Table of Contents

- 1. Nutmeg - Best Beginner-Friendly Robo Advisor

- 2. Wealthyhood - Best App for Beginners Overall

- 3. Wealthify - Actively Managed Investments

- 4. Moneyfarm - Best for Personalized Investing

- 5. Plum - Great for Micro Investing

- 6. Wombat - Good For Sector Investing

- 7. Moneybox - Best for Micro Investing

- 8. Lightyear - Most Cost Efficient Begginers' App

- 9. AJ Bell Dodl - Safest Option

- 10. Freetrade - Best for Beginner Traders

- 11. InvestEngine - Best Because of Real Time Data

I've spent considerable time exploring the best investment apps for beginners, and I'm excited to share my findings with you. Embarking on an investment journey can be both thrilling and overwhelming, especially for newcomers. Fortunately, today's market is filled with apps designed to simplify and demystify investing. These apps are not just tools; they're gateways to understanding the stock market, mutual funds, and a plethora of other investment opportunities.

In this article, I'll walk you through my top picks for investment apps, highlighting their features and how they can help you confidently start your investing adventure but first lets have a look at the key takeaways of this article.

Key Takeaways:

Wealthyhood is the best investing app for beginners overall considering everything from ease of use to fees and customer support

Nutmeg is great for beginners due to doubling down as a robo advisor and an investment app

Wealthify is awesome if you are looking for an actively managed approach by humans

Moneyfarm is perfect for those looking for personalised portfolios

Plum is recommended to beginner investors who are looking for a micro investing solution

1. Nutmeg - Best Beginner-Friendly Robo Advisor

Platform Type: Robo Advisor & Investing App

Nutmeg operates as a Robo Advisor, leveraging automated algorithms for investment management. This makes the platform highly accessible and easy to navigate for beginners.

Beginner-Friendly Aspect:

As a robo-advisor, Nutmeg simplifies the investment process for beginners. It uses algorithms to recommend a portfolio based on your goals and risk preferences. This automated approach can be particularly helpful for those who may not have extensive knowledge of investing. It's important to mention that Nutmeg was rated as the best Robo Advisor in our comparison review.

Key Features:

Nutmeg's primary features include personalized portfolio management, where its algorithms tailor investment strategies based on individual risk profiles and goals. The platform also offers a range of investment types, from socially responsible investing to fixed allocation portfolios, making it a comprehensive tool for diversified investing for beginners.

Fees:

Nutmeg's fee structure includes charges for account management and investment funds, with a clear and transparent pricing policy. Nutmeg charges an account fee of up to 0.75% for investments up to £100,000, and 0.35% for amounts beyond £100,000. Additionally, there are fund management fees which range between 0.22% to 0.36% and a market spread cost.

Pros:

Simplified Investing: Ideal for beginners due to its easy-to-use Robo Advisor model.

Diverse Investment Options: Offers a range of investment styles and account types.

Fee-Free Start: The first year without fees is particularly advantageous for new investors.

Cons:

Limited Customization: The platform might offer less flexibility in investment choices compared to other platforms.

Fees After First Year: Standard fees apply after the initial fee-free period.

Automated Nature: Might offer limited educational insights for those seeking to learn detailed investment strategies.

In summary, Nutmeg is a great starting point for a beginner's journey, in my opinion, offering ease of use and a fee-free first year. While it could improve in customization, it's an excellent choice for beginners looking to step into investing.

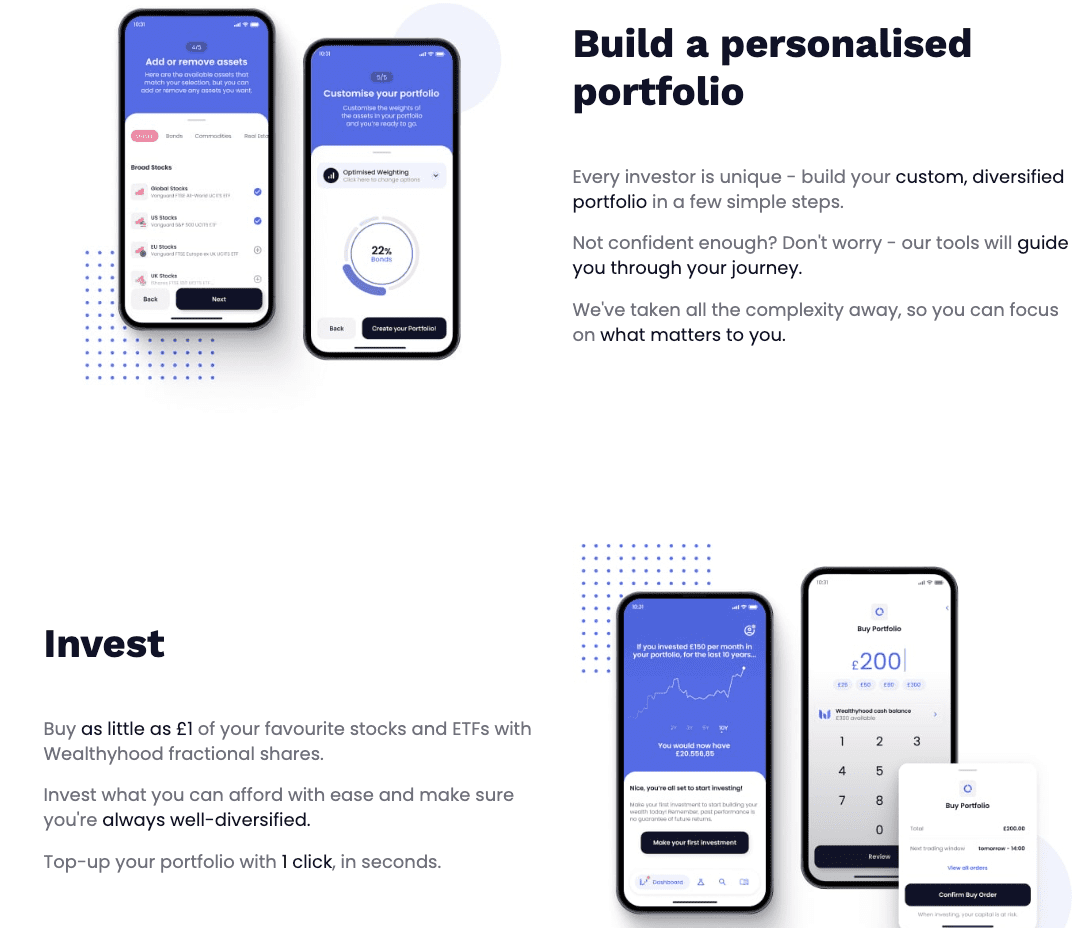

Go to Nutmeg2. Wealthyhood - Best App for Beginners Overall

Platform Type: Investment App

Wealthyhood is an innovative online investment app that seamlessly blends an easy to use investing interface with cutting-edge technology. This unique combination caters to beginner investors, who are seeking a more guided approach to building their wealth.

