdraft fees by automatically transferring funds when necessary.

Pros:

Ideal for both beginners and hands-off investors.

Low fees and a diverse range of account types, including ISAs and SIPPs.

Excellent customer reviews, emphasizing its ease of use and effective automatic saving features.

Cons:

Not suitable for short-term traders due to its long-term saving and investment focus.

Limited research tools for stock and fund analysis.

Absence of educational resources for financial learning.

Account Types and Membership Levels

Fees

Plum offers several account types, each tailored to different user needs:

Plum Basic (Free): Includes automatic savings, bill alerts, and unlimited withdrawals.

Plum Pro (£2.99/month): Adds features like multiple saving pockets and gamified saving rules.

Plum Ultra (£4.99/month): Offers additional benefits like higher interest rates on savings and a Plum debit card.

Plum Premium (£9.99/month): Provides the most comprehensive range of features, including repeat investments and enhanced cashback options.

Reviews

Plum has received overwhelmingly positive reviews from its users. It's praised for its user-friendly interface, effective automatic saving features, and the diverse range of financial tools it offers. Many users highlight the ease with which they can save money and manage their investments, even for those new to saving and investing. The AI-driven functionalities that analyze spending habits and tailor savings accordingly are frequently mentioned as standout features.

Go to Plum5. SoFi Automated Investing- Lowest Fees Automatic Investing Tool

While not specific to UK investors, SoFi Automated Investing, known for its no-fee structure, offers a compelling choice for both beginning and cost-conscious investors. It provides a selection of 10 portfolios using diversified low-cost ETFs, catering to various risk levels.

Description

I found SoFi Automated Investing to be an ideal starting point. The quick account setup and ultra-low $1 minimum investment removed all barriers to entry. SoFi then recommended portfolios matching my risk tolerance using low-cost, diversified ETFs – it took the guesswork out of investing.

Ongoing, I appreciate SoFi's no advisory fees alongside unlimited access to certified financial planners. Also, the support is exceptional. SoFi's team of experts provides knowledgeable guidance completely free of charge. For new investors, having this financial support system makes a big difference.

Between the quality portfolios, no-fee structure, and availability of financial planners, SoFi empowers even beginning investors to securely build wealth over time.

Automatic Investing Features

SoFi Automated Investing offers straightforward portfolio automation including:

10 Portfolio Options – Select conservative to aggressive allocations across stocks, bonds and cash based on your risk appetite. Underlying ETFs provide instant diversification.

Automated Rebalancing – SoFi rebalances back to target asset levels when drift exceeds 5% to maintain risk exposures.

Tax Management – Municipal bonds feature in taxable accounts to maximize after-tax returns.

Set and adjust deposits, then SoFi handles everything from portfolio creation to performance tracking.

Pros

Key advantages of SoFi Automated Investing include:

$1 minimum investment and account balance makes investing wildly accessible

No management fees, account fees, or commissions

Access to certified financial planners at no extra cost

Broad selection of low-cost, diversified ETF portfolios

Hands-off automation ideal for passive investors

With affordable access, quality portfolios and advisor support, SoFi removes all traditional investing barriers.

Cons

Potential limitations include:

No ability to select individual stocks/ETFs or customize

Limited to 10 conservative portfolio templates

Lacks more advanced services like tax-loss harvesting

The streamlined approach improves accessibility but constrains options for more involved investors. As an introductory platform, however, SoFi hits the mark.

Fees/Pricing

The automated investing service has no management fees, account fees, or trading commissions. SoFi does not charge for:

Account setup, maintenance, or closures

Deposits, withdrawals, or transfers

Rebalancing or dividend reinvestments

Access to certified financial planners

The only fee is an outbound transfer charge. For cost-conscious investors, this no-fee access sets SoFi apart.

Reviews

In reviews and customer feedback, SoFi earns strong marks as an automated investing platform.

Top pros frequently mentioned include easy sign-up, quality of portfolios built with name brand ETFs, and the invaluable free access to human financial planners. Even seasoned investors praise the value proposition.

The primary constructive feedback is for advanced traders seeking more control, customization options, and tools like tax-loss harvesting. But reviewers overwhelmingly feel SoFi hits the mark on core goals of simplicity, affordability and long-term automated investing for regular folks.

