Investing often seems exclusive for the wealthy - but unlocking the stock market can be surprisingly affordable in bite-sized amounts today. Micro-investing apps now empower anyone to securely grow modest sums long-term.

This guide cuts through the noise to spotlight the best micro-investment platforms in the UK for kickstarting your wealth-building journey or augmenting existing holdings through clever automation. Gain actionable insights tailored to your risk appetite and financial targets without needing large upfront capital.

I’ve downloaded each one of those apps and tested them extensively to create this comparison review article. If you believe that an app is missing from this article then feel free to reach me on Linkedin or by email (george@weathyhood.com) and let me know; I am always trying to keep these articles up to date and helpful.

Key Takeaways:

Moneybox stands out as the most popular app for micro investing in the UK, with intuitive tools to develop long-term savings habits through spare change investing.

We found Wealthyhood is the best micro-investing app for beginners who are seeking guidance with their portfolio creation.

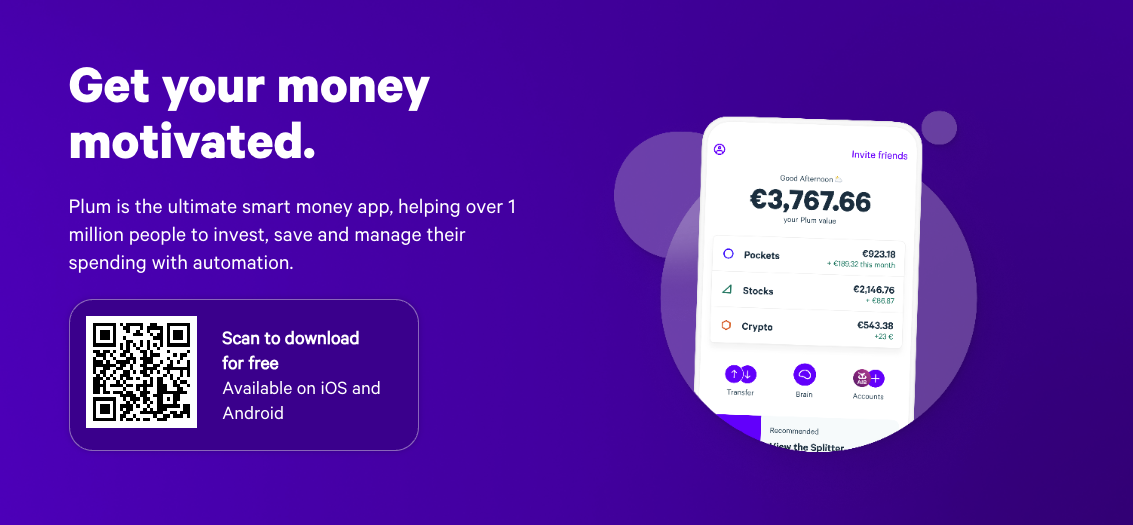

Plum is a top contender for its automation in optimizing spending, saving, and hands-off investing based on personalized financial analysis and education.

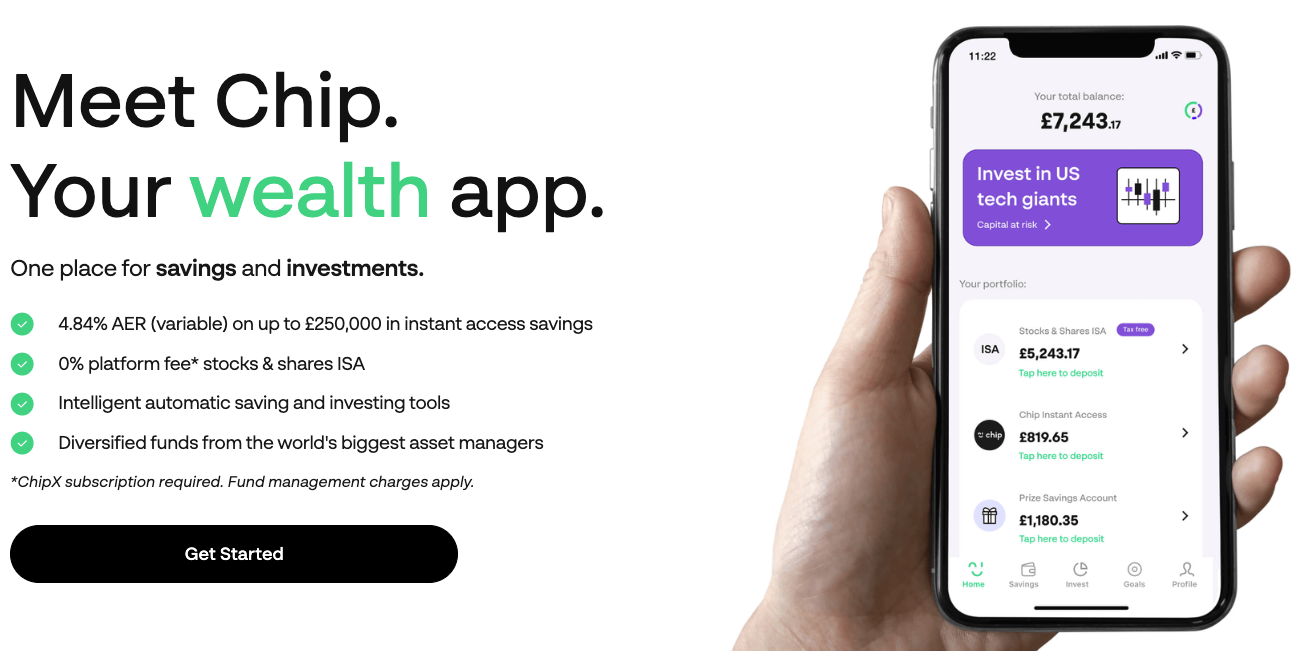

Chip follows closely behind for its seamless integration with bank accounts to enable automated micro-savings and access to diverse fractional investments.

Wealthify and Nutmeg lead in the robo-advisor space with easy account setup, portfolio creation and ongoing rebalancing suited to passive investors with £500+ initial deposits.

Freetrade's unlimited zero-commission trading model grants all investors access to fractional shares and tax wrappers like stocks ISAs for steady wealth building.