Beginner-Friendly Aspect:

Wealthyhood stands out as an ideal choice for beginners due to its commitment to making investing simple through an intuitive experience. The platform's large variety of ETFs and stocks is further amplified by a mobile app and website that guide the user through the investing experience. A seamless onboarding process and great customer support are the toppings on the cake of Wealthyhood making it the perfect investing app for beginners.

Key Features:

Wealthyhood offers various handy features for beginner investors. The pre-created portfolios and automatic rebalancing are some underrated tools that make investing in Wealthyhood more fun and super simple. Wealthyhood also offers scheduled top-ups so you can schedule your monthly DCA. My favourite feature though has to be the in-app portfolio builder and the projected returns of saving vs investing.

Fees:

Wealthyhood also comes with a fair fee structure that won't hurt. Fees include a 0.35% currency conversion fee, 0.45% per order fee, and a 0.18% annual custody fee charged monthly. These are available in the free plan but Wealthyhood also offers paid plans that eliminate fees and give you access to a 4% dividend!

Pros:

Suitable for Beginners: Wealthyhood is designed for those new to investing, with a user-friendly interface and educational resources.

Customizable Investment Portfolio: Offers the flexibility to create a tailored investment portfolio.

Guided Investment Process: The app guides users through the investment process, making it easier for beginners.

Decent Range of Investments: Provides a good selection of ETFs, bonds, and commodities like gold, suitable for building a diverse portfolio.

Auto Investment and Portfolio Rebalancing Features: Facilitates automatic investment and rebalancing to maintain desired risk levels. Regulatory Safeguards: Regulated by the Financial Conduct Authority (FCA) and offers protections like the Financial Services Compensation Scheme (FSCS).

Cons:

Relatively new to the market but still it is regulated by the FCA and accounts are FSCS protected

It doesn't offer ISA accounts but they are planning to add.

In summary, Wealthyhood serves as an excellent entry point for beginners embarking on their investment journey. Its combination of guided support, ease of use, and diverse investment plans makes it a valuable tool and honestly the perfect investing app for those looking to grow their wealth. While it may not suit investors who prefer complete control over their investments, I would wholeheartedly recommend Wealthyhood to individuals who prioritize a simplified, expert-guided approach to building their financial future.

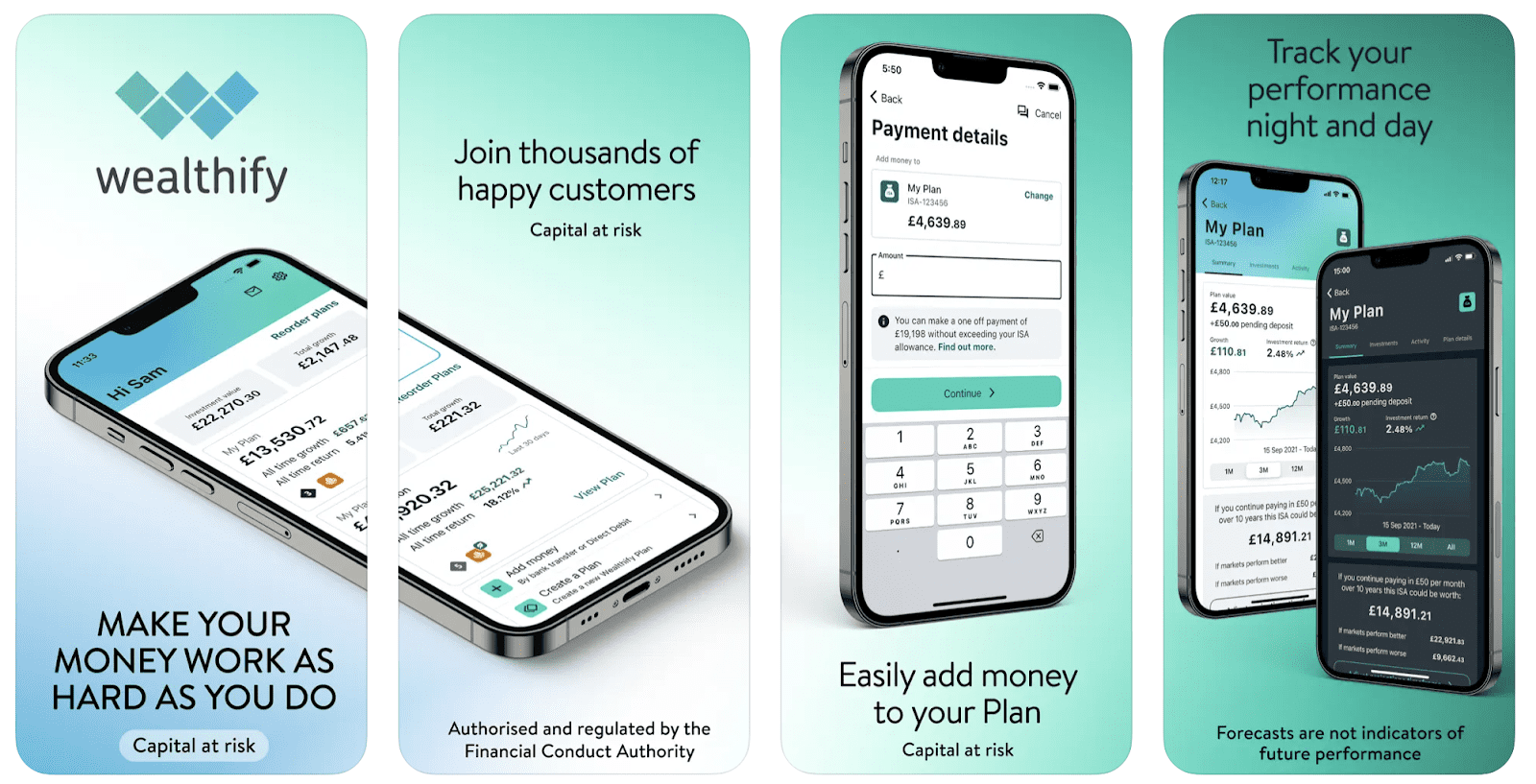

Try Wealthyhood3. Wealthify - Actively Managed Investments

Platform Type: Investing App / Actively Managed Investments by a Team

Wealthify is an online investment management service, utilizing a combination of expert human investment insight and advanced technology. This blend makes the platform particularly suitable for beginners who seek a more guided approach to investing.

