In previous articles, we’ve investigated the best investment apps and platforms for general investing but today I am going to dive deep into the best ETF platforms in the UK.

I’ve created accounts for every available ETF platform in the UK and I’ve handpicked the 7 best according to specific criteria which I am sharing with you below.

Without further ado let’s find out which are the best ETF brokers for 2024.

Here is a quick list of them:

7 Best ETF Platforms in the UK

Wealthyhood - Best ETF platform for beginners

Invest Engine - Best ETF Platform Overall

Interactive Investor - Best for Intermediate Investors

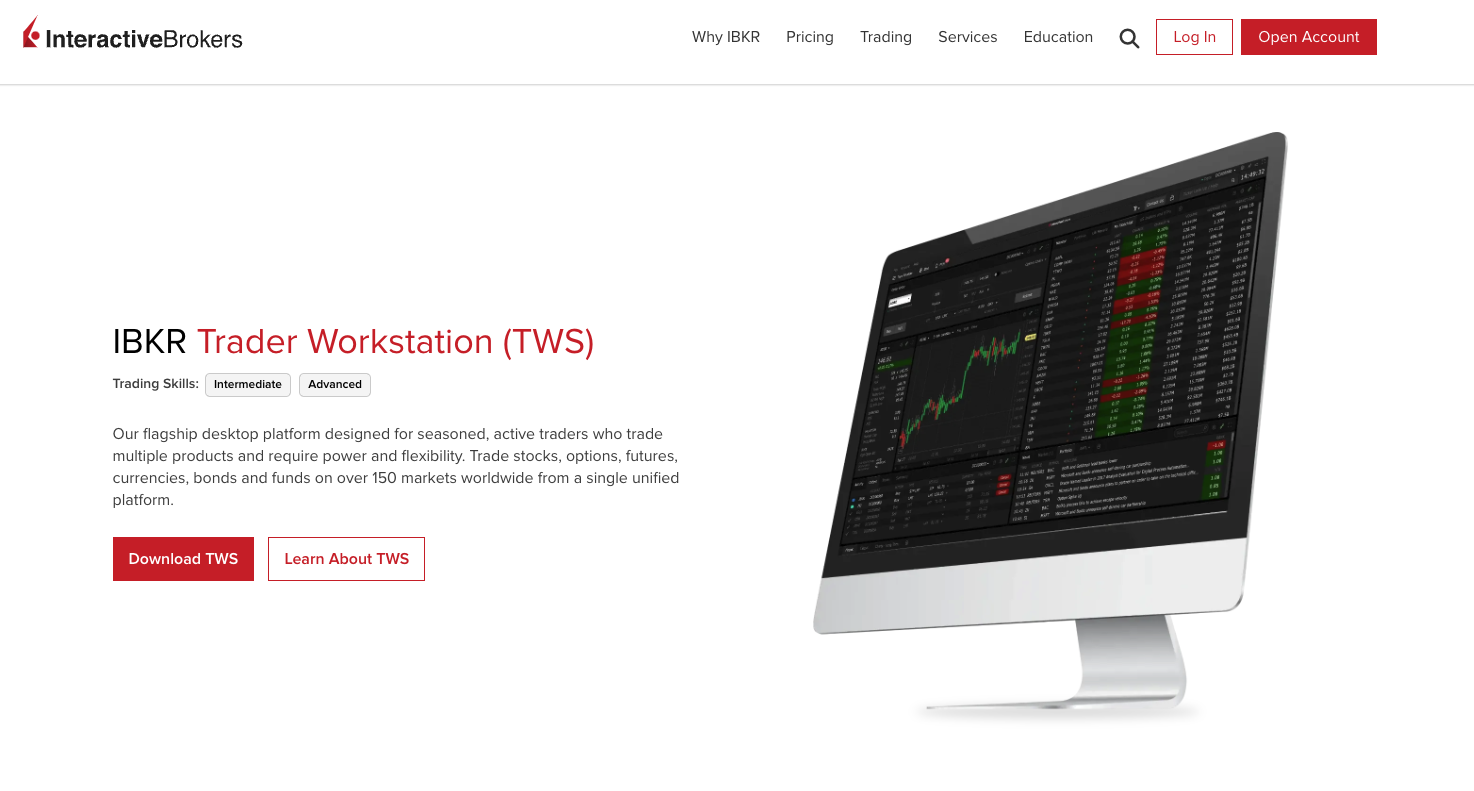

Interactive Brokers - Best For Experienced ETF Investors

Lightyear - Good for Occasional Investors

Freetrade - Cheapest ETF Platform

Saxo - Best for ETF Traders

Disclosure

I maintain no affiliate partnership with any of the etf platforms mentioned above but I am employed by Wealthyhood. The article was created to present my unbiased opinion after thorough testing and not to promote Wealthyhood's products.