Summary of Micro Investing Apps

Platform | Fees | Best For | Ease of Use Rating |

Moneybox | Annual Platform Fee (£1 per month for Investing Account) and Trading Fees (typically 0.45% per year of the fund value for equity funds) | Beginner investors, those who want a simple introduction to investing with low minimum deposits | 4.7 |

WealthyHood | No Fees in the paid plans. 0.45% on the free plan | Beginners looking for simplified investing processes and personalized portfolios | 4.8 |

Wealthify | Annual management fee starting at 0.7% for general investment accounts and slightly lower for ISAs and pensions | Investors looking for a hands-off approach with diversified portfolios and ethical investment options | 4.5 |

Nutmeg | 0.45% up to £100k assets, 0.35% on value above £100k, plus underlying fund fees averaging 0.22% annually | Those seeking a hybrid digital-human service with expert oversight and managed portfolios | 4 |

Moneyfarm | Management fee starting at 0.7% up to £100k assets, reducing incrementally for larger portfolios, plus £3 trading fees per transaction | Investors looking for a balance of automation and personalization with dynamic asset allocation | 4.5 |

Plum | Free for basic features, £2.99 to £9.99 monthly for Invest account with auto-investing capabilities | Users seeking a comprehensive money management solution with budgeting, saving, and investing tools | 4 |

Chip | Free for basic saving and budgeting, £5.99 monthly for ChipX with auto-investing and additional features | Those looking for automated savings and investments with personalized tips and education | 4 |

Acorns | Subscription model with Lite at $1/month, Personal at $3/month, and Family at $5/month | U.S. residents interested in spare change investing with Round-Ups and diversified portfolios | 4 |

Freetrade | Free share dealing, optional Plus subscription at £9.99/month, foreign exchange charges of 0.45% for non-GBP stocks | Those looking for commission-free trading and access to fractional shares in UK, US, and European stocks | 4.5 |

Lightyear | £1 per trade for European shares, £1.99 for US stocks, no monthly account fees, 0.35% FX fee for currency conversion | Investors seeking a low-fee, mobile-first experience with commission-free ETFs and cheap share dealing | 4 |

What is Micro Investing?

Micro-investing refers to the practice of regularly investing small, incremental amounts into the stock market, typically via easy-to-use intuitive mobile apps.

How to Choose the Right Micro Investing App

While experimenting with micro-investing, I've learned it's crucial to carefully consider fees and charges, as they can significantly impact returns, particularly with smaller investments. I always look closely at the fee structures of different apps, keeping an eye out for monthly subscriptions, trading commissions, and management fees that could eat into my gains.

Before I commit, I calculate the total costs, considering how I plan to invest over time. For example, I compare the cost of regular small investments in fractional shares against larger, less frequent stock purchases.

I prefer investing apps with transparent pricing models that clearly outline all fees, including platform charges and foreign exchange rates for international investments. I've found that the best micro-investing apps prioritize user returns over their revenue.

When assessing investment options and features, the variety and functionality offered by an app significantly influence my choice. I check if an app provides access to specific markets or assets, like US tech stocks or niche ETFs, and whether there are any restrictions on the types of contributions I can make.

Features like automatic rebalancing, tax-efficient accounts like ISAs, and even cash management accounts can be real game-changers. They not only make investing more efficient but can also significantly enhance returns through tax savings and better portfolio management.

In summary, choosing the right micro-investing app for me involves a careful balance of fees, investment options, and features that align with my long-term financial goals and strategy.

Best Micro-Investing Apps for Easy Investing

1. Moneybox Platform Overview and Analysis

Moneybox is a standout micro-investing app in the UK, notable for its user-friendly approach to investing. Since its inception in 2016, it has grown to over a million users, appealing particularly to those new to investing.

Key Micro Investing Features:

Round-Up Investing: A signature feature where spare change from everyday transactions is invested. For example, a purchase of £2.60 results in 40p being added to your investment account.

Diverse Investment Options: Includes stocks, shares ISAs, and cash savings, catering to different risk profiles and financial goals.

Pre-Made Investment Plans: Beneficial for beginners, these plans simplify the investment process based on your risk tolerance.

Educational Resources: Moneybox provides a learning-friendly environment with easy-to-understand content for investment novices.

Regulation and Safety:

Moneybox is regulated by the Financial Conduct Authority (FCA), ensuring adherence to strict financial standards. Key aspects include:

Segregated Client Accounts: Funds are kept separate from the company’s finances.

Encryption and Data Security: Uses 256-bit encryption to protect user data.

FCA Oversight: Regular reporting and audits maintain transparency and trust.

Fees:

Understanding the fee structure is crucial:

Annual Platform Fee: A fixed yearly fee for account maintenance.

Trading Fees: Variable charges based on the type of assets held.

While these fees are competitive, they can impact overall returns, especially for small-scale investors.

Ease of Use:

Moneybox is particularly user-friendly:

Simple Setup: Requires only basic personal details.

Intuitive Interface: The app is easy to navigate.

Automated Savings: The “round-up” feature passively adds to your investments.

Educational Tools: Enhances investment knowledge through various mediums.

Pros and Cons:

Pros:

User-friendly for beginners.

Small initial investment requirement.

Educational resources for financial literacy.

Diverse investment options with pre-made plans.

Cons:

Fees may reduce returns on small investments.

Limited customization for advanced investors.

Inherent risks in investment compared to cash savings.

Time needed for significant portfolio growth.

Moneybox offers an accessible entry into investing, particularly suited for those new to the financial market. It balances educational resources with a range of investment options, making it an excellent choice for building foundational investment knowledge and habits. However, users should be aware of the fees and inherent investment risks, especially when starting with smaller amounts.

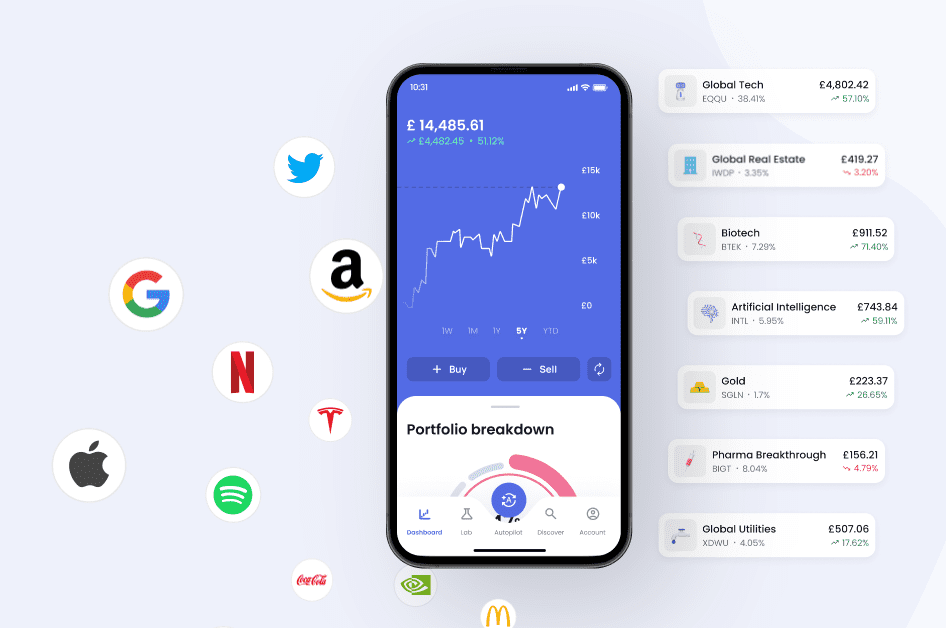

Go to Moneybox2. WealthyHood Platform Overview and Analysis

WealthyHood has emerged as a notable investing platform, particularly in the UK, tailored to beginners. It distinguishes itself by simplifying the investment process, a feature that resonates well with those just starting their investment journey.

Key Micro Investing Features:

Initial Deposit as Low as £1: Allows users to start investing with minimal amounts.

Diverse Investment Choices: Offers stocks, ETFs, fractional shares, and more, catering to various risk appetites and financial goals.