As one user put it:

"As a total newbie, the no account minimums and management fees brought me peace of mind. SoFi lets me dip my toes into investing with expert support along the way."

For hands-off beginner investors, SoFi Automated Investing represents an easy on-ramp towards building wealth over time.

Go to SoFi6. Freetrade - Award Winning App

Freetrade is an award-winning online trading app that offers commission-free investing in a wide range of stocks and ETFs. It's designed for simplicity, making it an ideal platform for both novice and experienced investors.

Description

As an investor focused on keeping fees low, I found Freetrade to be a gamechanger. The intuitive mobile app makes executing free trades effortless. I can invest in fractional shares of big name US stocks like Tesla or Amazon for less than a £1 – opening opportunities that seemed out of reach before.

Beyond cost savings from commission-free trading, I appreciate Freetrade's flexibility. I use it for everything from short-term speculation to tax advantaged long-term wealth building. Features like ISAs, interest on cash balances up to 3%, and diverse assets keep me engaged. Whether I'm an active trader or passive investor, Freetrade fits the bill.

Automatic Investing Features

Freetrade offers a few helpful features to automate investing:

Fractional Shares - Invest any amount in slices of stocks/ETFs. Diversify broadly with minimal capital.

Auto Invest - Schedule recurring buy orders at custom frequencies to steadily build positions over time.

Interest on Cash - Uninvested cash earns up to 3% interest depending on your plan.

While Freetrade focuses more on trading execution than portfolio automation, these features allow hands-off investing.

Pros

Key advantages of using Freetrade include:

Commission-free trading massively reduces costs

Huge selection of 6,100+ UK and international stocks/ETFs

Fractional shares unlock diversified investing for any budget

Tax-efficient accounts (ISA, SIPP) available

Intuitive mobile app ideal for easy trading

By removing barriers like high fees, account minimums and location restrictions, Freetrade makes investing remarkably accessible.

Cons

Potential drawbacks to note:

Light on pre-built portfolios or auto-rebalancing tools - more DIY customization needed

Limited to stocks, ETFs and funds - no bonds, crypto or exotic assets

Less research/analysis compared to full-service brokers

The streamlined experience improves simplicity but constrains options for investors seeking more advanced capabilities.

Fees/Pricing

Freetrade offers 3 pricing tiers:

Basic - Free

Standard - £5.99/month or £59.88/year

Plus - £11.99/month or £119.88/year

All plans enable commission-free trading of UK stocks. Higher tiers add more assets, automated order types, lower FX fees, interest on cash balances and tax-advantaged accounts.

Additional costs include:

0.45% custody fee (waived through April 2024)

FX fee of 0.39-0.99% based on plan

The fee structure aims to make investing affordable through zero trading commissions.

Reviews

With 4.7 stars across 30,000+ reviews, Freetrade users praise the investing app for its accessibility, flexibility, and cost savings. Top highlights include the easy-to-use interface, commission-free model, fractional share capabilities, and range of assets for all investment styles.

Constructive feedback focuses on the lack of research tools, pre-made portfolios, retirement planning functionality and other advanced capabilities found at full-scale brokers - areas clearly sacrificed to achieve simplicity and low costs.

For casual traders and long-term holders alike, Freetrade delivers an engaging, low-cost investing experience.

Go to Freetrade7. Acorns - Great APY on Savings

Acorns is renowned for its innovative approach to investing, particularly for beginners and those looking to integrate saving into their daily routine. It offers a range of services, including investment accounts, retirement accounts, and an option for investing for kids.

Description

I found Acorns incredibly welcoming as a beginner platform. Linking my bank account activated the magical Round-Ups feature – now my spare pennies get automatically invested into a diversified ETF portfolio. Between effortless contributions and steady growth over time, watching my wealth accumulate is remarkable.

I also appreciate how Acorns simplified opening additional accounts for retirement and my daughter’s future education. The ability to invest, save, and spend smartly all from one app helps me build financial security for every stage of life. Whether I’m investing daily spare change or building an emergency fund with the 5% APY savings account, the app makes making sound money decisions a piece of cake.