Beginner-Friendly Aspect:

Wealthify is a perfect beginner-friendly platform as it offers investment services that are managed by its expert investment team. This was particularly appealing to me as it removed much of the complexity associated with investing. One of Wealthify's key beginner-friendly features is its intuitive app and website, offering an easy onboarding process and continuous investment insights, making the investment journey more accessible and less intimidating for newcomers.

Key Features:

Wealthify offers a user-friendly interface and a hands-off investment approach. It provides a range of investment plans, including ISAs and general investment accounts, catering to diverse financial goals and risk appetites.

Fees:

The fees are calculated as a percentage of the total investment amount, with the rates varying depending on the type of plan chosen. For instance, the platform typically charges a fee ranging from around 0.6% to 0.7% annually for its services, which includes fund management and platform fees. This is in addition to the fund charges, which average around 0.16% to 0.22%. These fees are relatively lower compared to traditional investment services, making Wealthify an attractive option for those who are cost-conscious or are investing smaller amounts.

Pros:

Guided Investment Experience: Wealthify's blend of technology and expert management offers a guided investing experience.

Diverse Investment Plans: Caters to various financial goals with different types of investment accounts.

Transparent Fees: Simple and clear fee structure, making it easier for beginners to manage their investments.

Cons:

Limited Direct Control: Beginners seeking hands-on experience might find Wealthify's managed approach less appealing.

Fee Structure: While transparent, the fees may be higher compared to DIY investing platforms.

Less Customization: The platform may offer fewer options for personalized investment strategies.

In summary, Wealthify is an excellent gateway for beginners to start their investment journey, providing a guided, easy-to-navigate platform with a variety of investment plans. While it offers less control over individual investments, I would recommend it to someone who doesn't want a lot to get hands-on with their investments.

Go to Wealthify4. Moneyfarm - Best for Personalized Investing

Platform Type: Investing App and Digital Wealth Manager

Moneyfarm is a digital wealth manager, that combines advanced technology with human expertise to provide personalized investment strategies. This hybrid approach is particularly appealed to me during my testing because it provides a lot of flexibility and guidance to investors who lack experience.

Beginner-Friendly Aspect:

Moneyfarm offers dedicated investment consultants to each user, providing personalized advice and support. This feature particularly benefits beginners who may require additional guidance and reassurance in their investment journey. If I were getting started today that would be definitely a feature I would want.

Key Features:

The defining feature of Moneyfarm is its integration of algorithm-driven investment advice with the human touch of financial consultants. This combination ensures personalized investment strategies, which I found to be a major advantage. The platform offers a variety of portfolios, each tailored to different risk appetites and investment goals, and is particularly strong in providing clear, strategic guidance for long-term investments.

Fees:

Moneyfarm's fee structure is tiered and transparent, designed to be cost-effective as the investment amount increases. The fees are a percentage of the invested amount, which decreases as the investment value grows. For example, for investments up to a certain threshold, the fee might be around 0.7% per year, and this percentage decreases progressively for higher investment brackets. Additionally, there are underlying fund charges, typically around 0.2% to 0.3%, which cover the costs of the funds in which your money is invested.

Pros:

Tailored Investment Portfolios: Personalized investing approach based on individual risk profiles.

Human Expertise: Access to investment consultants for personalized advice and support.

Transparent and Tiered Fees: Clear fee structure that becomes more cost-effective with higher investment amounts.

Cons:

Higher Minimum Investment: May require a larger initial investment compared to other platforms, which could be a barrier for some beginners.

Limited Investment Options: While personalized, the investment choices may be more restricted than other DIY investing platforms.

Fee Impact on Smaller Portfolios: The fee structure might be less favorable for smaller investments compared to other robo-advisors.

Moneyfarm is an excellent choice for beginners who prefer a more personalized approach to digital investing, offering professional guidance and tailored portfolios. While the platform is user-friendly and transparent, the minimum investment requirement and fee structure might be considerations for those starting with smaller amounts.