Preset Combined Portfolios: Ideal for novices, these portfolios are aligned with different risk levels, simplifying investment choices.

Automated Portfolio Management: Includes features like rebalancing and tax loss harvesting, easing the investment management process.

Regulation and Safety:

WealthyHood operates under the oversight of the Financial Conduct Authority (FCA), ensuring robust safety measures:

Compliance with FCA Standards: Adherence to stringent financial conduct and risk management.

Client Asset Protection: Implements measures to safeguard client investments and data.

Fees:

It’s essential to understand the fee structure at WealthyHood:

Annual Platform Fee: This is likely based on the account value.

Potential Trading Fees: May apply when purchasing assets.

These fees, though seemingly low, are not explicitly detailed and could impact investment returns.

Ease of Use:

WealthyHood excels in providing an accessible platform:

Simple Onboarding Process: Only basic personal information is needed to start.

Intuitive Portfolio Building Tools: Designed for easy navigation and portfolio selection.

Educational Content: Offers learning resources for investment beginners.

Pros and Cons:

Pros:

Beginner-friendly platform design.

Low minimum investment requirement.

Automated portfolio tools like rebalancing and tax loss harvesting.

FCA regulation ensures a high level of security and compliance.

Cons:

Ambiguity in the fee structure.

Less suitable for experienced investors seeking detailed customization.

Mainly tailored to UK investors, which might limit global investment opportunities.

WealthyHood is an appealing option for beginners entering the investment world. Its user-friendly approach, combined with educational resources and a range of investment choices, makes it an effective platform for novice investors. However, potential users should be mindful of the unclear fee structure and consider the platform’s suitability based on their investment experience and goals.

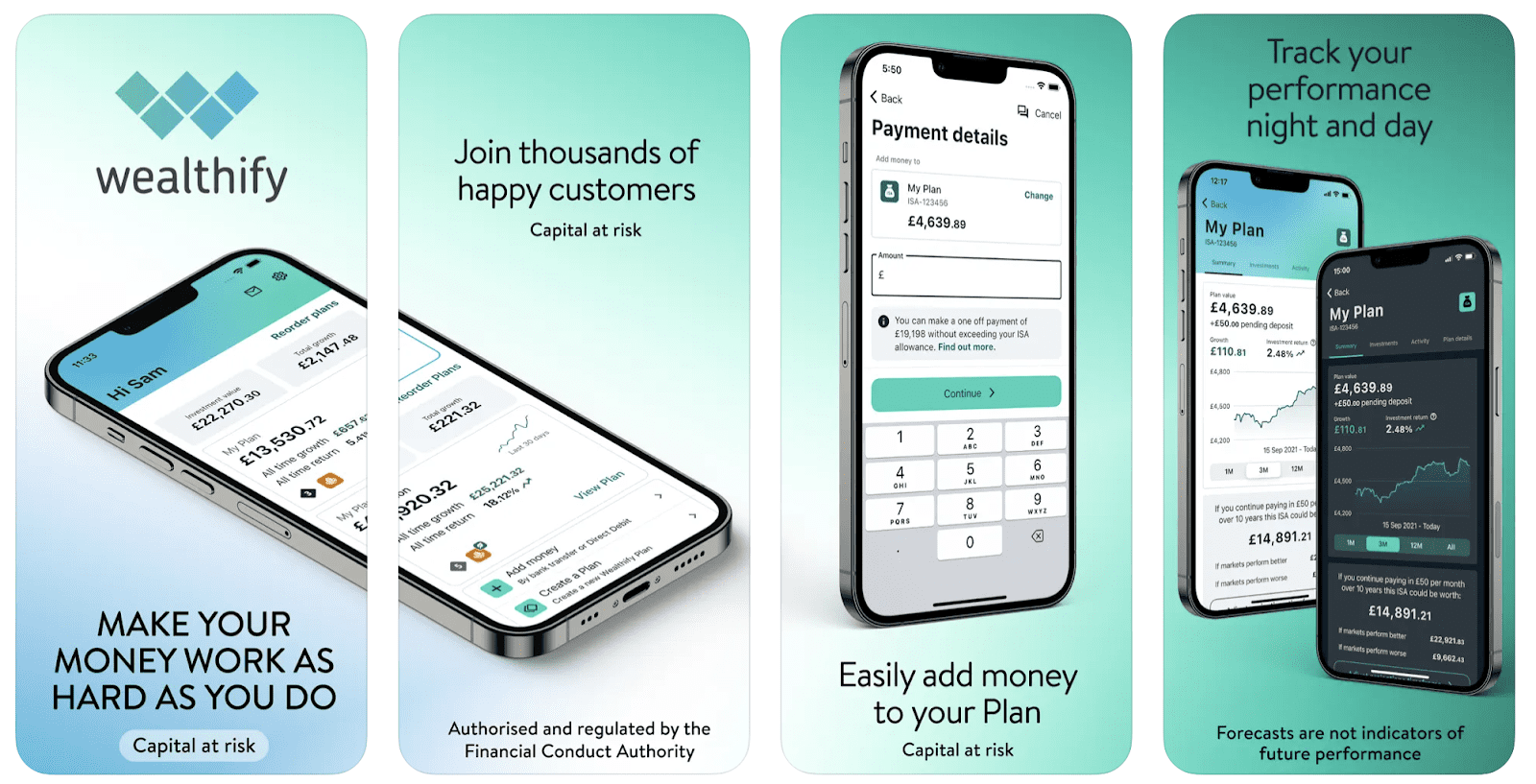

Try Wealthyhood3. Wealthify Platform Overview and Analysis

Wealthify has made a name for itself in the UK as a digital wealth management service, simplifying the investing process for both seasoned and novice investors. It stands out for providing an easy-to-use platform that accommodates various investor needs, from those seeking a hands-off investment approach to beginners taking their first step into the financial markets.

Key Micro Investing Features:

Low Initial Deposit: Offers the ability to open an investment account with just £1.

Wide Range of Account Types: Includes ISAs, JISAs, pensions, and general investment accounts, catering to different savings and investment goals.

Investment Style Selector: Users can choose from five investing styles, from cautious to adventurous, leading to a tailored portfolio of low-cost ETFs and index funds.

Ethical Investment Plans: Specifically caters to investors who prioritize ethical investing, avoiding sectors like oil, weapons manufacturing, and tobacco.

Regulation and Safety:

Wealthify is regulated by the Financial Conduct Authority (FCA), which ensures adherence to strict investment standards and protection of investor interests. This includes:

Segregated Client Funds: Safeguards client money by keeping it separate from the company's finances.

Enhanced Data Security: Utilizes encryption technologies to protect personal information.

The backing of the Aviva Group adds another layer of trust and assurance to Wealthify's offerings.

Fees:

Wealthify’s fee structure is straightforward:

Annual Management Fee: Starts at 0.7% for general investment accounts and 0.6% for ISAs and pensions.

Ethical Investment Plans Cost: Slightly higher at 0.79%, reflecting the additional costs of ethical screening processes.

While these fees are competitive within the industry, they are a crucial factor to consider, especially when calculating long-term investment costs.