ETF Brokers Comparison Table

Platform | Pricing | Fees | Number of Available ETFs | Available Investing Instruments | Customer Support | Platform User Experience |

Free and Paid Plans | Commission-free in every plan | 50 Best ETFs in the UK | ETFs, Stocks | Live Support | Simple and easy to use with automatic investing features | |

0.03% for DIY accounts or 0.25% for Managed | No fees for DIY Portfolio 0.25% annual fee for Managed Portfolio. | Over 600 ETFs | ETFs are the primary focus. | Support available | User-friendly and suitable for beginners | |

Starts at £4.99/month | £3.99/per trade | More than 1,000 ETFs | Stocks, ISA, SIPP, Funds,Bonds and more | Support available | User Frienly UI without limitations | |

Starts at £1/trade | 0.05% of Trade Value | More than 1,000 ETFs | ETFs, Stocks, CFDs, Options, Metals, Bonds and more | Support available | Perfect for advanced Traders | |

£1/trade for stocks No fee for ETFs | Free for ETFs | About 40 for the UK, 160 in Total | ETFs, Stocks, and Interest on Cash | No Live Support | Simple and easy to use but limited tools. | |

Free and Paid Plans | Commision free trades / 0.45% currency conversion fees | 400 | ETFs, Stocks | No live support | Simple Platform with lack of advance features in free plan | |

£3 minimum per share + custody fees | 0.08% | 7000+ | ETFs, Stocks, Bonds, CFDs, Mutual Funds | No live support | Advanced Platform with steep learning curve |

How Do I Evaluate ETF Brokers?

In preparing this review on the top ETF platforms, I, as Wealthyhood's Head of Growth, employed a thorough approach, actively analyzing and testing various investing platforms and apps over four months.

This process was integral to my role, aiming to understand the competitive landscape and identify the best solutions for ETF investing in the UK that I am going to share with you now.

It’s important to clarify that the platforms mentioned here are considered the best for UK investors in no particular order. I’ve also done my best to maintain an unbiased and neutral position for Wealthyhood (which is included in this list) and the content provided does not exaggerate, oversell, or make fake promises.

Here are the key points that I took into consideration to create this comparison review of the best ETF platforms for UK investors.

Number of ETFs Available

Fees, Commissions and Costs

Platform User Experience

Availability of other Features and Investment Instruments

Customer Support

You may notice that eToro is missing from this list while many others are mentioning as one of the best brokers for ETF buying. This is because most of these recommendations come from affiliate sites, which means that they get paid a commission every time some clicks on their links. In my opinion, eToro shouldn’t be included in the main list as it falls behind other brokers when it comes to ETF investing.

In-depth review of the Best ETF Platforms in The UK

1.Wealthyhood - Best ETF Platform for Beginners

Pricing | Fees | Number of Available ETFs | Other Available Investing Instruments | Customer Support | Platform User Experience |

Free and Paid Plans | Commission-free in every plan | 50 Best ETFs in the UK | ETFs, Stocks | Live Support | Simple and easy to use with automatic investing features |

Overview

Wealthyhood, a fresh face in the investment app landscape, aims to simplify investing for beginners and small investors.

It stands out for its commission-free model and focuses on ETF investing, featuring all major ETFs for UK users, and promoting a DIY approach to wealth building. Wealthyhood offers both an investment platform and an investing app available for Android and IOS.

Available ETFs

Wealthyhood allows investors to create a personalized portfolio of ETFs, focusing on various asset classes such as stocks and shares, bonds, commodities, and property.

It offers guided steps to help users decide on their investment allocations based on geographical and sector preferences.