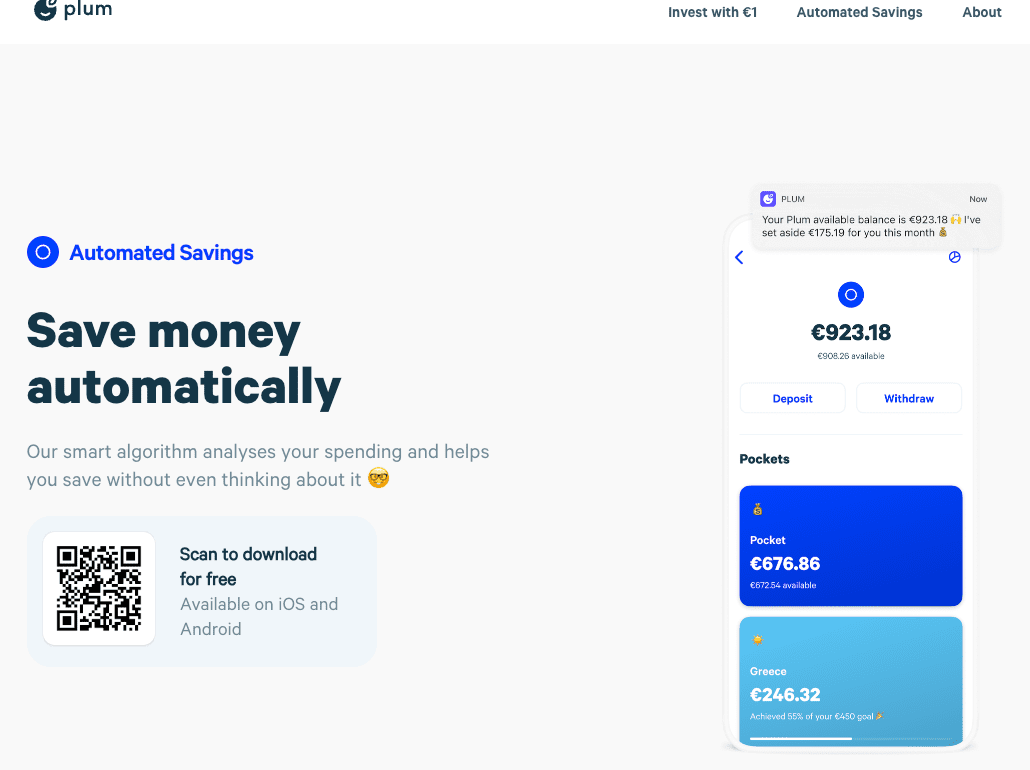

Go to Moneyfarm5. Plum - Great for Micro Investing

Platform Type: Automatic Investing App / Micro Investing App

Plum is an innovative FinTech platform, primarily known for its automated savings and investment capabilities. It's designed for individuals who seek a hassle-free and intelligent approach to managing their finances. This platform is particularly suited for those who are new to saving and investing, offering a seamless entry into the world of financial planning.

Beginner-Friendly Aspect:

Plum excels in providing a beginner-friendly experience. Its automated savings feature simplifies the process of setting money aside, and the investment options are presented straightforwardly. This would have been a particularly helpful feature to me if I was starting out, as it would reduce the overwhelming nature of financial decision-making.

Key Features:

The standout feature of Plum is its AI-driven technology that automates savings and investment decisions. This smart technology analyzes your financial habits and automatically sets aside funds for savings or investments, which I found to be incredibly convenient. Furthermore, Plum provides a range of investment options, including stocks and shares ISAs, and various funds, catering to different investment goals and risk appetites.

Fees:

Plum's fee structure is noteworthy for its clarity and adaptability to different user needs. The platform operates on a tiered subscription model, with various levels offering different services. For instance, the basic tier may include automated savings and budgeting tools at a low cost, while higher tiers offer more advanced features like investment options for a slightly higher fee. It's important to note that investment funds also have their own management fees, which are separate from Plum's subscription fees. These additional fees are generally in line with industry standards, but it's always prudent to check the specific charges associated with each investment option.

Pros:

Automated Savings: The AI-driven tool effectively adjusts savings based on spending habits.

Diverse Investment Options: Offers a range of investment choices suitable for different goals and risk levels.

User-Friendly Interface: The platform is intuitive, making it easy for beginners to navigate and manage their finances.

Flexible Subscription Model: Different service levels cater to varying user needs and budgets.

Cons:

Limited Investment Control: May not be ideal for those who prefer direct and extensive control over their investments.

Subscription Fees: Ongoing costs associated with different service levels might be a consideration for budget-conscious users.

Basic Investment Features: The investment options could be basic for experienced investors seeking a comprehensive investment platform.

In summary, Plum offers a user-friendly and intelligent approach to saving and investing, making it an excellent tool for beginners. The platform's AI-driven savings feature and intuitive design simplify financial management. However, the simplicity of the platform and its tiered subscription model might not cater to everyone, particularly those looking for more advanced investment features or more control over their financial choices.

Go to Plum6. Wombat - Good For Sector Investing

Platform Type: Investing App

Wombat is an app, primarily recognized for its user-friendly approach to investment and savings. It's designed for individuals seeking an intuitive and engaging way to manage their finances, particularly appealing to those who are new to investing and want a straightforward experience.

Beginner-Friendly Aspect:

Wombat stands out for its beginner-friendly interface and concept. The thematic investment approach simplifies the decision-making process for new investors, which I found very helpful when I was starting out. The platform makes investing relatable and accessible, reducing the intimidation often associated with financial investments.

Key Features:

Wombat's main appeal lies in its ease of use and the unique thematic investment options it offers. The platform allows users to invest in a range of themed funds, which I found particularly engaging and easy to understand. These themes are based on certain sectors or trends, making it simpler for users to invest in areas they are passionate about or find interesting. Additionally, Wombat offers a 'round-up' feature that automatically invests spare change from everyday purchases, a great tool for effortlessly building savings.

Fees:

The fee structure of Wombat is designed to be accessible and transparent. The platform charges a monthly subscription fee for using its services, which covers the cost of managing your investments. This fee is relatively modest, making it appealing for those starting with smaller investment amounts. Additionally, there are fund management fees associated with the specific investment funds you choose, typically in line with industry averages.

Users need to be aware of these additional costs when selecting their investments.

Pros:

Thematic Investment Options: Unique themes make investing more relatable and engaging.

User-Friendly Interface: The platform is intuitive and easy to navigate, ideal for beginners.

Round-Up Feature: Automated savings tool that helps in gradually building investments.

Accessible Fee Structure: The modest monthly subscription fee is attractive for those starting small.

Cons:

Limited Investment Depth: The thematic focus may lack the depth desired by more experienced investors.

Subscription Fee Model: The ongoing monthly fee, while modest, is a factor to consider for budgeting.

Basic Features: More seasoned investors might find the features somewhat limited for advanced investment strategies.

In summary, Wombat is an excellent platform for those new to investing, offering a unique and engaging approach to financial management. Its thematic investment options and user-friendly design make investing approachable and enjoyable. However, the platform's simplicity and subscription fee model may not fully meet the needs of more experienced investors or those looking for a more comprehensive investment toolkit.