Ease of Use:

Wealthify is designed with simplicity in mind:

User-Friendly Onboarding: The signup process is straightforward, and a risk assessment quiz matches you to an appropriate investment style.

Intuitive Website Layout: The platform offers easy navigation and personalized dashboards for tracking investments.

Educational Content: Regular updates and insights help users stay informed about market trends and investment strategies.

Pros and Cons:

Pros:

Accessible with a minimal initial deposit.

Diverse account options for various investment goals.

Automated management of diversified portfolios.

Ethical investment options for value-driven investors.

Robust security protocols for investor protection.

Cons:

Higher fees for ethical investment plans compared to standard options.

Limited exposure to international assets.

Less control over asset selection due to preset portfolio structures.

Wealthify presents an accessible and straightforward solution for those venturing into the world of investing. It's particularly attractive for beginners and those who prefer a hands-off approach, offering a range of investment options, including ethical plans. However, the platform's fee structure and investment limitations should be carefully considered, especially for those seeking more diversified or customized investment strategies.

Go to Wealthify4. Nutmeg Platform Overview and Analysis

Since its inception in 2011, Nutmeg has become a trailblazer as the UK's first fully online discretionary investment manager. Their mission to democratize intelligent investing is commendable, and in my experience, they excel in making it simple and accessible, not just for the affluent but for everyone. Nutmeg combines user-friendly digital tools with expert human guidance, striking a balance that appeals to a broad range of investors.

Key Micro Investing Features:

Initial Deposit Flexibility: Starting at £500 for general trading or a £50 monthly contribution for Lifetime ISAs.

nvestment Style Questionnaire: Helps tailor your portfolio to a suitable risk level, ranging from cautious to adventurous.

Diverse Portfolio Options: Includes globally diversified ETFs and mutual funds, curated by Nutmeg's investment team.

Clear Communication and Support: Their straightforward language on the website and the option for 1-on-1 financial advisor sessions are particularly helpful for those new to investing.

From my perspective, Nutmeg’s approach to customer education and focus on financial inclusion is evident in every aspect of their service.

Regulation and Safety:

As an FCA-regulated entity, Nutmeg adheres to stringent standards ensuring the safety of client investments and data.

Client Asset Protection: Assets and funds are kept separate from the company’s finances, offering security against any financial issues Nutmeg might encounter.

Partnerships for Enhanced Security: Collaborations with institutions like Barclays and State Street for cash custody and trade settlement bolster confidence in their operational integrity.

Nutmeg's compliance with extensive regulatory requirements fosters a trustworthy investing environment.

Fees:

Nutmeg’s fee structure is both simple and transparent:

Management Fee Tiers: 0.45% for assets up to £100k, and 0.35% for the value above that.

Underlying Fund Fees: Averaging around 0.22% annually, which adds to the overall cost.

Their all-inclusive pricing model, in my assessment, remains competitive within the active management space.

Ease of Use:

Targeted at the novice, particularly millennial investors, Nutmeg emphasizes ease of use:

ntuitive Platforms: Both web and mobile interfaces are well-designed, offering straightforward navigation.

Personalized Investment Questionnaire: Streamlines portfolio customization based on your risk appetite and goals.

Performance Monitoring Tools: Personalized dashboards and notifications keep you informed about your investments.

The platform's design effectively reduces the complexity of managing investments while providing enough depth for those who wish to be more involved.

Pros and Cons:

Pros:

Affordable entry point with low monthly contributions.

Expertly managed portfolios with professional oversight.

Straightforward and competitive fee structure.

Simplified digital experience suitable for self-management.

High standards of security and regulatory compliance.

Cons:

The requirement of a £500 minimum for lump-sum deposits.

Additional costs due to underlying fund fees.

Limited global diversification due to a focus on UK assets.

Reduced customization options compared to traditional brokerage services.

Nutmeg is an excellent choice for individuals seeking a hassle-free entry into the world of investing, particularly those who prefer a hands-off approach. Their commitment to transparency, combined with expert management and an easy-to-use platform, makes investing accessible and less daunting. However, potential investors should consider the minimum deposit requirements, additional fund fees, and the focus on UK assets when deciding if Nutmeg aligns with their investment goals and preferences.