The range of investments is also great, offering hundreds of stocks and ETFs from various sectors like the Property market and Precious metals. Soon they will also add Money Market funds which means that investors will be able to earn interest on their uninvested cash. It’s important to mention that users who subscribe to the paid plan will also benefit from the 4% dividend which is ludicrous.

Costs

Wealthyhood's fee structure is highly appealing for those looking to invest with minimal costs.

Deposits on Wealthyhood are completely free, which means that your capital won’t erode every month if you regularly top up your account.

The platform also offers free ETF investing for the paid plans with no account charges and 0.45% per order for the free plan making it one of the most cost-effective options for starting small.

The platform operates on a subscription model, with plans starting with £0 and commision free for the free plan, £2.99 for the Plus plan and £12.99 for the Gold plan.

Other Features

Wealthyhood provides features like auto-investment and portfolio rebalancing to help manage investments effectively over time making it an effective automatic investing app.

The platform guides users through creating a professional investment portfolio suited to their goals and allows for customization and adjustment based on risk tolerance and market changes. There is also live customer support ready to assist investors throughout their building journey making it a great investing app for beginners.

Personal Take

I’ll try to keep this as unbiased as possible.

Wealthyhood offers a promising option for beginners looking to enter the world of investing without being overwhelmed by complex choices or high fees.

It's commission-free investing in ETFs in the paid plans and straightforward portfolio creation process caters well to those who prefer a guided but hands-on approach to investing. However, for users who are looking for ISA accounts or a greater range of investing instruments this might find the platform restrictive. As Wealthyhood continues to develop, it's worth watching for potential enhancements and expansions as new features like ISA and returns on cash balances through Money Market Funds are on the roadmap.

Try Wealthyhood2.InvestEngine - Best ETF Platform Overall

Pricing | Fees | Number of Available ETFs | Other Available Investing Instruments | Customer Support | Platform User Experience |

0.03% for DIY accounts or 0.25% for Managed | No fees for DIY Portfolio 0.25% annual fee for Managed Portfolio. | Over 600 ETFs | ETFs are the primary focus. | Support available | User-friendly and suitable for beginners |

Overview

In my opinion, if you truly care about ETF investing, Invest Engine should definitely be on your radar. This is because this platform not only offers but also maintains low fees making it perfect for ETF investors who like to rebalance their portfolios or change strategies.

On top of that, it also offers managed portfolio services.

Available ETFs

The platform boasts a significant range of over 600+ ETFs, which is quite impressive. These ETFs span various sectors and geographies, offering ample opportunities for portfolio diversification. The platform specializes solely in ETFs, and while it may not provide individual stocks or a vast range of other investment instruments, its focus on ETFs allows for streamlined and efficient investment management.

Costs

Invest Engine stands out for its minimal fee structure and transparent pricing. The platform charges no account fees for DIY portfolios and a competitive 0.25% annual management fee for its managed portfolios.

Additionally, it offers tax-efficient accounts like Stocks & Shares ISAs, free from income or capital gains tax, further enhancing its appeal to cost-conscious investors. Notably, the platform doesn’t charge for trading fees, except for the spread, and the annual ETF costs vary depending on the portfolio type, hovering around 0.15% to 0.5%.

Other Features

A unique aspect of Invest Engine is its fractional investing feature, which allows investors to start with as little as £1.

This, combined with its automated investing and portfolio rebalancing services, makes the platform highly accessible, especially for new investors. However, it's worth noting that the platform's tools are relatively basic and may not suit investors seeking advanced charting or technical analysis capabilities.

Personal Take

Particularly for ETF-focused investors I believe that Invest Engine is an excellent choise. Its low fees and no-cost approach for DIY portfolios are particularly attractive.

While the platform's focus on just ETFs might seem limiting to some, it offers a simplified and efficient way to diversify investments.

It’s also important to mention that it lacks advanced trading tools and has a limited market reach (primarily the London Stock Exchange) which might be a downside for some more advanced investors. However, for those looking to invest primarily in ETFs with a straightforward, cost-effective platform, Invest Engine certainly stands out

Go to Invest Engine3.Interactive Investor - Best for Intermediate Investors

Pricing | Fees | Number of Available ETFs | Other Available Investing Instruments | Customer Support | Platform User Experience |

Starts at £4.99/month | £3.99/per trade | More than 1,000 ETFs | Stocks, ISA, SIPP, Funds,Bonds and more | Support available | User Frienly UI without limitations |

Overview

Interactive Investor provides a broad range of investment choices, including Stocks & Shares, ETFs, Investment Trusts, Bonds, and more.