Automatic Investing Features

Acorns automated investing capabilities include:

Round-Ups – Spare change from transactions gets invested into your portfolio.

Recurring Investments – Schedule routine deposits on a weekly, bi-weekly or monthly basis.

Portfolio Investing – Select from conservatively allocated portfolios of low-cost ETFs managed by investment experts.

Banking – FDIC-insured checking and savings accounts with up to 5% APY.

By automating everything from spare change investments to portfolio creation, Acorns streamlines building wealth.

Pros

Key advantages of using Acorns include:

Innovative Round-Ups feature invests your digital change effortlessly

Educational content to build financial literacy

Retirement, kids, and standard investment accounts options

Managed portfolios selected from vetted, low-cost ETFs

Checking and savings accounts with attractive yields

Acorns makes investing approachable for newcomers while also providing quality offerings for long-term wealth building.

Cons

Potential drawbacks to note:

No ability to select individual assets or customize portfolios

Lacks advanced tax minimization strategies

Primarily designed for passive, hands-off investors

Investment choices limited compared to full-scale brokers

The streamlined experience improves simplicity but limits customization capabilities.

Fees/Pricing

Acorns offers three pricing tiers:

Personal - $3/month

Personal Plus - $5/month

Premium - $9/month

Each plan includes core investment account capabilities and automated Round-Ups investing spare change. Higher tiers add features like retirement accounts, bonus investment reward boosts, debit cards, and more.

An additional 0.25% annual fee applies to account balances over $1 million.

The affordable fee structure enables casual, hands-off investing for anyone.

Reviews

With nearly 6 million users and 4.8 stars across over 69,000+ reviews, Acorns is hailed for its automatic investing approach making saving effortless. Top highlights include Round-Ups, diversified portfolios, and wealth building education.

Critical feedback focuses on the lack of customization options, individual asset selection, and advanced capabilities catered more towards passive, set-it-and-forget-it investors rather than active trading. But Acorns clear focus stays on simplicity over flexibility.

By innovating and automating

small-dollar investing, Acorns provides an essential gateway to growing wealth over time.

Go to Acorns8. Betterment - Best for Managed Portfolios

Betterment, recognized as a top robo-advisor, offers a blend of automated investing and personal finance management tools. It's known for its expert-built stock and bond portfolios, crypto investment options, and high-yield cash accounts.

Description

As an investor interested in hands-off wealth growth, I've found Betterment to be a game-changer. Linking accounts activated intelligent automation around goals-based investing strategies. Betterment curates custom ETF portfolios aligned to my timeline and risk appetite, handling the ongoing management. I now have diversified, optimized portfolios automatically built and maintained for retirement, education savings and more - easing the investing burden tremendously while I focus on living life.

I also appreciate Betterment's cash management capabilities letting me consolidate finance. The high-yield savings earns up to 4.75% APY while checking helps optimize spending - all managed seamlessly through Betterment's app.

Automatic Investing Features

Key highlights of Betterment's automation include:

Managed Portfolios - Expert-built, optimized stock/bond portfolios tailored to your goals.

Rebalancing - Portfolios stay aligned to target allocations automatically.

Dividend Reinvesting - Dividends get reinvested optimally across your portfolios.

Tax Coordination - Strategies like tax-loss harvesting and asset placement minimize tax drag.

Together this enables truly hands-off, personalized investing catered specifically to your needs.

Pros

Betterment advantages as an investing platform:

Intelligently automated portfolios & tax strategy

No fees and up to 5.5% for the first 3 months APY on cash savings

Retirement, investing, banking, and crypto options

Access to personalized advice from financial experts

User-friendly for both beginners and sophisticates

Betterment delivers premium automation to simplify money management.

Cons

Potential limitations to note:

No individual stock picking available

Must link bank accounts for full functionality

Premium pricing may deter smaller investors

For passive investors focused on ETFs over stocks, Betterment hits the automation sweet spot. But active traders may find the platform restrictive.

Fees/Pricing

Betterment charges:

$4/month basic investing account fee

0.25% annual fee on balances above $20K

No cash account, checking or crypto fees (outside trading costs)

Premium 0.40% total fee including unlimited financial advisor access

Compared to traditional advisors charging 1%+ annually, Betterment offers significant value in automated money management.