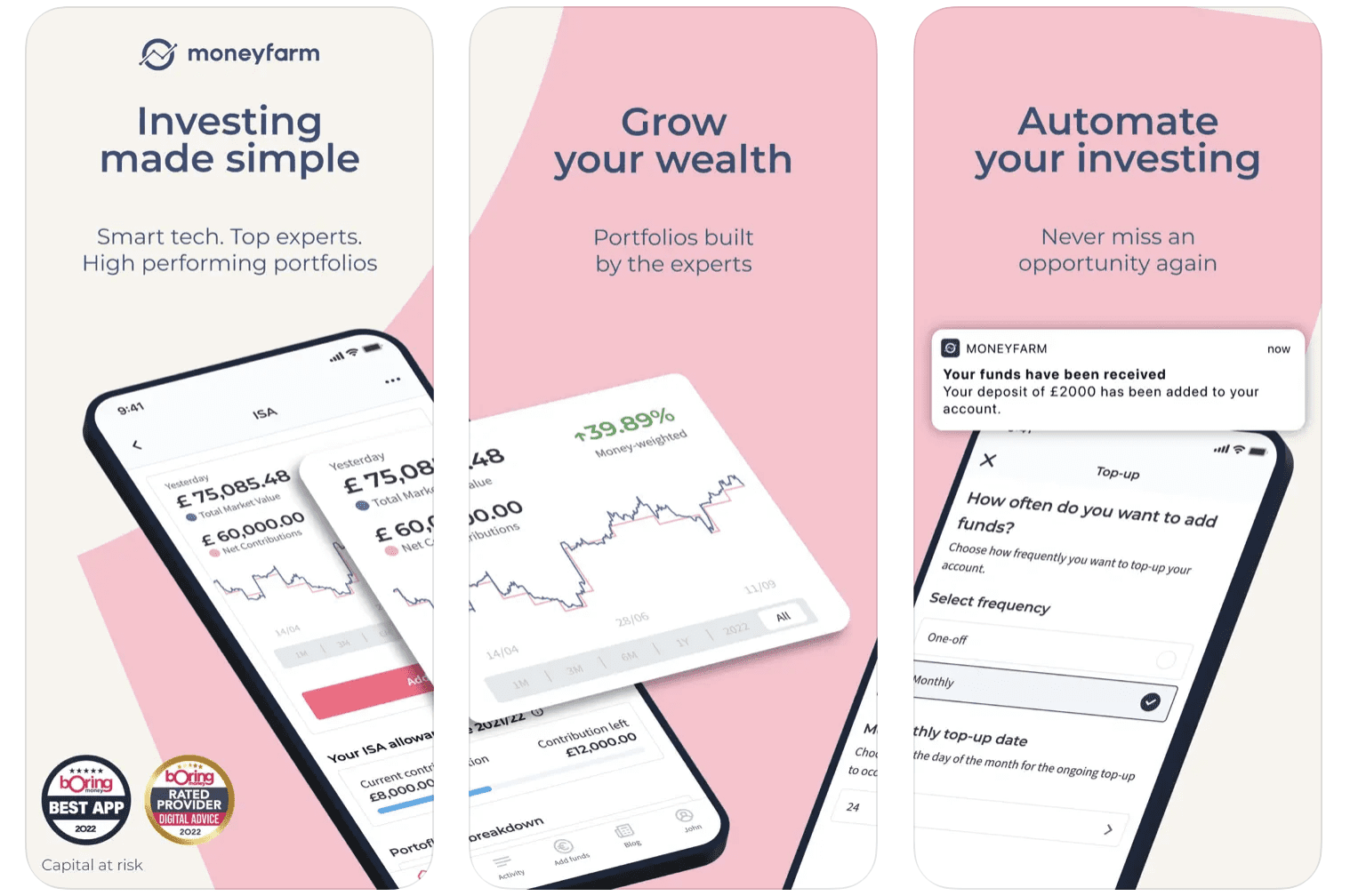

Go to Nutmeg5. Moneyfarm Platform Overview and Analysis

Moneyfarm, launched in 2011, has established itself as a digital wealth manager catering to investors of all experience levels. In my use of their service, I found that their blend of advanced technology and human advisory effectively simplifies portfolio management. Moneyfarm's approach to portfolio creation is intuitive, making it an excellent option for those who prefer a streamlined investment process.

Key Micro Investing Features:

Account Variety: Offers a range of accounts including ISAs, pensions, and investment funds, catering to different financial goals.

Minimum Investment Requirements: Starts at a £500 lump sum or £100 for monthly contributions.

Risk-Based Portfolio Construction: Utilizes low-cost ETFs and index funds to build portfolios based on your risk appetite.

Dynamic Asset Allocation: Adjusts your investments as you age, aligning with changing risk capacities and life stages.

What stands out for me is Moneyfarm's automatic asset allocation, which reduces emotional biases in investment decisions and maintains portfolio optimization.

Regulation and Safety:

Moneyfarm operates under the stringent regulations of the UK Financial Conduct Authority (FCA).

Client Asset Protection: Moneyfarm ensures client funds are kept in segregated accounts with their banking partner, Saxo Bank, providing an additional layer of security.

Robust Oversight: The FCA's oversight, combined with Saxo Bank’s European regulatory compliance, offers a solid foundation for safe investing.

The backing by financial giants like Allianz and M&G further adds to the trustworthiness of Moneyfarm.

Fees:

Moneyfarm’s fee structure is straightforward and competitive:

Management Fee: Ranges from 0.7% for assets up to £100k to 0.4% for portfolios over £500k.

Additional Trading Fees: £3 per transaction, a factor to consider in total investment costs.

For a £50,000 portfolio, the first year's management fees are reasonable. However, it's important to factor in both recurring and trading fees when planning your investment strategy.

Ease of Use:

Moneyfarm excels in creating a user-friendly platform:

Simplified Account Management: The web and mobile platforms offer a seamless experience, making it easy to manage investments on the go.

Efficient Signup Process: Features like form autofill and saved payment methods expedite account opening.

Informative Content: Regular updates and a digital magazine provide insights into market trends and investment strategies.

Moneyfarm's tools and resources blend educational content with functional capabilities, making the platform suitable for both beginners and experienced investors.

Pros and Cons:

Pros:

Regulated by the FCA, ensuring safe investment management.

Accessible entry points with £100 monthly contributions.

Innovative Dynamic Asset Allocation.

User-friendly multi-device platforms for easy self-management.

Fee structure that rewards larger investments.

Cons:

Initial £500 lump sum deposit requirement.

Limited global diversification due to a focus on UK assets.

Fees apply even during periods of low returns, which can impact overall gains.

Moneyfarm offers a secure and straightforward digital investment platform suitable for a wide range of investors. The integration of technology with expert advice, combined with their transparent fee structure and regulatory compliance, makes Moneyfarm a solid choice for those seeking a hassle-free investment experience. However, potential investors should consider the minimum deposit requirements and the impact of fees on their investment returns.

Go to Moneyfarm6. Plum Platform Overview and Analysis

Plum presents itself as more than just an investing application; it's a comprehensive money management tool encompassing saving, investing, budgeting, and spending tracking. Its rise to over 1 million users in the UK is a testament to its effectiveness in fostering better financial habits.

Key Micro Investing Features:

Automated Savings Analysis: By linking to your bank account, Plum analyzes your finances to suggest potential savings, automatically investing a chosen percentage of your spare money.

Investment Options: Offers risk-based thematic portfolios with underlying ETFs, managed by Plum to optimize and rebalance your investments.

Flexibility: You can adjust your savings rate and investment risk level as your financial situation changes.

I found Plum’s flexibility and adaptability to different financial goals, such as emergency funds or retirement planning, to be particularly valuable.

Regulation and Safety:

Plum's approach to security is robust, employing encryption, authentication, and continuous infrastructure monitoring. Being an FCA-authorized FinTech company, it adheres to stringent standards for risk management and operational integrity. Plum also features Segregated Client Accounts. This means that deposited funds are transferred to regulated Barclays Bank accounts, providing a safeguard against Plum’s potential financial issues.

This arrangement provides a reassuring layer of protection, making Plum a secure platform for managing finances.

Fees:

Plum's fee structure caters to a range of needs:

Free Account: Offers basic auto-savings, budgeting, and spending analytics at no cost.

Paid Accounts: Ranging from £2.99 to £9.99 per month, these accounts enable auto-investing and advanced analytics.

For instance, a £5 monthly fee on a £500 investment equates to a 1.2% annual fee. This is reasonable, but the value derived from the paid features should be weighed against the costs over time.

Ease of Use:

Plum’s user-friendly interface is a standout feature:

Bank Account Integration: Seamless connectivity through open banking APIs.

Visual Interface: Offers a clear overview of budgets, savings, and transactions.

Educational Notifications: Personalized tips and financial best practices are shared based on your spending patterns.

The combination of automated tracking, investing, and personalized financial education makes Plum a smart and effective tool for financial management.

Pros and Cons:

Pros:

Strong regulatory compliance and security measures.

Free access to basic financial management tools.

Automated saving and investing simplify wealth building.

Customized educational content to improve financial literacy.

Accessible to all income levels with no minimum investment requirement.

Cons:

A paid subscription needed for auto-investing features.

Limited customization in underlying investment assets.

Bank connectivity primarily with major UK financial institutions.

Plum excels in providing an all-encompassing financial management solution that is both intelligent and user-friendly. Its blend of automated tools and educational content makes it an attractive option for anyone looking to take control of their finances. While the free version offers significant value, the paid accounts provide enhanced capabilities for those willing to invest in their financial wellness. Plum’s approach to money management, with its focus on accessibility and ease of use, is ideal for users seeking a comprehensive yet straightforward financial tool.