It stands out for offering more than 1,000 ETFs, and 40,000 global shares and Funds, covering multiple regions and currencies. The platform is known for its user-friendly design, making it accessible to both beginners and experienced investors.

Available ETFs

It’s not clear how many ETFs exactly Interactive Investor features but on their ETF page they claim that more than 1,000 ETFs are available. Interactive Investor's extensive selection includes Share ETFs and Index ETFs. Interactive Investor also provides access to a list of 60 handpicked ETFs called Super 60, including both active and passive funds, investment trusts and ETFs.

The platform allows investors to access a wide range of ETFs, both from the UK and international markets. This diversity enables investors to create diversified portfolios and align their investments with various market trends, including socially responsible investing.

Costs

Interactive Investor employs a clear, flat fee structure, with monthly plans ranging from

£4.99 to £19.99, depending on the account type and investment level. The platform offers several subscription plans, including Investor Essentials, Investor Account, and Super Investor Account, each tailored to different investment sizes and needs.

Trading fees for UK and US shares, including ETFs, are generally £3.99/trade, with other international share trades costing £9.99. Notably, the platform pays interest on cash balances, which is a unique feature.

Other Features

The platform is noted for its robust research tools, educational resources, and customer support.

Interactive Investor offers comprehensive market analysis and expert insights, making it easier for investors to make informed decisions. The security and reliability of the platform are also highly rated, with advanced encryption and secure login processes in place.

Personal Take

From my perspective, Interactive Investor is a top choice for those who seek a wide array of investment options beyond just ETFs.

Its flat fee structure is particularly appealing for active traders, though it might be less economical for infrequent traders or those with small portfolios. The platform's extensive research tools and resources are excellent for informed decision-making, catering to investors at all levels. Moreover, the positive customer feedback and high Trustpilot score reflect the platform's reliability and user satisfaction.

However, I wouldn’t suggest it to investors with smaller sums to invest, that are not really interested in such a variety of investment options as the costs will significantly erode their portfolio. For this kind of investor, Invest Engine or Wealthyhood might be a better choice.

Go to Interactive Investor4.Interactive Brokers - Best ETF Platform for Advanced Investors

Pricing | Fees | Number of Available ETFs | Other Available Investing Instruments | Customer Support | Platform User Experience |

Starts at £1/trade | 0.05% of Trade Value | More than 1,000 ETFs | ETFs, Stocks, CFDs, Options, Metals, Bonds and more | Support available | Perfect for advanced Traders |

Overview

Interactive Brokers is an ETF trading platform that I would recommend to those who are looking to trade ETFs instead of using more passive investing methods like DCA.

Known for its global reach and extensive range of investment options, it offers robust tools and resources that can significantly enhance the trading experience. The platform is particularly appealing for those interested in diversifying their portfolios through international exposure.

Available ETFs

While it’s not clear how many ETFs are available on this platform after having tested the platform I can say that UK investors have access to an impressive array of ETFs (more than 1,000), including both UK and international options.

This extensive range allows for diversified investment strategies, aligning with various market trends and investment preferences. The platform’s ability to offer access to foreign stocks in over 150 global markets, including a wide range of ETFs, is a significant advantage for portfolio diversification.

Costs

Interactive Brokers’ fee structure is particularly attractive for ETF traders and investors.

For UK users, the commission fees are structured based on the monthly trade value. The fees are calculated in tiers, with lower percentages charged for higher trade values starting from 0.05% and going up to 0.015%.

There's also a minimum fee per order which is between £1,00 and £4,00.

Other Features

One of the highlights of Interactive Brokers is its range of trading platforms, catering to different experience levels.

The Trader Workstation (TWS), for example, is ideal for active traders requiring extensive functionality and power. Additionally, the availability of robust research tools, educational resources, and access to overnight trading are features that I find particularly valuable.