Reviews

With over 700K users and 4.8+ stars across 31,000+ reviews, Betterment earns outstanding marks for revolutionizing hands-off investing through smart automation. Users praise goal-based portfolios, cash management capabilities, and timesaving automation that enables effortless wealth growth.

Some comments focus on limitations on direct stock trading, congested interfaces, and areas of friction for linking external accounts. But reviewers agree Betterment excels where it matters most — automating personalized wealth building aligned to each investor's needs.

Go to Betterment9. Vanguard Digital Advisor - Best For Larger Accounts

Vanguard Digital Advisor is a robo-advisory service that stands out for its low fees and streamlined approach to investment management. It offers a personalized retirement plan and portfolio creation using Vanguard's proprietary ETFs.

Description

Vanguard Digital Advisor is an affordable hands-off automatic investing tool. After a quick call to set parameters around my retirement goals, Vanguard built and automatically manages personalized portfolios on my behalf consisting of low-cost Vanguard ETFs.

I also like Vanguard Digital Advisor's flexibility around sustainable investing. With the same low fees, I could construct an ESG-focused portfolio aligning my wealth-building to my values around environmental, social and governance factors. Regardless of strategy selected, Vanguard makes automated investing simple and cost-effective.

Automatic Investing Features

Vanguard Digital Advisor's system automates:

Portfolio Construction - Personalized to your goals using Vanguard ETFs

Rebalancing - Keeps portfolios aligned to targets

Tax-Loss Harvesting - Optimizes taxable accounts

Ongoing Management - Portfolio adjustments over time

Together this enables transparent, low-cost hands-off wealth building.

Pros

Key advantages of Vanguard Digital Advisor include:

Ultra-low advisory fees from 0.15%

Retirement planning guidance

Vanguard ETFs with proven long-term performance

Automated, optimized portfolio management

Flexible account types (taxable, retirement, etc)

As an affordable robo-advisor backed by Vanguard's esteemed index fund expertise, fees and automation pair perfectly for effortless investing.

Cons

Potential limitations to note:

No access to human advisors for guidance

Very Large minimum deposit amount

Less customization flexibility being index-focused

Limited to Vanguard ETFs - no stocks or third party funds

The streamlined experience reduces options but enhances simplicity and cost transparency.

Fees/Pricing

Vanguard Digital Advisor charges:

0.15% advisory fee

0.05% average fund expense ratio

With no trading commissions, account fees or other hidden costs, the straightforward pricing provides exceptional value.

Compared to traditional advisor fees often over 1%, Vanguard Digital Advisor cuts costs by over 80% while still providing personalized, automated portfolio management.

Reviews

Reviews praise the combination of human guidance and customized robo-management for low fees. The retirement planning support and universe of broadly diversified, low-cost ETFs appeals to passive, long-term investors focused on costs.

For cost-conscious investors who still want personalized advice and customization, Vanguard is difficult to beat on fees or portfolio quality. Automation then eases the management burden for smooth long-horizon growth.