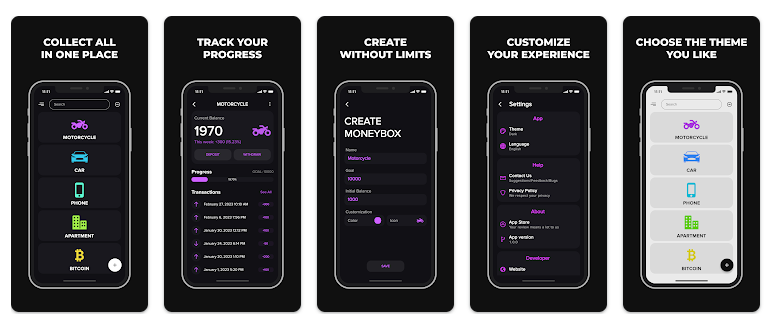

Go to Plum7. Chip Platform Overview and Analysis

Launched in 2016, Chip has evolved from a simple automatic savings and investing app into a comprehensive tool for managing savings, investments, and spending. It's impressive how Chip has garnered over 600,000 users, a clear indication of its effectiveness in simplifying financial management through smart automation and educational guidance.

Key Micro Investing Features:

Automated Savings: By linking to your bank account, Chip calculates and automatically sets aside affordable savings amounts.

Investment Options: Offers pre-made portfolios and a selection of stocks/ETFs, managed by Chip for optimized portfolio balance.

Financial Goal Adaptability: Whether it’s for saving more efficiently, retirement planning, or general investing, Chip offers versatile financial tools.

As a user who doesn't like complicated processes, I particularly appreciate how Chip removes much of the manual effort from the investment process, making it more accessible and less daunting.

Regulation and Safety:

Chip ensures safety and compliance by partnering with regulated financial institutions like JPMorgan Chase NA and Barclays.

Data Security: Utilizes strong encryption for user data in transit and at rest.

Legal Compliance: Adheres to open banking regulations and requires detailed verification for investors, enhancing user protection.

The FSCS protection on eligible Cash Savings accounts adds another layer of security, which is a significant plus.

Fees:

Chip offers a flexible fee structure suitable for a range of financial needs:

Basic Plan: Provides core automatic saving and spending analytics for free.

ChipX Plan: For £5.99 monthly, this premium plan includes auto-investing capabilities and an ISA with no platform fees.

When considering Chip, it's essential to assess whether the convenience and features of the premium plan justify the cost for your individual financial strategy.

Ease of Use:

Chip's user interface is exceptionally intuitive and visually engaging.

Visual Tracking: Savings and investments are represented through easily interpretable graphics.

Personalized Education: Customized tips based on spending patterns offer relevant financial advice and learning opportunities.

Chip’s approach to automation, combined with actionable insights, makes it a powerful tool for those seeking both simplicity and control in managing their finances.

Pros and Cons:

Pros:

Simplifies wealth building with automated saving and investing.

Offers free tools for budgeting and basic financial management.

Provides educational content tailored to individual spending habits.

Ensures safety with FSCS protection on savings accounts.

Accessible for all income levels, with no minimum investment requirement.

Cons:

Premium subscription required for auto-investing features.

Limited customization in investment choices.

Bank account connectivity restricted to major UK financial institutions.

Potential fees for accounts with balances below £100.

Chip stands out as a versatile and user-friendly financial management app, ideal for individuals who value ease and automation in their financial journey. Its commitment to educational content and tailored advice enhances its appeal, particularly for those new to investing or budget management. While the free version of Chip offers significant value, the premium plan could be worthwhile for users looking to maximize their investment returns over time. The decision to opt for Chip’s paid features should be based on an individual’s financial goals and the value they place on convenience and enhanced capabilities.

Go to Chip8. Acorns Platform Overview and Analysis

Acorns, a pioneer in micro-investing in the US, offers an ingenious approach to investing small change. By linking your debit and credit cards, Acorns automatically rounds up your purchases and invests the difference. This unique Round-Ups® feature enables users to build an investment portfolio effortlessly with their everyday spending.

Key Micro Investing Features:

Round-Ups: Automatically invests spare change from purchases.

Diverse Portfolios: Investments are placed into portfolios constructed with ETFs from top asset managers like Vanguard and BlackRock.

Risk Tolerance Matching: Offers portfolios from Conservative to Aggressive to suit different investor profiles.

As a user, I find Acorns' hands-off approach to investing small amounts particularly effective for steadily growing an investment portfolio without much effort.

Regulation and Safety:

Acorns is a regulated entity, ensuring robust protection for your investments.

SIPC Protection: Acorns Invest, Later, and Early investment accounts are covered up to $500,000, protecting against losses due to broker failure or theft.

FDIC Insurance: Deposits in checking and savings accounts are insured for up to $250,000.

This dual-layer of SIPC and FDIC protection provides comprehensive coverage, offering peace of mind to Acorns users.

Fees:

Acorns adopts a clear subscription pricing model.

Tiered Plans: Range from $1 to $5 per month, offering varying levels of features and services.

No Trading Fees: For accounts under $1 million, Acorns absorbs trading and transaction costs within the subscription fee.

This predictable pricing structure makes it easy to understand the costs involved and ensures that frequent small investments through Round-Ups accumulate without additional charges.

Ease of Use:

Acorns stands out for its simplicity and user-friendly design.

Quick Account Setup: You can open an investment account in less than 5 minutes.

Intuitive Mobile App: Provides easy access to key actions like selecting investment portfolios and setting up recurring deposits.

Educational Content: Offers resources to help beginners understand investing concepts.

Acorns’ focus on making micro-investing accessible is evident in its streamlined app, which integrates effortlessly into daily spending patterns.

Pros and Cons:

Pros:

Simplifies investing by automating spare change investments.

Offers access to expertly curated, diversified portfolios.

Comprehensive protection with SIPC and FDIC insurance.

User-friendly interface and helpful educational materials.

Straightforward subscription-based pricing without additional transaction fees for larger accounts.

Cons:

Only available to U.S. residents, limiting its global reach.

Requires a subscription fee, which may not be cost-effective for those investing very small amounts.

Less customization in investment choices compared to more comprehensive investment platforms.

Acorns is an excellent option for those new to investing or those who want to invest with minimal effort. Its unique approach to micro-investing, combined with a strong focus on user experience and safety, makes it a standout choice in the financial app space. While its subscription model and limited availability might not suit everyone, Acorns' ability to make investing both accessible and engaging is commendable. The app is particularly well-suited for individuals looking to integrate investing seamlessly into their daily financial habits.

Go to Acorns9. Freetrade Platform Overview and Analysis

Freetrade is a noteworthy British investing app focused on democratizing wealth access. It stands out for offering unlimited commission-free trading on a wide range of stocks and ETFs. The app's modern mobile-first interface provides access to over 6,000 shares and funds, including high-profile companies like Tesla and Apple, as well as FTSE 250 stocks.

Key Micro Investing Features:

Global Stock Access: Offers trading in US and UK stocks, including fractional shares, which is a feature I find particularly valuable for diversifying investments.

Tax Efficiency: Supports Stocks & Shares ISAs and SIPPs, enabling efficient tax sheltering of returns.

Educational Resources: Provides beginners with guidance, making the investment journey more approachable.

As a user, I appreciate Freetrade’s commitment to making self-directed investing straightforward and accessible, especially with its zero-commission trades.