Personal Take

In my humble opinion, Interactive Brokers is an excellent choice for UK investors seeking a platform with a global reach and a diverse range of ETFs to actively trade on.

The low fee structure is an attractive feature, particularly for those looking to invest in U.S. markets. However, the platform can be overwhelming for beginners due to its complexity.

The advanced tools and comprehensive market research offerings make it a more suitable option for experienced investors. Nonetheless, the flexibility and the variety of options in plans allow for a tailored trading experience depending on individual investment needs and expertise.

Go to Interactive Brokers5.Lightyear - Good for Occasional Investors

Pricing | Fees | Number of Available ETFs | Other Available Investing Instruments | Customer Support | Platform User Experience |

£1/trade for stocks No fee for ETFs | Free for ETFs | About 40 for the UK, 160 in Total | ETFs, Stocks, and Interest on Cash | No Live Support | Simple and easy to use but limited tools. |

As someone very interested in what Wealthyhood competitors are doing, I am always on the lookout for innovative financial tools. So I recently explored Lightyear, a newer player in the ETF investment platform scene.

Lighyear has a focus on ETFs and stocks, and it’s tailored for the long-term investor. The ease of navigating its mobile trading platform, combined with the reassurance of being regulated in both the UK and Estonia, presents a secure and user-friendly investing experience.

Available ETFs

While the official number of their available ETFs is not stated clearly, I counted by hand about 160 ETFs specifically 40 for the UK users.

Lightyear also offers the ability to buy fractional shares but buying fractional ETFs is not possible which is not great for everyday investors.

The platform's curated selection of ETFs, ranging from sector-specific themes like technology and renewable energy to broad market indices such as the Vanguard S&P 500, offers a strategic blend of investment opportunities.

Costs

What truly sets Lightyear apart is its competitive fee model. The platform champions commission-free ETFs and boasts minimal stock trading fees, capped at a mere £1 for US stocks.

Its currency conversion fees are equally attractive, ensuring investors can manage their portfolios without fretting over excessive costs. Notably, Lightyear maintains a no-fee policy on account management, inactivity, and withdrawals, enhancing its appeal.

However, depositing money in your account will cost you 0.5% for depositing and 0.35% for currency conversion. While this may sound small, if you are DCAing every month these fees could stack up pretty fast.

Other Features

Lightyear's appealing interest rates on uninvested cash, reaching up to 4.5% for USD and GBP, further enhance its value proposition. Also, the platform's mobile application is a standout, providing comprehensive stock information, real-time price alerts, and a seamless interface for managing investments effortlessly.

Personal Take

In my exploration of Lightyear, the platform's dedication to low fees, especially the absence of commissions on ETFs and reasonable stock trading fees, is commendable.

The unique advantage of earning interest on uninvested cash is a thoughtful addition that distinguishes Lightyear.

The platform doesn’t excel in its range of ETFs, and those seeking broader investment vehicles may find it somewhat restrictive.

The mobile app's functionality and the convenience of managing investments on the move are major pluses. However, the platform's limited educational resources and lack of live support might pose challenges for newcomers to investing.

Go to Lightyear6. Freetrade - Cheapest ETF Platform

Pricing | Fees | Number of Available ETFs | Other Available Investing Instruments | Customer Support | Platform User Experience |

Free and Paid Plans | Commision free trades / 0.45% currency conversion fees | 400 | ETFs, Stocks | No live support | Simple Platform with lack of advance features in free plan |

Overview

Freetrade is a UK-based fintech startup offering a straightforward and user-friendly platform for trading stocks and ETFs without commission.

The platform is especially appealing to beginners due to its seamless, fully digital account opening process and its highly-rated mobile app. Freetrade emphasizes commission-free trading across its product portfolio, which includes a wide array of ETFs among other securities.

Available ETFs

Freetrade provides access to over 400 ETFs, including major ones like Vanguard S&P 500, INVESCO NASDAQ 100, and Vanguard FTSE 1000.

It supports trading on various international stock exchanges, including NASDAQ, NYSE, London Stock Exchange, and several Euronext locations, making it possible to diversify across markets. However, it's important to note that Freetrade focuses on real stock and ETF trading, excluding CFDs from its offerings.