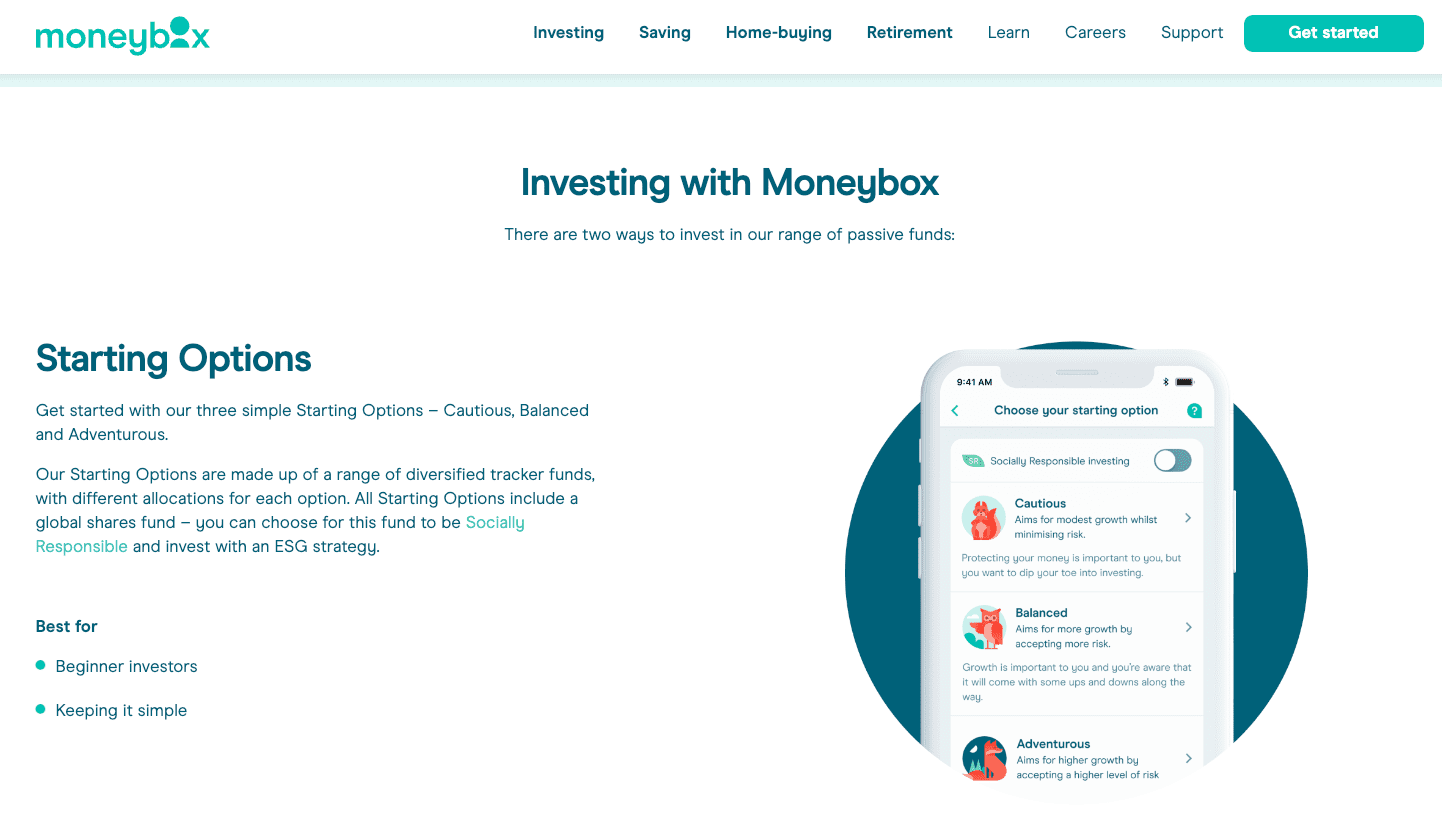

Go to Wombat7. Moneybox - Best for Micro Investing

Platform Type: Micro Investing App

Moneybox is a forward-thinking FinTech platform that specializes in micro-investing. It is particularly designed for those who are new to investing, offering a simple and accessible route into the world of finance. The platform is a great fit for individuals looking to start investing with small amounts and gradually build their investment portfolio. Moneybox was also rated as the best micro-investing app in our previews testings.

Beginner-Friendly Aspect:

As someone who was initially daunted by investing, I found Moneybox to be incredibly beginner-friendly. The app's design is intuitive, making it easy to set up and manage investments. The automatic round-up feature in particular is a great way to get accustomed to investing without having to make large commitments upfront.

Key Features:

The standout aspect of Moneybox is its focus on round-ups, a feature that automatically invests your spare change from everyday purchases. This approach is not only innovative but also incredibly user-friendly, making investing almost effortless. In addition to round-ups, Moneybox offers a range of ISA options, including Stocks & Shares ISA, Lifetime ISA, and pensions, catering to various long-term financial goals. This variety was something I particularly appreciated, as it allowed me to diversify my savings strategy.

Fees:

The platform fee is 0.45% annually, charged on the total value of your investments. On top of these, there are fund charges, which average around 0.12% to 0.30% annually, depending on the chosen funds. This comprehensive fee model is essential to understand for anyone considering Moneybox, especially as their investment grows in size.

Pros:

Easy-to-Use: Intuitive app design, perfect for those new to investing.

Micro-Investing with Round-Ups: Innovative feature that allows for building investments with spare change.

Diverse ISA Options: Offers various ISA and pension options for long-term financial planning.

Transparent Fee Structure: Clear fees with a breakdown of subscription, platform, and fund charges.

Cons:

Fee Accumulation: While fees are reasonable for small investments, they could become significant as the investment grows.

Limited Advanced Features: More experienced investors might find the features too basic for complex investment strategies.

Predominantly App-Based: The focus on app-based management might not appeal to those who prefer desktop or more traditional forms of investment management.

Moneybox is an excellent platform for those beginning their investment journey, particularly due to its micro-investing approach and user-friendly interface. The platform makes investing accessible and uncomplicated, which is ideal for newcomers. However, the fee structure and the relatively basic features might be limiting factors for those with larger investment amounts or more advanced investment knowledge.

Go to Moneybox8. Lightyear - Most Cost Efficient Begginers' App

Platform Type:

Lightyear is a contemporary investment platform that stands out for its global investment focus. It's particularly designed for those who are interested in accessing international markets easily. This platform is a great fit for investors who are looking to diversify their portfolios across different global markets, including both beginners and those with some investing experience.