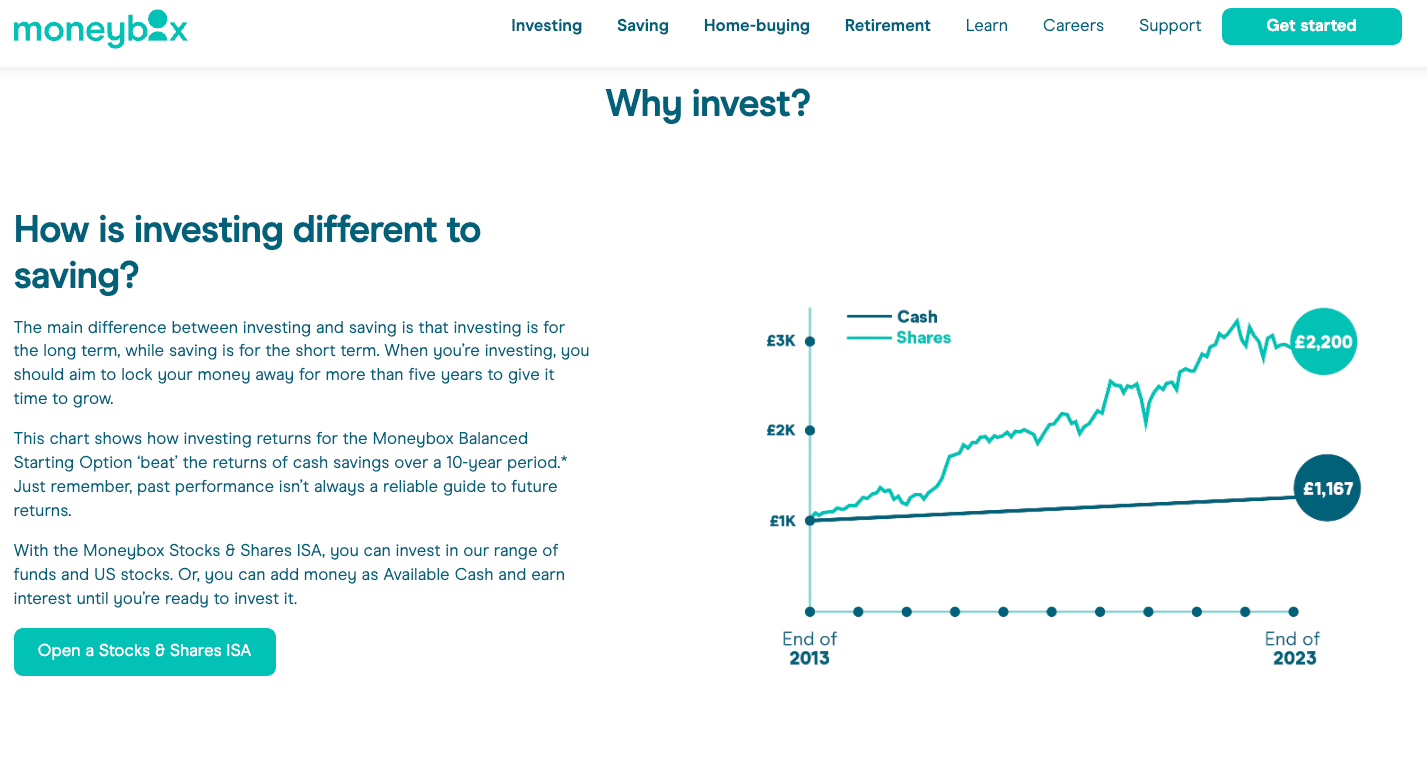

Go to Betterment10. Moneybox - Automatic Investing with ISAs

Moneybox was rated as the best micro investing app in our previous guide.It's ideal for beginners and those looking to integrate saving into their daily routine. It offers a unique round-up feature, allowing users to invest spare change from everyday purchases. The app provides a range of products, including Stocks and Shares ISA, personal pensions, Lifetime ISAs, and Cash ISAs.

Description

As someone who struggles to save consistently, I found Moneybox provided some much-needed innovation. Between effortlessly building a Stocks & Shares ISA with lattes and having a pension grow through grocery shops, watching small sums compound over time is remarkably motivating.

I also appreciate how Moneybox simplified opening additional specialised accounts like my Lifetime ISA for first home savings or Junior ISA for my niece's future. The ability to save, invest and plan various financial goals seamlessly through one app helps me build security at every life stage.

Automatic Investing Features

Moneybox automated investing capabilities include:

Round-Ups - Digital change from transactions gets invested into your chosen products.

Recurring Investments - Schedule routine deposits at custom frequencies.

ISA Investing - Tax-advantaged investment account in your choice of portfolios.

Pension Investing - Personal pension invested in diversified low-cost ETFs.

By transforming even the smallest sums into automated wealth building, Moneybox offers an easy path towards growing long-term savings and investments.

Pros

Key advantages of using Moneybox include:

Innovative Round-Ups features invests your digital change seamlessly

Low minimum requirements - start from just £1

ISA, pension and other account types available

Simple mobile interface great for beginners

Start small and build confidence in investing

Moneybox makes building wealth intuitive through clever automation around daily spending.