Costs

One of Freetrade's major selling points is its fee structure. The platform offers commission-free trading for stocks and ETFs, though it does apply a currency conversion fee of 0.45% for trades in non-GBP currencies.

There are no account, inactivity, or withdrawal fees, but Freetrade offers a Basic Plan for free and two subscription-based plans:

Standard and Plus, which cost £5.99 and £11.99 per month, respectively. These plans provide access to additional features and investment options.

Other Features

Freetrade doesn't offer margin trading, keeping in line with its focus on long-term investment rather than speculative trading. The platform is of coutse regulated by the Financial Conduct Authority (FCA) in the UK, offering a high level of investor protection of up to £85,000 under the FSCS.

Personal Take

Freetrade stands is a simple ETF trading solution and an attractive option for those new to investing or looking for an uncomplicated way to trade ETFs and stocks without worrying about complex fee structures.

The commission-free model is making it one of the most cost-effective investing platforms in the market, although potential users should be aware of the currency conversion fees and the limitations of the free plan.

The platform's focus on ETFs and the ease of use of its mobile app make it a strong contender for anyone looking to start or simplify their investment journey.

However, experienced traders looking for a broader range of investment vehicles or more advanced research and trading tools might find Freetrade's offerings somewhat basic.

Go to Freetrade7.Saxobank - Best for ETF Trading

Pricing | Fees | Number of Available ETFs | Other Available Investing Instruments | Customer Support | Platform User Experience |

£3 minimum per share + custody fees | 0.08% | 7000+ | ETFs, Stocks, Bonds, CFDs, Mutual Funds | No live support | Advanced Platform with steep learning curve |

Overview

Saxo Bank, a premier trading and investment ETF platform, offers a sophisticated yet intuitive interface that I would only suggest to serious investors ideally with a large capital or traders interested in sophisticated trading tools.

With regulatory oversight in multiple countries, it provides a secure and comprehensive trading environment.

Available ETFs

The platform boasts an expansive selection of ETFs (more than 7000 as it’s claimed on their website), enabling investors to diversify across various sectors and geographical regions globally.

This wide array ensures opportunities for strategic portfolio allocation tailored to individual investment goals.

Costs

Saxo Bank's fee structure is definitely not the most straightforward or the most affordable on this list. There is a £3 minimum per share or ETF or 0.1% transaction fee.

However, it also applies custody fees and higher fees for trading options and futures. The minimum deposit varies by country and their etf commissions are presented on their official website. As I mentioned earlier this is a great platform for traders or investors with larger sums but for smaller investors Saxo would be a bad pick.

Other Features

The platform stands out for its advanced trading tools and features, including detailed charting capabilities and extensive research resources.

Saxo Bank's platforms, SaxoTraderGO and SaxoTraderPRO, cater to a range of investor needs, from casual traders to professionals.

Personal Opinion

Saxo Bank is suited for investors who value a high-quality trading experience and are willing to navigate its complex fee structure and account requirements. If you are a beginner with smaller capital you shouldn’t even consider using Saxo as other ETF brokers like Wealthyhood or Invest Engine would make more sense in terms of cost effectiveness.

The bank's advanced platform and broad market access are significant advantages for those seeking depth in research and analytics. However, potential users should consider the costs associated with higher-end services and the minimum deposit requirement to ensure they aligns with their investment strategy and budget.

Go to Saxo

Best ETF Platforms for Beginners

I know that many of you, reading this article are probably beginners so I created a mini list of the best ETF platforms for beginners. My review is based on the critical aspects that matter most to those new to investing, such as ease of use, educational resources, and the overall cost of investing. Here's my personal take on the top ETF platforms that cater to beginners.

Wealthyhood - Great Investing App for Beginners

This is the best ETF app I've encountered so far. The platform's intuitive design and straightforward approach to investing make it my top recommendation for anyone just starting out. Wealthyhood is designed with the beginner in mind, offering a seamless entry into the world of ETFs without overwhelming users with complexity.

InvestEngine - Best for ETF Beginners

I consider InvestEngine one the best ETF platform in the UK for beginners. It strikes an excellent balance between offering comprehensive investment options and maintaining an accessible platform for those new to investing. The educational resources available here are particularly helpful, guiding users through the basics of ETF investing and helping them make informed decisions.