Beginner-Friendly Aspect:

While not the perfect investing app for a beginner Lightyear offers tools could be used by a newcomer, especially due to its easy-to-use interface and the absence of trading commissions. For someone new to international investing, the simplicity of the platform and the access to global markets without complex fee structures were incredibly helpful in easing the learning curve.

Key Features:

One of Lightyear’s most appealing features is its offering of commission-free investing in international stocks and ETFs. This allows users to invest in a wide range of global markets without worrying about the cost of each trade, which I think is a significant advantage. Additionally, Lightyear provides real-time market data and analytics, making it easier to make informed investment decisions. The platform also offers a multi-currency account, which is particularly useful for those who want to hold and invest in different currencies.

Fees:

What's notable about Lightyear is its straightforward and low-cost fee structure. The platform does not charge any commission on trades, which is a major benefit for active traders. Instead, it earns revenue through the spread of currency exchange. For currency conversion, Lightyear charges a fee close to the interbank rate, which is typically around 0.15%. It's important to note that there are no account fees or minimum deposit requirements, making it an attractive option for investors of all sizes.

Pros:

Commission-Free Trading: Ideal for frequent trading without incurring additional costs.

Global Market Access: Offers a wide range of international stocks and ETFs.

Real-Time Data: Provides up-to-date market information, aiding in informed decision-making.

Multi-Currency Account: Allows holding and investing in different currencies, adding to portfolio diversification.

Cons:

Currency Conversion Fee: While competitive, the fee on currency conversions is something to consider.

Limited Advanced Features: This may not cater to the needs of more experienced investors looking for a comprehensive trading platform.

Newer on the Market: Being relatively new, it may not have the same track record or range of services as more established platforms.

Lightyear presents a compelling option for those interested in global investment opportunities, especially with its commission-free trading and access to a variety of international markets. Its user-friendly interface and multi-currency account are particularly advantageous for beginners and those looking to diversify across currencies. However, the currency conversion fee and potentially limited advanced features might be considerations for some investors, especially those with more experience or specific investment needs.

Go to Lightyear9. AJ Bell Dodl - Safest Option

Platform Type: Investment Platform

AJ Bell Youinvest is a versatile investment platform that caters to investors of all experience levels, offering a wide range of investment opportunities. AJ Bell's DODL (Do Only Digital Life) is a more specific offering within their platform, designed for digital natives and those seeking a streamlined and mobile-focused investment experience.

Beginner-Friendly Aspect:

The mobile-centric design and user-friendly interface of DODL make it a great choice for beginners. The platform's educational resources also support new investors in gaining confidence and understanding the investment process. The absence of trading commissions further reduces barriers for those new to investing.

Key Features:

DODL is primarily designed for mobile devices, providing a seamless and convenient investment experience for users who prefer managing their portfolios on smartphones or tablets. The mobile app is intuitive and user-friendly, making it easy for investors to navigate and execute trades. DODL also allows users to build and customize their portfolios according to their investment goals and risk tolerance. It offers various investment options, enabling investors to diversify their holdings to align with their preferences.

Fees:

AJ Bell DODL's fee structure is competitive and transparent. As mentioned, the platform offers commission-free trading, which is attractive for investors looking to keep their costs low. However, it's essential to be aware of other potential charges, such as account maintenance fees or currency conversion fees, depending on your specific investment activity.

Pros:

Mobile-Centric: Ideal for investors who prefer managing investments via mobile devices.

Commission-Free Trading: Helps investors minimize trading costs.

Customization Options: Allows users to tailor their portfolios to their investment goals.

Educational Resources: Provides valuable content for investors looking to learn more.

Cons:

Limited to Digital Experience: DODL may not cater to investors who prefer desktop or web-based platforms.

Additional Fees: Users should be aware of potential account fees and currency conversion charges.

In summary, AJ Bell DODL is a mobile-focused investment platform designed for digital natives and those who prefer a user-friendly, commission-free investment experience on their mobile devices. It offers portfolio customization options and educational resources, making it an attractive choice for beginners and investors seeking a streamlined, mobile-centric approach to investing. However, investors should be mindful of additional fees and consider their preference for a purely digital platform.

Go to Dodl10. Freetrade - Best for Beginner Traders

Platform Type: Trading App / Investing App

Freetrade is a modern investment platform that caters to the needs of both novice and experienced investors. With a primary focus on simplicity and accessibility, Freetrade offers commission-free trading in a variety of assets, making it an attractive choice for those looking to enter the world of investing or seeking cost-effective options for their portfolios.

Beginner-Friendly Aspect:

Freetrade's simplicity and commission-free trading make it an excellent choice for beginners. The intuitive interface and user-friendly mobile app ensure that new investors can easily navigate the platform and start building their portfolios without the complexity of additional fees. Freetrade also provides educational resources and guides to help users get started on their investment journey.

Key Features:

One of the standout features of Freetrade is its commitment to commission-free trading. This means that users can buy and sell stocks and ETFs without incurring additional charges, making it an appealing choice for cost-conscious investors. The platform also provides real-time market data and analytics, ensuring that users have access to up-to-date information to make well-informed investment decisions. Additionally, Freetrade offers a user-friendly mobile app, making it convenient to manage your investments on the go.

Fees:

Freetrade's fee structure is straightforward and investor-friendly. As mentioned, the platform does not charge any commissions on trades, eliminating a significant cost for frequent traders. Instead, Freetrade generates revenue through its premium subscription service, which offers enhanced features for a monthly fee. There are no account maintenance fees, and the minimum deposit requirement is low, making it accessible to investors of all levels.

Pros:

Commission-Free Trading: Ideal for cost-conscious investors and frequent traders.

User-Friendly Interface: The platform's simplicity makes it accessible to beginners.

Real-Time Data: Offers up-to-date market information to support informed decision-making.

Mobile App: Allows users to manage their investments on the go.

Educational Resources: Provides resources to assist new investors in getting started.

Cons:

Premium Subscription: Some advanced features require a monthly subscription fee.

Limited Asset Selection: While Freetrade offers a variety of assets, it may not have the same extensive selection as some other platforms.

To summarise, Freetrade is a user-friendly investment platform that excels in providing commission-free trading, making it a compelling choice for investors looking to minimize costs. Its intuitive interface and educational resources are particularly beneficial for beginners. However, users should be aware of the premium subscription service for advanced features and the potential limitations in terms of available assets compared to more comprehensive platforms.