Cons

Drawbacks to consider:

£1 monthly subscription fee

Limited control over custom investments

Missing advanced features some investors may expect

The streamlined experience improves simplicity but reduces flexibility. However, Moneybox focuses squarely on helping beginners overcome inertia.

Fees/Pricing

Moneybox charges:

£1 monthly subscription fee

0.45% annual platform fee

0.12% - 0.58% fund fee depending on portfolio

There are no setup costs, exit fees or trading commissions.

The transparent, low-cost pricing structure aims to make investing accessible.

Reviews

With over 150,000 reviews averaging 4.6 stars, Moneybox users praise the app's simplicity, innovative features, and clarity in empowering investing habit creation through seamless automation. Top highlights include easy account setup, fractional share investing, and the intuitive round up functionality.

Critical feedback focuses on support improvements for linking external accounts or resolving technical issues. But most agree Moneybox excels at making market investing fun, incremental, and frictionless.

For hands-off beginners focused more on behavior change than short-term trading, Moneybox provides the perfect creative solution.

Go to MoneyboxKey Features of Top Automatic Investing Apps

The best automatic investing apps share several key features that enable them to effectively manage portfolios and deliver strong risk-adjusted returns over time.

Diversified Asset Allocation

Rather than trying to predict market trends or pick individual stocks, top automatic investing apps utilise globally diversified portfolios primarily consisting of low-cost ETFs and index funds. This provides broad exposure across thousands of stocks and bonds from markets around the world. Apps determine the precise asset allocation based on the individual's goals and risk tolerance.

Automatic Rebalancing

As some investments within a portfolio outperform others over time, the original target asset allocation can shift. Automatic rebalancing sells off outsized positions and buys lagging assets to bring the percentages back in line with the targets. This is a form of buy low, sell high that helps manage risk.

Tax-Loss Harvesting

Tax-loss harvesting is a sophisticated strategy that sells losing positions to realise capital losses, using those losses to offset taxes owed on capital gains and investment income. It can boost after-tax returns by an estimated 0.25-1% annually. The best apps for automatic investing monitor portfolios specifically looking for tax-loss harvesting opportunities.

Low Account Minimums

In contrast to traditional advisor fees which can run over 1% annually, automatic investing apps charge between 0.15-0.50% with no trade commissions or account fees. This ultra-low cost structure combined with automated portfolio management is what enables most apps to profitably offer services with minimum investments between £1-5,000.

By leveraging algorithms and the scale of collective assets, automatic investing apps can deliver a low-cost, diversified, automatically managed portfolio personalised to each individual's financial life. The technology has made advanced investing strategies accessible to nearly anyone.

How to Choose an Automatic Investing App?

Consideration | Description | Relevance for Investors |

Customization Options | Level of control over investment choices and portfolio management | More experienced investors may prefer platforms with greater control over asset selection and portfolio management |

Educational Resources | Availability of educational materials and support for building investment knowledge | Newer investors often benefit from more guided portfolio construction and expanded educational resources |

Fee Structure | Understanding the costs associated with using the app, including management fees and any additional charges | Investors should weigh fee structures against their budget and desired features |

Account Types | Types of accounts offered, such as ISAs, pensions, or general investment accounts | Choose a platform that offers account types aligned with financial goals and tax considerations |

Investment Products | The range of investment products available, like ETFs, individual stocks, or socially responsible assets | Select a platform that aligns with investment preferences and goals |

Automated Features | Features like tax-loss harvesting, automatic rebalancing, and dividend reinvesting | Consider platforms that offer specific automatic features that align with investment strategies |

Risk Management | The ability to tailor investment strategies to personal risk tolerance | Ensure the platform matches the investor's risk appetite and investment horizon |

Support and Security | Availability and quality of customer support, along with security measures like FSCS protection | Consider platforms with robust customer support and security measures for peace of mind |

Things to Consider Before Investing Automatically

While automated investing platforms offer unmatched simplicity and value, certain factors warrant consideration before fully outsourcing portfolio management to algorithms.