Freetrade - Best for Cost-Aware Investors

Freetrade is one more great pick specifically for beginners. The user-friendly interface combined with the 0 fees even in the free plan makes Freetrade an attractive option for beginners. It's a straightforward platform that encourages new investors to take the first step into investing without any unnecessary complications.

Lightyear - Good for Occasional Investors

The low-cost structure of Lightyear makes it accessible for anyone looking to start investing without a significant financial burden. It's an excellent platform for those who want to dip their toes into the investment world without committing a large sum of money upfront.

In my testing, these platforms have proven to be the best starting points for beginners in the ETF investment journey. Each platform has its unique strengths, whether it's the cost-effectiveness of Lightyear, the user-friendly interface of Wealthyhood, the educational resources of InvestEngine, or the enticing 0 fees offered by Freetrade. My exploration into these platforms has been enlightening, and I believe they offer a solid foundation for anyone looking to begin their investment journey with ETFs.

Best ETF Platforms for Trading

Some of you might be more interested in trading ETFs instead of investing for the long term. The following platforms (some of them were not included to the main list, as I wouldn’t consider them the best for all-around ETF investing) are great for trading as they offer various tools that can be handy to professional traders, like charting and buying orders or Stop Loss functionality. Some of them also offer CFDs which are preferred by traders due to their flexibility.

XTB - Lowest Cost ETF Trading Platform

XTB provides a compelling choice for ETF traders looking for a user-friendly interface and competitive pricing. Known for its award-winning trading platform, XTB offers access to a vast array of global ETFs, making it a solid option for those looking to diversify internationally.

The platform's standout features include real-time market analysis, comprehensive educational resources, and transparent fee structures. With XTB, traders can enjoy commission-free trading on select ETFs, making it an attractive option for both novice and experienced investors.

Saxo - Most Comprehensive Trading Tools

Saxo Bank is a global leader in online trading and investment, offering sophisticated trading tools and access to a wide range of ETFs across global markets.

As mentioned earlier, Saxo stands out for its comprehensive research tool and, detailed market analysis. Although the platform may come with a steeper learning curve, its extensive offerings make it a top choice for traders looking for depth and breadth in ETF investments.

IG - Good Charting Tools

IG is a leading online trading and investments provider that offers a comprehensive platform for ETF trading.

With its user-friendly interface, IG caters to both beginners and experienced traders. The platform provides access to thousands of ETFs across global markets, along with detailed analytics, live data feeds, and advanced charting tools.

IG's competitive pricing, including low commission fees and tight spreads, makes it an attractive option for those looking to trade ETFs efficiently and cost-effectively.

eToro - Best for Beginner Traders

eToro stands has an innovative approach to trading and investment, particularly with its social trading features.

This platform allows users to copy the trades of successful traders, making it an excellent option for those new to ETF trading or looking to leverage the expertise of others.

eToro offers a wide range of ETFs on a commission-free basis, coupled with a user-friendly platform that simplifies the trading process. Additionally, eToro's community-focused features, such as forums and discussions, provide valuable insights and networking opportunities.

Why Even Invest in ETFs?

Investing in ETFs (Exchange-Traded Funds) offers a compelling blend of simplicity, diversity, and cost-effectiveness, making them an attractive choice for both novice and seasoned investors.

ETFs allow individuals to buy into a basket of stocks, bonds, or other assets, providing instant diversification with just a single transaction.

This diversification can significantly reduce the risk associated with investing in individual stocks.

Furthermore, ETFs are known for their lower expense ratios compared to traditional mutual funds, meaning investors can keep more of their returns. They also offer the flexibility of trading like a stock, with the ability to buy and sell throughout the trading day at market price, which can be beneficial for those looking to capitalize on short-term market movements.

Additionally, the transparent nature of ETFs ensures that investors have a clear understanding of what they are invested in.

Whether you're aiming to build a robust, diversified portfolio or seeking exposure to specific sectors, industries, or global markets, ETFs can serve as an essential tool in achieving your investment goals.

How to Buy ETFs

Buying ETFs is a fairly easy task especially if you use one of the apps mentioned in this article

For this short guide we are going to use Wealthyhood as an example.