Go to Freetrade11. InvestEngine - Best Because of Real Time Data

Platform Type: Investing Platform / Investing App Although placed at the bottom of this list, Invest Engine is an investment platform that caters to both newcomers and experienced investors. It places a strong emphasis on simplicity and accessibility, offering commission-free trading across various asset types. This makes it an appealing option for individuals seeking a straightforward and cost-effective way to start investing or manage their portfolios.

Beginner-Friendly Aspect:

Invest Engine's simplicity and commission-free trading make it an excellent choice for beginners. The platform's intuitive interface and user-friendly mobile app make it easy for new investors to navigate and start building their portfolios without the complexity of additional fees.

Key Features:

One of Invest Engine's standout features is its commitment to commission-free trading. This means you can buy and sell stocks and ETFs without worrying about additional charges, making it an attractive choice for those looking to keep their investment costs low. Invest Engine also provides real-time market data and analytics, ensuring users have access to the latest information to make informed investment decisions. Additionally, Invest Engine offers a user-friendly mobile app, making it convenient for users to manage their investments from anywhere.

Fees:

Invest Engine's fee structure is transparent and investor-friendly. As mentioned, the platform doesn't charge commissions on trades, which is a significant benefit for frequent traders. Instead, Invest Engine generates revenue through its premium subscription service, offering advanced features for a monthly fee. There are no account maintenance fees, and the minimum deposit requirement is low, ensuring accessibility for investors at all levels.

Pros:

Commission-Free Trading: Ideal for cost-conscious investors and active traders.

User-Friendly Interface: The platform's simplicity makes it accessible to beginners.

Real-Time Data: Provides up-to-date market information for informed decision-making.

Mobile App: Allows users to manage their investments conveniently on the go.

Educational Resources: Offers resources to help new investors get started.

Cons:

Premium Subscription: Some advanced features come with a monthly subscription fee.

Limited Asset Selection: While Invest Engine offers various assets, it may not have the same extensive selection as some other platforms.

Invest Engine is a user-friendly investment platform that excels in providing commission-free trading, making it an attractive choice for investors looking to minimize costs. Its straightforward interface and educational resources are particularly beneficial for beginners. However, users should be aware of the premium subscription service for advanced features and the potential limitations in terms of available assets compared to more comprehensi platforms.

How to Choose a Beginner's Investing App

Beginner investors have to be aware of the risks involved when investing. They also have to look for specific features when looking for investing apps as there are multiple solutions out there that can seem complicated for investing newcomers. Thankfully I've prepared a step-by-step list of how you should choose the perfect investing app for you, if you are a beginner.

Determining Your Investment Goals

Before embarking on your investment journey, it's crucial to clearly define your financial goals. Are you aiming for long-term retirement savings, building a nest egg for a down payment, or simply diversifying your income streams? Having a clear objective will help you select the investment app that aligns with your financial aspirations.

Exploring Investment Options

Investment apps offer a variety of investment vehicles, including stocks, bonds, exchange-traded funds (ETFs), and cryptocurrency. Consider your risk tolerance and investment timeframe when choosing the types of assets you want to invest in.

Fees: The Hidden Cost of Investments

Investment apps charge various fees, such as commissions, trading fees, and account fees. These fees can significantly impact your investment returns over time. Carefully review the fee structure of each app to ensure it aligns with your budget and investment strategy.

Ease of Use: Simplicity for Beginners

As a beginner, you want an investment app that is easy to use and navigate. Look for apps with a user-friendly interface, clear explanations of investment terms, and a comprehensive educational section.

Educational Resources: Empowering Your Investing Journey

Investment apps should provide a wealth of educational resources to help you enhance your financial knowledge. This may include articles, videos, tutorials, and interactive tools that explain investment principles and strategies.

Customer Support: A Guiding Hand

Investment apps should offer responsive and knowledgeable customer support to address your queries and provide assistance when needed. This is particularly important for beginners who may have questions or need guidance.

Considerations for Choosing an Investment App:

Fees: Compare the overall fee structure, including commissions, trading fees, and account fees, to find an app that fits your budget and investment strategy.

Ease of Use: Opt for an app with a user-friendly interface, clear explanations, and a comprehensive educational section to make investment decisions confidently.

Educational Resources: Prioritize an app that provides a variety of educational resources, such as articles, videos, tutorials, and interactive tools, to enhance your financial knowledge.

Customer Support: Look for an app with responsive and knowledgeable customer support to address your queries and provide assistance when needed.

How to Invest as a Beginner in UK

As we've discussed in our in-depth guide about beginners' investing, you will need a structured approach and a clear understanding of the basics, to succeed in investing. I higly suggest that you read our guide first before started investing but here is an overview of what I've talked about in this article:

1. Educate Yourself

Understanding the Basics: Before investing, familiarize yourself with basic investment concepts like stocks, bonds, mutual funds, ETFs (Exchange-Traded Funds), and other investment vehicles. Resources like books, online courses, and financial news can be invaluable.

Risk Tolerance: Assess your risk tolerance. This involves understanding how much risk you are comfortable taking and how it aligns with your investment goals.

2. Set Clear Investment Goals

Short-term vs. Long-term: Define what you're investing for. Is it for a short-term goal like buying a car in a few years, or a long-term goal like retirement?

Specific Objectives: Be specific about your goals. For instance, instead of a vague goal like 'saving for retirement', aim for something more tangible, like 'accumulating $500,000 by age 65'.

3. Create a Financial Plan

Budgeting: Determine how much money you can set aside for investing. Look at your income, expenses, and see where you can cut back to allocate more towards investments.

Emergency Fund: Before investing, ensure you have an emergency fund, typically 3-6 months’ worth of living expenses, set aside in a readily accessible account.

4. Understand Different Investment Options

Stocks: Buying shares of a company, offering potential for growth but with higher risk.

Bonds: Lending money to a government or corporation and receiving fixed interest payments. Generally lower risk than stocks.

Mutual Funds: Pooled funds from many investors managed by professionals, investing in a mix of stocks, bonds, and other assets.

ETFs: Similar to mutual funds but traded like stocks on an exchange, often tracking a specific index.