Regulation and Safety:

Freetrade is regulated by the Financial Conduct Authority (FCA) and is a member of the London Stock Exchange.

Client Asset Protection: Follows strict asset segregation rules, ensuring user funds are securely separated from company finances.

Robust Security Measures: Implements data encryption and bank-level logins to safeguard user information and investments.

These regulatory and security measures instill confidence in Freetrade as a reliable and safe investing platform.

Fees:

Freetrade’s fee structure is appealing for its simplicity and affordability.

Commission-Free Trading: Enables unlimited free trades on a broad range of stocks and ETFs.

Optional Plus Subscription: For £9.99 per month, users can access additional features like an ISA allowance.

Foreign Exchange Charges: A nominal fee of 0.45% for trading non-GBP denominated share The lack of trading commissions is a significant advantage for users, particularly those adopting a buy-and-hold strategy.

Ease of Use:

Freetrade excels in offering a user-friendly platform that caters to all investor levels.

Streamlined Account Setup: Quick and digital verification process for new accounts.

Intuitive App Design: The mobile app mirrors the website’s functionality, providing a seamless user experience.

Investment Tools and Education: Includes share price alerts, portfolio performance graphs, and educational articles.

The platform's design and functionality make investing approachable and manageable, even for those new to the financial markets.

Pros and Cons:

Pros:

Offers commission-free trading on a diverse range of stocks and ETFs.

Enables investment in fractional shares for wider portfolio diversification.

Tax-efficient investing options like ISAs and SIPPs.

Straightforward interface suitable for all investor levels.

Transparent and flexible pricing plans to suit different user needs.

Cons:

Limited to UK, US, and European stocks, potentially restricting wider global diversification.

Foreign exchange fees on non-GBP stocks.

May not provide advanced trading tools for more experienced traders.

Freetrade is an excellent platform for individuals looking to venture into investing without the burden of hefty fees. Its wide range of accessible stocks and ETFs, combined with a user-friendly interface and educational resources, make it a suitable choice for both novice and seasoned investors. While the platform might have limitations in terms of global diversification and advanced trading features, its strengths in affordability and ease of use make it a compelling option for those starting their investment journey.

Go to Freetrade10. Lightyear Platform Overview and Analysis

Launched in 2020, Lightyear merges a modern design with low fees, catering to both novice and experienced investors. This mobile-first app offers commission-free ETFs and low-cost share dealing on over 3,000 US and European stocks. I am particularly impressed by Lightyear's inclusion of both US and European stocks, and the option to buy fractional shares.

Key Micro Investing Features:

Diverse Asset Range: Provides access to stocks and ETFs, with a focus on mobile execution.

Competitive Features: Offers high interest on cash balances and no minimum account deposit, alongside tight spreads and transparent fees.

Fractional Shares: Enables investment in small portions of shares, useful for diversifying into expensive stocks.

From my experience, Lightyear excels in removing traditional investing barriers, making it an attractive option for those seeking a straightforward, cost-effective investment platform.

Regulation and Safety:

As a new player in the fintech market, Lightyear holds registrations with top-tier European regulators.

UK FCA and Estonian FSA Regulation: Ensures adherence to strict standards for conduct and operations.

Investor Protections: US stocks are covered by SIPC insurance up to $500,000, and non-US shares and cash balances are protected by the FSA up to €20,000.

These regulatory safeguards provide a secure environment for investors to trust Lightyear with their funds.

Fees:

Lightyear stands out for its low-fee model, maximizing value for investors.

Trading Costs: Charges just £1 per trade for European shares and £1.99 for US stocks.

Zero Commission on ETFs: Offers cost-effective diversification options.

No Monthly Fees: Eliminates recurring charges for standard account maintenance. While there are FX and card fees to consider, Lightyear’s overall fee structure is designed to minimize costs for investors.

Ease of Use:

The Lightyear app is designed for ease of use, with a focus on intuitive navigation.

User-Friendly Interface: Allows for quick tracking of positions and easy account management.

Efficient Account Opening: Digital identity verification streamlines the signup process.

Integrated Support and Education: Offers in-app chat support and useful features like price alerts and a news feed.

Lightyear’s mobile platform is well-suited for investors who prefer a straightforward and engaging trading experience.

Pros and Cons:

Pros:

Offers high interest on cash balances.

Access to commission-free ETFs and low-cost stock trading.

Quick and easy account opening process.

Regulated by top-tier authorities for investor safety.

Sleek and user-friendly mobile app design.

Cons:

Limited to stocks and ETFs, with no advanced trading options.

Currently offers only email support, lacking real-time assistance.

Basic charting tools and a lack of advanced order types.

FX fee and card fee after a certain monthly deposit limit.

Lightyear is an excellent choice for investors looking for a modern, low-cost platform for trading stocks and ETFs. Its mobile-first approach and focus on user experience make it particularly appealing to new investors and those who prefer managing their investments on the go. While the app may lack some of the advanced features of more comprehensive trading platforms, its simplicity, competitive pricing, and strong regulatory backing make it a strong contender in the micro-investing app market.

Go to LightyearRobo Advisors Vs Micro Investing Apps

Micro-investing apps and robo-advisors both democratize investing, but they cater to different needs.

Micro-investing apps, like Acorns are perfect for beginners with limited capital. They typically round up your purchases or auto-invest making it effortless to invest small amounts.

Robo-advisors, such as Nutmeg, offer automated, algorithm-driven financial planning services with minimal human supervision.

With that said you'll see many micro investing apps make it to the robo advisors list. That's because some of these apps can be both

They're ideal for those with more capital, seeking a diversified portfolio and tailored investment strategies. If you're starting small and prefer a hands-off approach, micro-investing is great. For more comprehensive financial planning and larger investments, robo-advisors are the better choice. I’ve reviewed the best Robo-Advisors in the UK in a previous article but here are the 5 best according to my opinion:

Nutmeg: Known for its tax-wrapped investment strategies, Nutmeg is user-friendly and ideal for beginners. It offers a range of portfolio options, including socially responsible and thematic portfolios. The fee structure ranges from 0.75% to 0.25%, and it's regulated by the Financial Conduct Authority (FCA).

Wealthyhood: This is one of the best investing apps for beginners, Wealthyhood provides a user-friendly platform with a focus on fractional share investments. It offers a fee structure that's free for basic features, with certain advanced features having associated fees.

Moneyfarm: Touted as the best overall robo-advisor, Moneyfarm stands out for its personalized investment plans and low minimum investment requirement. It features a degressive fee structure starting at 0.75% for a minimum amount of £500. The platform is also FCA regulated and offers a user-friendly design.

InvestEngine: Best for its low management fees, InvestEngine focuses on ETFs and offers a transparent fee structure with an annual management fee of just 0.25%. It's a good choice for beginners and those looking for a straightforward investment approach.

IG Smart Portfolios: Praised for its automated and professional approach, IG Smart Portfolios offers a clear pricing structure with management fees capped at £250 per year. It's suitable for investors looking for a straightforward experience with user-friendly features.

Pros and Cons of Micro Investing

Advantages of Micro Investing

A significant appeal of micro investing lies in its accessibility for beginners thanks to minimum barriers. You can open an account and start investing in minutes from your phone with just a few pounds. This allows practically anyone to build investment exposure and experience gradually.