Step 1 - Create an Account

To buy ETFs with Wealthyhood, the first step is to create an account on the platform, which involves providing some personal information, completing a verification process, and linking your bank account for funding purposes.

Step 2 - Select your ETFs

Once your account is set up and funded, you can navigate through Wealthyhood's user-friendly interface to explore its wide range of available ETFs. Wealthyhood typically categorizes ETFs by sectors, geographic regions, or investment themes, making it easier for you to find ETFs that align with your investment goals.

Step 3 - Specify the Ammount

When you've selected the ETFs you wish to invest in, you can specify the amount you want to invest or the number of ETFs you wish to purchase. Wealthyhood allows for fractional ETFs, meaning you can invest specific dollar amounts and buy fractions of ETFs regardless of the ETF price.

Step 4 - Confirm Buy

After confirming your transaction details, execute the trade. Wealthyhood's platform will then process your order and add the ETFs to your portfolio. It's also advisable to take advantage of Wealthyhood's tools and features for portfolio management and strategic planning, helping you to make informed investment decisions and to monitor your investments over time.

Step 5 - Monitor your Portfolio

Monitor your portfolio. Your investing journey doesn’t stop there. After buying your ETFs you’ll maximize your portfolio. This is a general rule that should be followed regardless of the investment vehicle. Investing requires attention and strategy and that’s why you’ll need to always be aware of changes in the market regime or lookout for better alternatives.

What is the Cheapest Way to Invest in ETFs in The UK?

The cheapest way to invest in ETFs involves several strategies aimed at minimizing fees and maximizing returns. You can start by picking one of the most affordable ETF platforms mentioned in this article like Wealthyhood, Freetrade, or Lightyear. But here are some key approaches to reduce your costs as much as possible:

Choose Commission-Free Platforms: Many online brokers and trading platforms offer commission-free trading for ETFs. By selecting these platforms, you can save on the costs associated with buying and selling ETF shares.

Look for Low Expense Ratios: The expense ratio is an annual fee expressed as a percentage of your investment in the fund. It covers the fund's operational costs. Choosing ETFs with low expense ratios can significantly reduce your costs over time, especially important for long-term investments.

Opt for No-Transaction-Fee ETFs: Some brokers offer a selection of ETFs that can be traded without transaction fees. While the selection may be limited, investing in these ETFs can help avoid costs associated with frequent trading.

Consider Using a Robo-Advisor: Robo-advisors often offer low-cost ETF investment strategies. They use algorithms to manage your investment portfolio, typically at a lower cost than human financial advisors. Some robo-advisors specifically focus on creating diversified portfolios using low-cost ETFs.

Automatic Investment Plans: Some platforms allow for automatic investing in ETFs, which can sometimes reduce or waive transaction fees. This not only saves money but also encourages a disciplined, long-term investment approach.

Tax Efficiency: ETFs are generally more tax-efficient than mutual funds due to their unique structure and lower turnover rates. Investing in ETFs through tax-advantaged accounts like ISAs or pensions can also help maximize after-tax returns.

Do Your Research: Before investing, compare different platforms and ETFs to find the best combination of low fees, reliable performance, and suitable risk level for your investment goals.

By employing these strategies, investors can significantly reduce the costs associated with ETF investing, ensuring a larger portion of their investment returns contributes to their financial goals.

Conclusion

In wrapping up our exploration of the best ETF investment platforms, it's clear that selecting the right platform is pivotal to your investing journey.

We've navigated through various options to help you make an informed decision that aligns with your investment goals and preferences.

Remember, while some platforms might come highly recommended, it's essential to consider your specific needs, including fees, accessibility, and the range of ETFs offered.

As the investing landscape continues to evolve, staying informed and adaptable will be key to maximizing your investment potential.

Happy investing, and may your portfolio grow with your aspirations!

Always happy to talk about anything related to investing. Don’t hesitate to reach me on Linkedin or send me an email at george@wealthyhood.com to take talk about stocks, ETFs or the economy in general.

Capital at risk. This article is for information purposes only and is not investment advice nor a recommendation. You should consider your own personal circumstances when making investment decisions. Past performance is not a reliable indicator of future performance. Tax treatment depends on your personal circumstances and rules can change.