Real Estate: Investing in property for rental income or capital appreciation.

Alternative Investments: Includes commodities, art, and cryptocurrencies. Generally riskier and more complex.

5. Choose the Right Investment Platform

Brokerage Accounts: Research and open an account with a reputable brokerage. Consider factors like fees, ease of use, available investments, and educational resources.

Robo-Advisors: For a more hands-off approach, consider robo-advisors that use algorithms to manage your investments based on your risk tolerance and goals

ETF Platforms: If you are particularly interested in ETF investing you can pick an ETF investing platform that offers both a wide range of ETFs and a great investing platform.

6. Diversify Your Investments

Spread Risk: Don’t put all your money in one type of investment. Diversify across different asset classes to spread risk.

Asset Allocation: This is how you divide your investments among different asset categories. It should align with your goals and risk tolerance.

7. Start Investing

Start Small: You don’t need a lot of money to start. Many platforms allow you to start with small amounts.

Regular Contributions: Consider setting up automatic contributions to your investment account to build your portfolio over time.

8. Monitor and Rebalance Your Portfolio

Regular Reviews: Check your investments periodically to see how they are performing against your goals.

Rebalancing: If your investments have drifted from your original asset allocation, rebalance by buying or selling assets to get back on track.

9. Stay Informed and Adjust as Needed

Stay Updated: Keep abreast of financial news and how it might affect your investments.

Adapt to Changes: Your financial situation, goals, or risk tolerance may change over time. Be prepared to adjust your investment strategy accordingly.

10. Practice Patience and Discipline

Long-term Perspective: Investing is a marathon, not a sprint. Be patient and avoid making impulsive decisions based on short-term market fluctuations.

Avoid Emotional Investing: Don’t let emotions drive your investment decisions. Stick to your plan even when markets are volatile.

How to Invest in Stocks Though?

Investing in stocks is a journey that combines education, strategy, and ongoing management. I've also done a full guide on this subject to guide beginner investors through stock picking and stock investing basics.

To begin, it's crucial to understand what stocks are: they represent ownership in a company, and as a shareholder, you can profit from capital appreciation and dividends.

Before diving in, dedicate time to educating yourself about the stock market, including different sectors and how economic factors influence stock prices. Utilize resources like books, online courses, and financial news to build a solid foundation of knowledge.

Setting clear investment goals is a vital next step. Determine whether you're investing for long-term growth, such as retirement, or short-term gains for specific upcoming expenses.

It's important to align these goals with your risk tolerance, as stocks can be volatile and present varying levels of risk. Next, you'll need to open a brokerage account. In the UK, this involves choosing between general investment accounts, Stocks & Shares ISAs, and SIPPs, each offering different tax benefits. When selecting a broker, consider factors like fees, user-friendliness, available research tools, and customer service.

Understanding different types of stocks is also key. There are blue-chip stocks from large, established companies known for stability, growth stocks from companies expected to outperform the market, dividend stocks that regularly pay out a portion of earnings, and small-cap or mid-cap stocks from smaller companies with higher growth potential but also higher risk.

Developing an investment strategy is the next crucial step. This includes deciding on your approach to diversification, spreading your investments across various companies and sectors to reduce risk, and choosing between active and passive investment strategies.

Analyzing stocks is an ongoing process. Fundamental analysis involves evaluating a company's financial health, management quality, and market position, while technical analysis focuses on stock price movements to predict future trends. When you start investing, it's wise to begin with a small amount of money and consider using stock market simulators to gain experience without financial risk.

Monitoring your investments is an ongoing responsibility. Stay informed with financial news and company updates, and regularly review the performance of your stocks. Knowing when to sell is as important as knowing when to buy. Set clear criteria for selling, whether for profit-taking or cutting losses, and strive to avoid emotional decisions driven by fear or greed.

Finally, be mindful of the tax implications of stock investing in the UK. You may be liable for Capital Gains Tax on profits, but investing through a Stocks & Shares ISA can offer tax benefits. As you gain more experience, continue learning and adapting your strategies to the dynamic nature of the stock market. Remember, investing in stocks involves risk, and it's important to be prepared for the market's inherent ups and downs.

F.A.Q.s

Is £1000 a Good Investing Amount?

Yes, £1000 is considered a good amount to start investing. It allows for reasonable growth before fees start impacting potential gains. While some investors prefer starting with larger sums, others begin with smaller amounts or regular monthly deposits. The exact amount to start investing depends on individual circumstances and the minimum requirements of chosen investment platforms. It's essential to consider your financial situation, including any existing debts and the necessity of an emergency fund, before investing.

Can I start Investing with £1?

Yes, you can start investing with as little as £1. Some investment platforms and robo-advisers allow investors to open accounts with minimal initial deposits. For example, Wealthyhood only requires an initial deposit of £1. This accessibility makes it easier for those with limited funds to begin their investment journey.

What is the Most Trusted Investment App?

The most trusted investment app can vary based on individual preferences and needs. It's important to choose apps that are regulated by relevant financial authorities and have strong customer reviews. While I can't specify the "most trusted" app without current market data, investors typically look for apps with good security measures, user-friendly interfaces, educational resources, and a range of investment options.

What is the Best Investment Platform in the UK?

The best investment platform depends on your investment goals, risk tolerance, and investment amount. Platforms like Wealthyhood, Nutmeg, and Vanguard are often recommended for different needs, such as Lifetime ISAs, SIPPs, and Stocks and Shares ISAs. Each platform has its unique features and fee structures, so it's important to research and compare based on your specific requirements. We have a full guide about the best investment platforms which you can read here.

What is the Simplest Thing to Invest In?

For beginners, exchange-traded funds (ETFs) are often considered one of the simplest investment options. ETFs allow investors to diversify their portfolios across a broad range of assets without the need to invest in individual stocks or bonds directly. They are available on most investment platforms and are suitable for those looking for a relatively straightforward way to start investing.

I am always reachable through email (george@wealthyhood.com) or on Social Media and excited to talk about anything related to investing. Feel free to connect with me and ask me any questions you might have.

Capital at risk. This article is for information purposes only and is not investment advice nor a recommendation. You should consider your own personal circumstances when making investment decisions. Past performance is not a reliable indicator of future performance. Tax treatment depends on your personal circumstances and rules can change.