As someone who has used leading robo-advisors for years, I suggest new investors contemplate their human support needs, customization options, account types, and overall fees to determine the best fit or look for apps that are created specifically for beginners. The most suitable level of automation integration varies individually based on financial situation, existing knowledge, growth objectives and risk appetite.

Those newer to investing may prefer more guided portfolio construction with expanded educational materials to continually build fluency. Goal-based investing platforms like Betterment allowing further strategy personalization based on timeline and amount parameters can also better suit certain investor archetypes.

Conversely, hands-on investors might better leverage expert automation for backend portfolio maintenance, while retaining control over asset selection and weighting aligned to outlook.

It helps assessing which specific automatic features most appeal as well when screening options. Micro-deposit round-up style investing, tax-loss harvesting, automatic rebalancing, dividend reinvesting, and integrated banking carry powerful compounding benefits over the long run.

Many also consider the specific types of investment products offered, with some focusing solely on ETFs while others enable individual stocks. Preferred access to fractional shares, crypto, socially responsible assets, or automated retirement planning guidance can significantly influence platform selection.

Those building up emergency funds may opt for lower risk fixed income allocations, while goal-directed investing buckets bring helpful Retirement and LISA offerings tailoring strategies to the investment timeline. Weighing key features against costs and functionality preferences assists finding one’s ideal automated investing platform match.

Switching costs and support channels also warrant inspection before transferring assets to a robo-advisor. I always verify my target provider offers phone, chat and email assistance with reasonable wait times in case my portfolio requires adjustments. FDIC/FSCS protection on cash balances up to £85k gives added account security assurances as well.

While initially daunting, embracing financial automation can profoundly enrich one's investment journey and accelerating returns. I encourage all to weigh the considerations above when assessing automated platforms to determine the right solution fitting investing experience level and wealth building aspirations. The transformative power of exponential compound growth through optimized, hands-free portfolios awaits.

FAQs

What are the tax implications of using automatic investing apps in the UK?

Automatic investing apps in the UK often incorporate tax-efficient strategies like using ISAs (Individual Savings Accounts) or pensions to optimize for tax. However, the specific tax implications can vary based on the type of account you choose and your personal financial situation. It's advisable to consult with a tax professional for personalized advice.

Can I switch between different automatic investing platforms without incurring fees?

Switching between automatic investing platforms may involve fees, depending on the platforms' policies. Some platforms might charge transfer or exit fees. It's important to review the fee structure of both your current and prospective platform before making a switch.

How do automatic investing apps handle market downturns or volatility?

Answer: Automatic investing apps typically use diversified portfolios and automatic rebalancing to manage market downturns and volatility. Diversification across different asset classes can help mitigate risk, while rebalancing ensures that your portfolio stays aligned with your risk tolerance and investment goals, even during market fluctuations.

Are there options for ethical or socially responsible investing in these apps?

Answer: Many automatic investing apps offer options for ethical or socially responsible investing. These options allow you to invest in funds or ETFs that align with certain environmental, social, and governance (ESG) criteria. The availability and range of these options vary by platform.

How do automatic investing apps cater to different levels of investor experience?

Answer: Automatic investing apps cater to various experience levels by offering user-friendly interfaces, educational resources, and customizable portfolio options. Beginners can benefit from guided portfolio construction and educational materials, while more experienced investors might appreciate platforms that offer greater control over asset selection and portfolio management.

In conclusion, the journey to finding the best auto-investing app is highly personal and depends on your individual financial goals, investment style, and the level of control you wish to maintain over your investments. From my extensive research and personal experience, I've found that the top auto-investing apps offer a blend of user-friendly interfaces, diverse investment options, and robust security features, all essential for a hassle-free investing experience.

Remember, the key is to choose an app that aligns with your investment strategy and financial objectives.

If you have any questions or you would like to discuss with me anything related to investing feel free to reach me on LinkedIn or send me an email at george@wealthyhood.com

Happy investing, and may your financial portfolio flourish with the aid of these innovative tools!

Capital at risk. This article is for information purposes only and is not investment advice nor a recommendation. You should consider your own personal circumstances when making investment decisions. Past performance is not a reliable indicator of future performance. Tax treatment depends on your personal circumstances and rules can change.