By letting technology automate and optimise repetitive investing, consistent savings habits become easier to maintain long-term. Small but frequent buy-ins like spare change round ups require minimal effort while compounding gains. This hands-off approach helps develop financial discipline.

Micro investing apps make diversification more straightforward too compared to selectively picking individual stocks. Pre-made portfolios efficiently spread your money across asset types and geographies at low costs.

Useful extras like fractional share dealing give finer control over allocating capital as well. So specific companies you admire become investable through bite-sized exposure.

Overall, micro investing apps lower monetary, education and effort obstacles that typically deter new investors. This makes them ideal springboards into long-term wealth creation journeys.

Limitations and Considerations

However, micro-investing contrasts heavily with active trading or managing substantial sums, so expect limitations. The incremental gains from tiny, irregular investments limits quickly building wealth or generating significant compound interest initially.

So while apps encourage regular small inputs, recognise that growing to financially life-changing sums requires vastly exceeding those levels eventually or waiting decades. Of course, patience with a long-enough timeframe can produce results.

Additionally, fixed platform fees and trading costs incentivise particular strategies. Frequency and purchase size impacts relative charges, so assess fee implications before commitment.

For example, making 10 small trades monthly could rack up more costs than 1 monthly lump sum buy. Check whether subscription or asset charges apply too.

The range of investment products is also narrower compared to full service brokers, constraining flexibility. You have less control over customizing portfolio makeup or accessing specialist asset niches.

So tread carefully if desiring more hands-on portfolio involvement beyond basic set and forget allocations. Evaluate if micro factors hamper your outlook and targets before assuming alignments.

Micro Investing for Different User Groups

Micro Investing for Beginners

As I discussed earlier, micro-investing apps cater exceptionally well to investing newcomers thanks to small barriers and guided education. Intuitive sign-up flows, preset portfolios and seamless mobile experiences allow quickly starting your journey.

When I started my investing I didn’t know a lot about picking stocks or investing strategies so I decided to start my investing journey with a micro investing app (that I won’t mention to keep the content unbiased). Watching this app Micro Invest helped me create the habit of investing small amounts that I carry to this day.

Useful extras like auto round-up investing takes the effort out of building discipline too. This hands-off approach funnels spare change into fractionally owning big brands you recognize and admire.

So micro-investing apps help demystify investing while building knowledge and experience over time. This develops confidence towards more advanced strategies having learnt the basics.

Many people hesitate investing due to perceptions of complexity, risk and high minimums. But tailored micro-investing design specifically tackles these adoption barriers. So dive in now without worries as a beginner.

Micro Investing for Experienced Investors

Micro-investing functionality understandably won't match sophisticated trading platforms. But apps can still complement existing portfolios for savvy investors too.

The ability to easily make recurrent, small investments provides an efficient way to continually top up holdings or test new assets. Set then forget automated investing frees up attention for core positions that need more hands-on oversight.

So while micro-apps naturally cater to beginners, don't underestimate their usefulness for augmenting traditional investing habits. They solve specific challenges even for seasoned investors.

Micro Investing for Specific Financial Goals

Aligning micro-investing strategies to financial targets boosts clarity and motivation. Apps often support integrated saving vaults alongside investing for instance.

This consolidates growing separate pots tailored to the timeframe makes tracking easier. For example, investing round-ups to build longer-horizon wealth while manually topping up for near-term spending ambitions like a wedding or holiday.

The ability to label goals within apps provides helpful separation. It also enables setting specific periodic contribution amounts and choosing conservative portfolio starting allocations aligned to the timescale.

Reviewing goal progress intermittently against target figures keeps you accountable. Advance warnings if falling behind contributions allow reacting too.

So while micro-investing endorses consistency, giving context and structure to your efforts via financial endpoints amplifies success. Check apps allow customising experiences to your personal objectives for maximum relevance.

Are Micro Investing Apps Safe?

This is something that I’ve already discussed in previous posts but for those new to our investing blog let’s break it down once more.

When assessing any investment service, trustworthiness rightly carries weight before commitment. But determining credibility extends beyond first glances with micro-investing apps.

User perception of slick mobile investing tools relies heavily on conveying robustness first. Safety around both money handling and personal data therefore requires communicating from the outset.

Understandably, entrusting hard-earned savings to a young, unknown startup feels riskier, even when emphasizing great usability. However dismissing micro-investing options based on long-standing brand recall alone overlooks meaningful evolution.

What underpins reliability?

Informative transparency builds trust fastest by avoiding vague claims. Outlining regulator registration, usage growth and client asset handling provides initial credibility indicators around finances and conduct.

Notably, reputable micro-investing brands clearly display watchdog supervisory badges like the UK’s Financial Conduct Authority (FCA) authorisation. Maintaining such memberships demands meeting strict reporting and capital standards.

Additionally, established funding rounds, growing member numbers and technology pedigrees suggest positive trajectories and risk management maturity. Concentrating narrowly on an app’s convenience can overlook the wider business fundamentals supporting it.

Externally audited financials add another trust layer too. Alongside security measures like bank-grade encryption safeguarding account access and transaction validation. Verify these defences suit personal preferences though - not all platforms support two-factor authentication for example.

Why Try Micro-Investing?

Significant barriers that deter potential investors centre upon limited money, time and knowledge. Micro-investing specifically alleviates these adoption hurdles through convenience-focused design.

Firstly, small but frequent contribution models fund investments gradually without demanding large upfront sums. Extra features like withdrawing money anytime provides flexibility missing from restrictive fixed accounts.

Secondly, automated set and forget tools handle the ongoing administrations around optimally distributing deposits. Preset expert portfolios efficiently spread risk across sectors and regions too. This condenses even sophisticated strategy access into a few app taps without overwhelming.

And lastly, bite-sized learning resources explain key concepts clearly to build know-how. Tracking performance dashboards relay progress to stay motivated as savings accumulate.

So by optimising micro-investing experiences into convenient and guided journeys, apps make enriching financial habits highly accessible. Over long timeframes, even modest initial investments compound significantly. Give it a try!

In conclusion, the world of micro-investing apps has opened up the realm of investing to a broader audience, making it accessible and manageable, even for those with limited financial knowledge or smaller amounts of capital. Apps like Acorns and Wealthyhood have revolutionized the way we think about investing, breaking down traditional barriers and offering user-friendly, tech-driven solutions.

Whether you're a beginner looking to dip your toes into the financial markets or someone seeking to effortlessly grow your savings, these micro-investing apps provide a convenient and effective way to achieve your financial goals. By automating investments, offering educational resources, and minimizing fees, these platforms are not just tools for investment; they are stepping stones towards a more financially savvy and empowered future.

If you have any questions or you'd like more apps added here don't hesitate to send me an email at george@wealthyhood.com or connect with me on Linkedin.

Capital at risk. This article is for information purposes only and is not investment advice nor a recommendation. You should consider your own personal circumstances when making investment decisions. Past performance is not a reliable indicator of future performance. Tax treatment depends on your personal circumstances and rules can change.